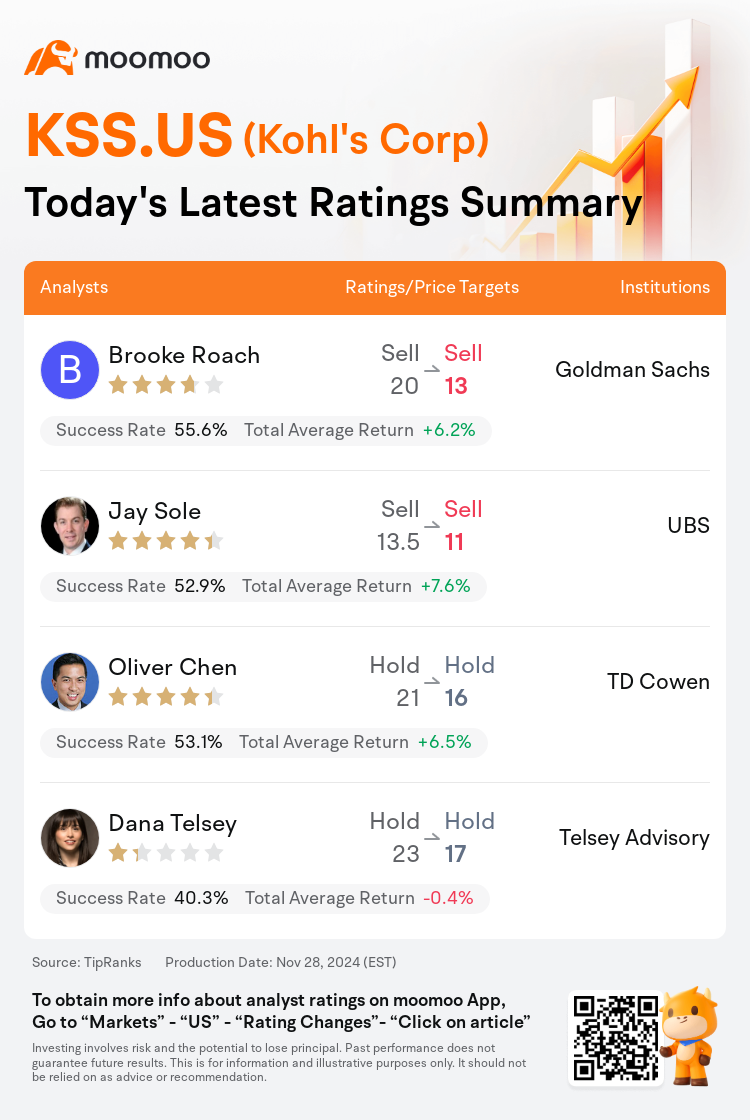

On Nov 28, major Wall Street analysts update their ratings for $Kohl's Corp (KSS.US)$, with price targets ranging from $11 to $17.

Goldman Sachs analyst Brooke Roach maintains with a sell rating, and adjusts the target price from $20 to $13.

UBS analyst Jay Sole maintains with a sell rating, and adjusts the target price from $13.5 to $11.

TD Cowen analyst Oliver Chen maintains with a hold rating, and adjusts the target price from $21 to $16.

TD Cowen analyst Oliver Chen maintains with a hold rating, and adjusts the target price from $21 to $16.

Telsey Advisory analyst Dana Telsey maintains with a hold rating, and adjusts the target price from $23 to $17.

Furthermore, according to the comprehensive report, the opinions of $Kohl's Corp (KSS.US)$'s main analysts recently are as follows:

After Kohl's management reduced FY24 guidance for sales, comps, operating margin, and EPS, concerns continue due to ongoing struggles in the core business and anticipation of a highly competitive holiday season. It was also noted that a new CEO has been announced, and while this leader's customer-facing expertise from prior experience is anticipated to bring value, many of Kohl's fundamental challenges are expected to persist.

Sales challenges have persisted at Kohl's for multiple years and worsened during the third quarter. The company's business prospects are deteriorating as its initiatives fail to meet expectations. Kohl's faces a tough competitive environment.

The company's performance downturn in Q3 was noted, accompanied by a revised, less optimistic outlook. Same-store sales shrunk by 9.3%, continuing a trend of contraction over the last 11 quarters. This recent downturn was influenced by a sequence of events including unfavorably warm weather, hurricanes, and disruptions leading up to the U.S. election, which together compounded the retailer's challenges.

The company's management is actively taking strong measures to stabilize sales, with anticipations that the new CEO will be well-suited for the role. However, there are concerns regarding the execution across private brands, inventory management, and the reintroduction of fine jewelry. Additionally, factors such as a selective consumer base and a shorter holiday shopping period present challenges.

Following Q3 outcomes along with a more conservative forecast regarding discretionary expenditure at Kohl's, EPS estimates for FY24 and FY25 have been adjusted to $1.20 and $1.55, down from previous figures. Despite disappointment in these results, optimism remains regarding the company's strategic initiatives.

Here are the latest investment ratings and price targets for $Kohl's Corp (KSS.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月28日,多家华尔街大行更新了$柯尔百货 (KSS.US)$的评级,目标价介于11美元至17美元。

高盛集团分析师Brooke Roach维持卖出评级,并将目标价从20美元下调至13美元。

瑞士银行分析师Jay Sole维持卖出评级,并将目标价从13.5美元下调至11美元。

TD Cowen分析师Oliver Chen维持持有评级,并将目标价从21美元下调至16美元。

TD Cowen分析师Oliver Chen维持持有评级,并将目标价从21美元下调至16美元。

泰尔西咨询分析师Dana Telsey维持持有评级,并将目标价从23美元下调至17美元。

此外,综合报道,$柯尔百货 (KSS.US)$近期主要分析师观点如下:

在Kohl's管理层降低了2024财年的销售、同店销售、营业利润率和每股收益的指导后,由于核心业务持续面临挑战以及对竞争激烈的假日季的预期,担忧仍在持续。有报道称新CEO已被任命,尽管预计这位领导者从以往经验中获得的客户沟通专业技能将带来价值,但Kohl's的诸多根本挑战预计仍将持续。

Kohl's在过去几年一直面临销售挑战,并在第三季度时情况恶化。由于公司的举措未能达到预期,其业务前景正在恶化。Kohl's面临着严酷的竞争环境。

该公司在第三季度的业绩下滑引起关注,伴随着修订后的更不乐观的前景。同店销售减少了9.3%,继续显示出过去11个季度的收缩趋势。这一最近的下滑受到一系列事件的影响,包括不利的暖天气、飓风,以及美国大选前的干扰,这些因素共同加剧了零售商的挑战。

该公司的管理层正在积极采取强有力的措施以稳定销售,预计新CEO将非常适合这一角色。然而,对于私人品牌的执行、库存管理以及重新引入优质珠宝的能力仍然存在担忧。此外,选择性消费群体和更短的假日购物期等因素也带来了挑战。

在第三季度的结果和对Kohl's可自由支配支出的更保守预测之后,2024财年和2025财年的每股收益预测已调整为1.20美元和1.55美元,低于之前的数字。尽管对这些结果感到失望,但对公司战略举措的前景仍然保持乐观。

以下为今日4位分析师对$柯尔百货 (KSS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Oliver Chen维持持有评级,并将目标价从21美元下调至16美元。

TD Cowen分析师Oliver Chen维持持有评级,并将目标价从21美元下调至16美元。

TD Cowen analyst Oliver Chen maintains with a hold rating, and adjusts the target price from $21 to $16.

TD Cowen analyst Oliver Chen maintains with a hold rating, and adjusts the target price from $21 to $16.