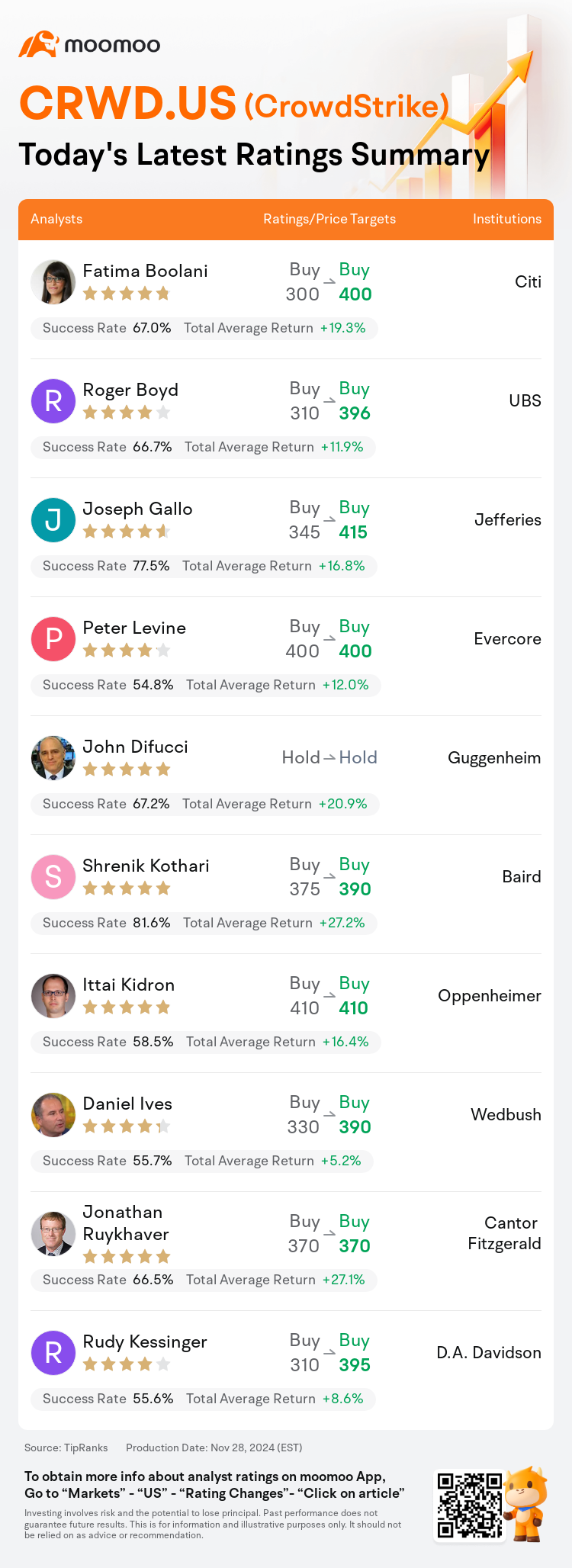

On Nov 28, major Wall Street analysts update their ratings for $CrowdStrike (CRWD.US)$, with price targets ranging from $370 to $415.

Citi analyst Fatima Boolani maintains with a buy rating, and adjusts the target price from $300 to $400.

UBS analyst Roger Boyd maintains with a buy rating, and adjusts the target price from $310 to $396.

Jefferies analyst Joseph Gallo maintains with a buy rating, and adjusts the target price from $345 to $415.

Jefferies analyst Joseph Gallo maintains with a buy rating, and adjusts the target price from $345 to $415.

Evercore analyst Peter Levine maintains with a buy rating, and maintains the target price at $400.

Guggenheim analyst John Difucci maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $CrowdStrike (CRWD.US)$'s main analysts recently are as follows:

Crowdstrike reported an impressive milestone revenue quarter of $1B, coupled with healthy operating leverage despite the realization of outage costs. The company's near-term business momentum has been notably affected by the July outage, with prudent expectations that this could extend into Q4 renewals, potentially leading to lower consolidation of the shares.

Although recent trends indicate considerable effects from the aftermath of an outage, there is optimism as the company demonstrates strong customer retention alongside sustained momentum for upsell and cross-sell opportunities. While the current customer retention initiatives are temporarily affecting net new annual recurring revenue and free cash flow, it is anticipated that these pressures will lessen in the latter half of FY26, leading to an acceleration in growth.

Crowdstrike exceeded expectations in all guided metrics during Q3. The company's relatively stable Gross Retention underscores the effectiveness of management's strategy and the company's overall ability to turn a crisis into an opportunity. Furthermore, management's cautious approach regarding the company's reduced visibility is seen as appropriate.

Crowdstrike's recent results were considered 'reasonable,' yet their net new annual recurring revenue upside, alongside the implied January quarter ARR, may have slightly missed the consensus expectations. Continuous headwinds from enhanced customer commitment packages are anticipated to push consensus ARR estimates lower in the upcoming quarters. Despite these challenges, the company's robust execution and the strength of its portfolio and customer packages are expected to progressively consolidate security spend over time.

CrowdStrike demonstrated robust performance in the third quarter, surpassing both top and bottom line expectations, whilst continuing to show strong gross retention and module adoption post the 7/19 outage. It's anticipated that the stock will stay within a certain range until there is more clarity on the adjustments from ARR to NNARR re-acceleration projected for the second half of 2026. Despite these adjustments, the long-term growth prospects for CrowdStrike are still viewed positively.

Here are the latest investment ratings and price targets for $CrowdStrike (CRWD.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

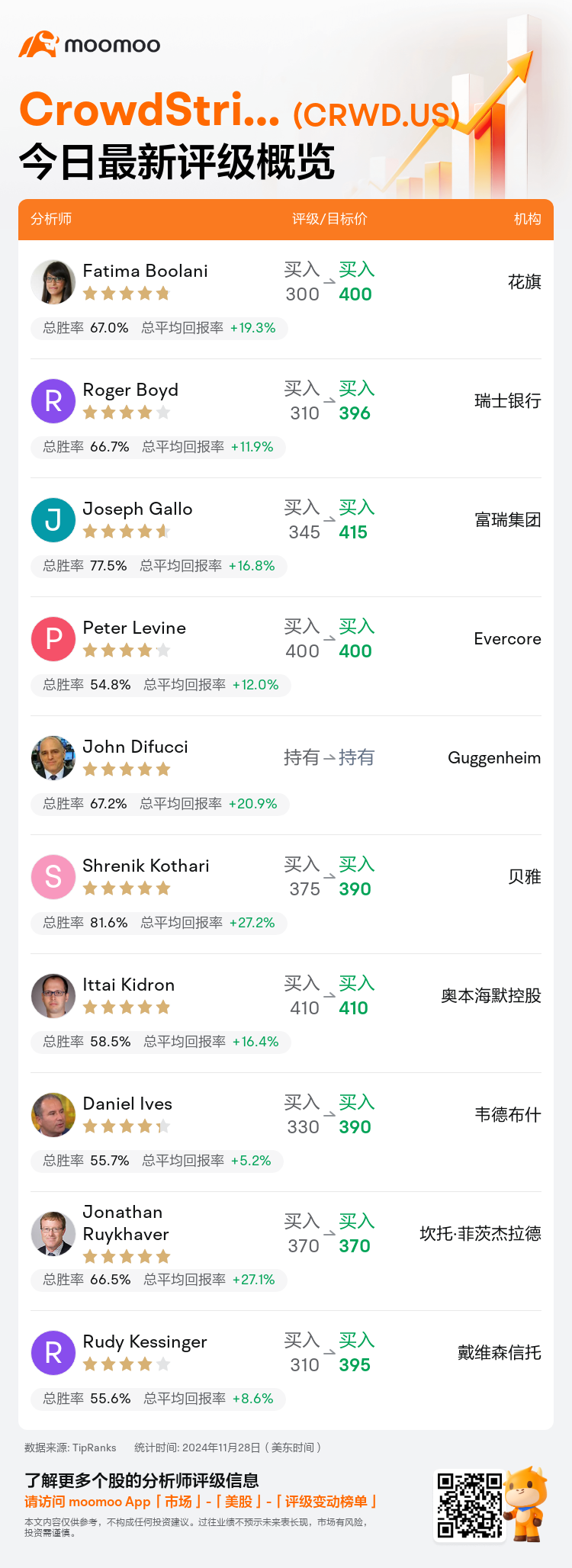

美东时间11月28日,多家华尔街大行更新了$CrowdStrike (CRWD.US)$的评级,目标价介于370美元至415美元。

花旗分析师Fatima Boolani维持买入评级,并将目标价从300美元上调至400美元。

瑞士银行分析师Roger Boyd维持买入评级,并将目标价从310美元上调至396美元。

富瑞集团分析师Joseph Gallo维持买入评级,并将目标价从345美元上调至415美元。

富瑞集团分析师Joseph Gallo维持买入评级,并将目标价从345美元上调至415美元。

Evercore分析师Peter Levine维持买入评级,维持目标价400美元。

Guggenheim分析师John Difucci维持持有评级。

此外,综合报道,$CrowdStrike (CRWD.US)$近期主要分析师观点如下:

CrowdStrike报告了一季度10亿美元的来之不易的营业收入,尽管有停机成本的实现,但公司的健康经营杠杆仍然不错。公司短期的业务势头显著受7月停机事件影响,谨慎地预计这可能延伸到第四季度续约,潜在导致股份较低的整合。

尽管最近的趋势显示受停机事件后果的影响显著,但公司展示了强大的客户保留力,同时为销售和交叉销售机会的持续势头带来了乐观。当前的客户保留举措暂时影响了净新年度重复营收和自由现金流,预计这些压力将在FY26的后半段减轻,导致增长加速。

CrowdStrike在Q3期间超出了所有引导指标的预期。公司相对稳定的毛收入保留表明管理策略的有效性和全公司将危机转化为机会的能力。此外,管理层对公司减少的透明度采取的谨慎态度被看作是合适的。

CrowdStrike最近的业绩被认为是'合理的',然而他们的净新年度重复营收增长潜力,加上隐含的一月季度年度重复营收,可能稍微没有达到共识预期。受增强的客户承诺套餐带来的持续阻力影响,预计在未来几个季度会将共识年度重复营收预测降低。尽管面临这些挑战,公司强劲的执行力和其组合和客户套餐的实力预计会随着时间的推移逐步巩固安全支出。

CrowdStrike在第三季度表现强劲,超出了预期的营业收入和净利润,同时继续表现出强劲的毛收入保留和7/19停机事件后的模块采用。预计股票将在一定的区间内保持,直至对2026年下半年预计的ARR到NNARR重新加速的调整有更多的明确性。尽管存在这些调整,人们对CrowdStrike的长期增长前景仍然持积极态度。

以下为今日10位分析师对$CrowdStrike (CRWD.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Joseph Gallo维持买入评级,并将目标价从345美元上调至415美元。

富瑞集团分析师Joseph Gallo维持买入评级,并将目标价从345美元上调至415美元。

Jefferies analyst Joseph Gallo maintains with a buy rating, and adjusts the target price from $345 to $415.

Jefferies analyst Joseph Gallo maintains with a buy rating, and adjusts the target price from $345 to $415.