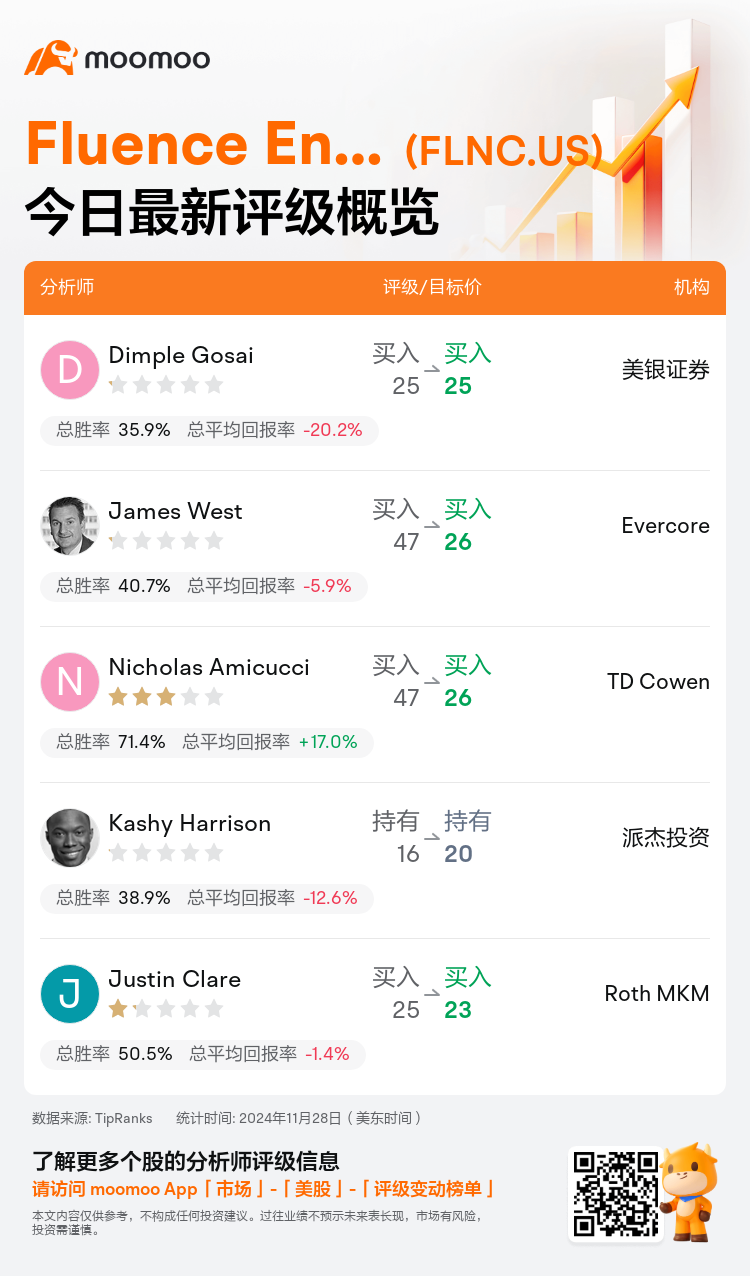

On Nov 28, major Wall Street analysts update their ratings for $Fluence Energy (FLNC.US)$, with price targets ranging from $20 to $26.

BofA Securities analyst Dimple Gosai maintains with a buy rating, and maintains the target price at $25.

Evercore analyst James West maintains with a buy rating, and adjusts the target price from $47 to $26.

TD Cowen analyst Nicholas Amicucci maintains with a buy rating, and adjusts the target price from $47 to $26.

TD Cowen analyst Nicholas Amicucci maintains with a buy rating, and adjusts the target price from $47 to $26.

Piper Sandler analyst Kashy Harrison maintains with a hold rating, and adjusts the target price from $16 to $20.

Roth MKM analyst Justin Clare maintains with a buy rating, and adjusts the target price from $25 to $23.

Furthermore, according to the comprehensive report, the opinions of $Fluence Energy (FLNC.US)$'s main analysts recently are as follows:

Fluence Energy's recent FY24 results were mostly in-line to positive compared to consensus estimates, and the backlog remains strong despite concerns about the impact of changes in the US political administration on the industry.

Expectations that the revenue guidance for the latter half of FY25 and anticipated large working capital outflows in 2025 may pose short-term challenges. However, ongoing late-stage negotiations on significant contracts anticipated to be disclosed with Q1 earnings and additional orders expected to be finalized soon might provide catalysts to firm up guidance and boost management's confidence in future projections.

Following the Q4 report, the company persists in experiencing robust growth; however, a consistent inability to meet expectations has fostered investor skepticism. This sentiment was not eased by an 80% revenue projection for the second half of fiscal 2025, which has been perceived as overly optimistic. The company's 2025 outlook is seen as demanding significant investor trust and leaving numerous unresolved questions. Nonetheless, it is noted that the company continues to enhance its market presence, with its digital backlog now surpassing 64 GW, of which 4.5 GW is firmly contracted.

Here are the latest investment ratings and price targets for $Fluence Energy (FLNC.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月28日,多家华尔街大行更新了$Fluence Energy (FLNC.US)$的评级,目标价介于20美元至26美元。

美银证券分析师Dimple Gosai维持买入评级,维持目标价25美元。

Evercore分析师James West维持买入评级,并将目标价从47美元下调至26美元。

TD Cowen分析师Nicholas Amicucci维持买入评级,并将目标价从47美元下调至26美元。

TD Cowen分析师Nicholas Amicucci维持买入评级,并将目标价从47美元下调至26美元。

派杰投资分析师Kashy Harrison维持持有评级,并将目标价从16美元上调至20美元。

Roth MKM分析师Justin Clare维持买入评级,并将目标价从25美元下调至23美元。

此外,综合报道,$Fluence Energy (FLNC.US)$近期主要分析师观点如下:

Fluence Energy最近的2024财年业绩基本与共识预期一致或偏好,尽管对美国政治管理变动对行业影响的担忧,订单积压依然强劲。

预计2025财年后半段的营业收入指引和预期的大量营运资金流出可能带来短期挑战。然而,目前正在进行的重大合同的晚期谈判预计将在第一季度财报中披露,并且额外的订单预计很快将被最终敲定,这可能为完善指引和增强管理层对未来预测的信恳智能提供催化剂。

在第四季度报告后,公司持续经历强劲增长;然而,始终无法满足预期导致了投资者的怀疑情绪。对于2025财年下半年的80%营业收入预测,此情绪并未得到缓解,人们普遍认为这一预测过于乐观。公司的2025年前景被视为需要显著的投资者信任,并留下许多未解决的问题。尽管如此,值得注意的是,公司仍在不断提升其市场地位,其数字订单积压现在已超过64 GW,其中4.5 GW已确保签约。

以下为今日5位分析师对$Fluence Energy (FLNC.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Nicholas Amicucci维持买入评级,并将目标价从47美元下调至26美元。

TD Cowen分析师Nicholas Amicucci维持买入评级,并将目标价从47美元下调至26美元。

TD Cowen analyst Nicholas Amicucci maintains with a buy rating, and adjusts the target price from $47 to $26.

TD Cowen analyst Nicholas Amicucci maintains with a buy rating, and adjusts the target price from $47 to $26.