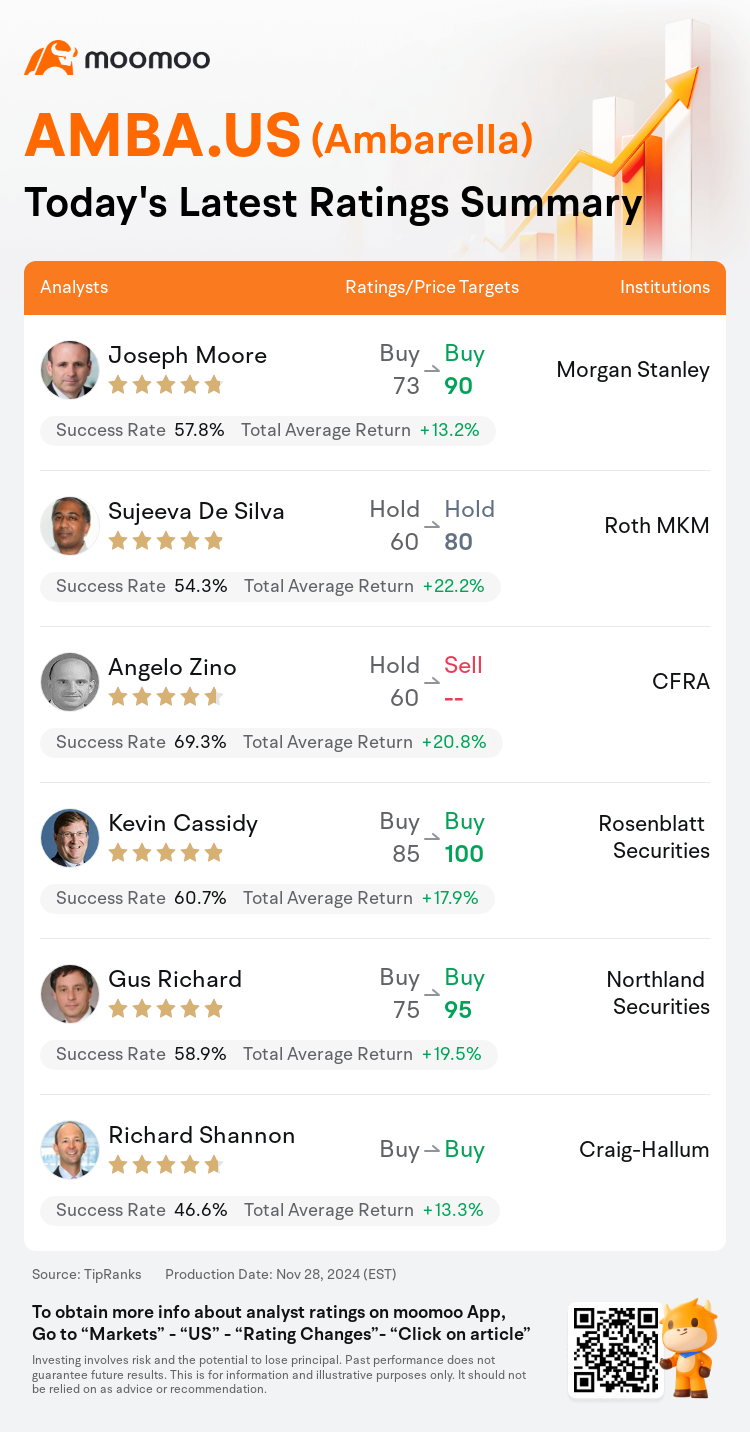

On Nov 28, major Wall Street analysts update their ratings for $Ambarella (AMBA.US)$, with price targets ranging from $80 to $100.

Morgan Stanley analyst Joseph Moore maintains with a buy rating, and adjusts the target price from $73 to $90.

Roth MKM analyst Sujeeva De Silva maintains with a hold rating, and adjusts the target price from $60 to $80.

CFRA analyst Angelo Zino downgrades to a sell rating.

CFRA analyst Angelo Zino downgrades to a sell rating.

Rosenblatt Securities analyst Kevin Cassidy maintains with a buy rating, and adjusts the target price from $85 to $100.

Northland Securities analyst Gus Richard maintains with a buy rating, and adjusts the target price from $75 to $95.

Furthermore, according to the comprehensive report, the opinions of $Ambarella (AMBA.US)$'s main analysts recently are as follows:

Ambarella reported strong October-end quarter results, leading to a positive response in its stock performance. However, concerns have been raised about the company's valuation, particularly questioning the justification for a relatively smaller-scale business where projections heavily rely on long-term growth prospects beyond 2025, which now appear uncertain. Despite a minor increase in sales estimates for 2025 and 2026, there's an expected decrease in pro-forma EPS for these years.

Ambarella's recent quarterly results and projections benefited from new product cycles, according to an analyst. There has been noticeable product strength in both IoT and automotive sectors. The robustness of their technology and the increasing demand for Edge AI are seen as factors that have sufficiently compensated for any challenges faced. Moreover, an anticipated significant advancement in automotive applications by 2026 was highlighted.

Ambarella's third-quarter performance exceeded the midpoint estimates and the fourth-quarter guidance was significantly above expectations. A noted concern was the decrease in auto revenue funnel, which dropped by 8% year-over-year to $2.2 billion from $2.4 billion, primarily due to lowered unit forecasts and delays and cancellations of projects, mainly associated with L2+ programs. Nevertheless, it's anticipated that product ramp-ups will drive stronger than usual seasonal revenue for the fourth quarter.

Following a solid third-quarter performance characterized by surpassing expectations and upward revisions, Ambarella continues to show strong execution in its CV product family pipeline. This success is propelling the company's status as a prominent figure in the expanding AI at the Edge ecosystem.

Here are the latest investment ratings and price targets for $Ambarella (AMBA.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

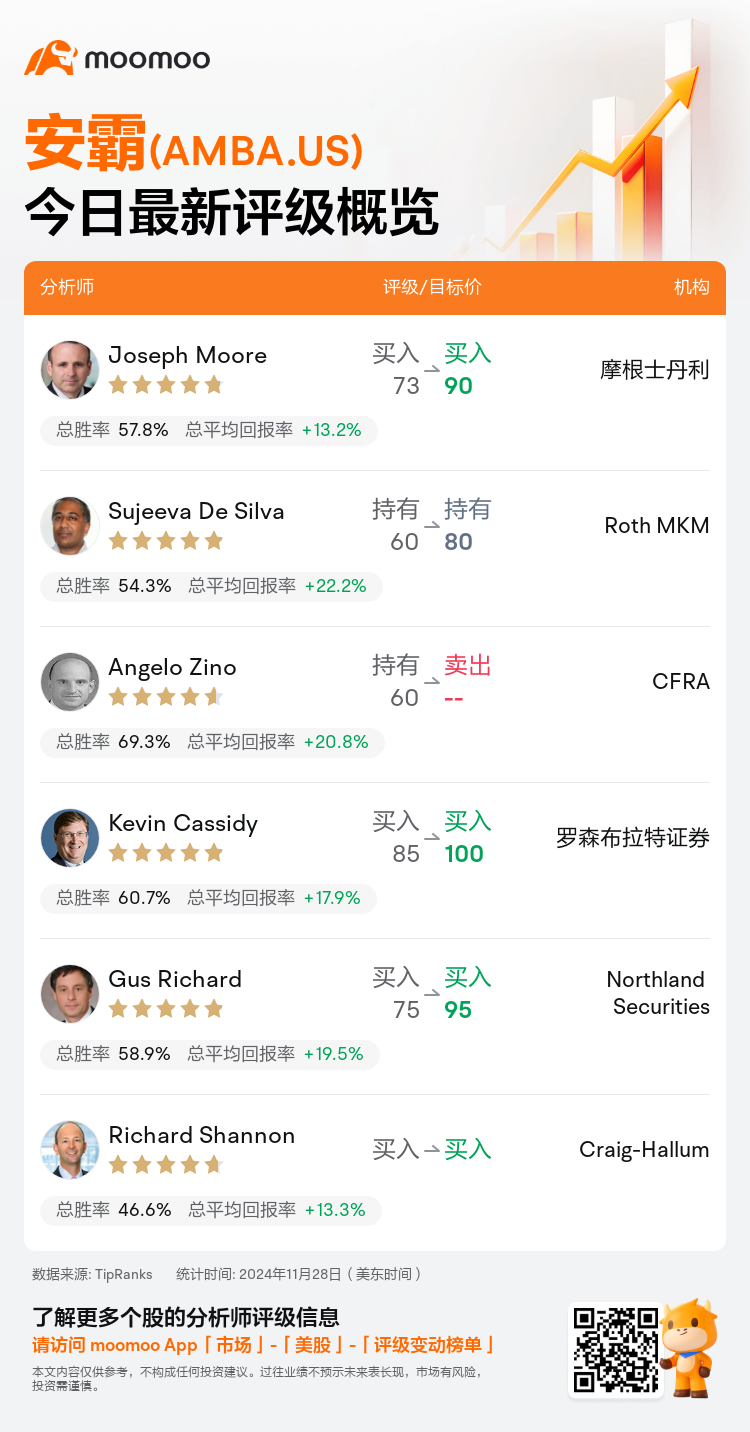

美东时间11月28日,多家华尔街大行更新了$安霸 (AMBA.US)$的评级,目标价介于80美元至100美元。

摩根士丹利分析师Joseph Moore维持买入评级,并将目标价从73美元上调至90美元。

Roth MKM分析师Sujeeva De Silva维持持有评级,并将目标价从60美元上调至80美元。

CFRA分析师Angelo Zino下调至卖出评级。

CFRA分析师Angelo Zino下调至卖出评级。

罗森布拉特证券分析师Kevin Cassidy维持买入评级,并将目标价从85美元上调至100美元。

Northland Securities分析师Gus Richard维持买入评级,并将目标价从75美元上调至95美元。

此外,综合报道,$安霸 (AMBA.US)$近期主要分析师观点如下:

安霸报告了截至十月的强劲季度业绩,导致其股票表现积极。然而,人们对公司估值提出了担忧,特别是质疑这家相对小规模业务的合理性,因为预计 heavily 依赖于 2025 年之后的长期增长前景,而这些前景现在显得不确定。尽管 2025 年和 2026 年的销售预估有所小幅上调,但预期这些年度的每股收益将会下降。

分析师表示,安霸最近的季度业绩和预测受益于新产品周期。在物联网和汽车领域都出现了显著的产品强度。他们的科技的强大及对边缘人工智能日益增长的需求被视为足以弥补所面临的任何挑战的因素。此外,预计到 2026 年汽车应用会有显著进展。

安霸的第三季度业绩超出了中点预估,第四季度的指导显著高于预期。一个突出的问题是汽车营业收入的下降,年同比下降 8%,从 24亿降到 22亿,这主要是由于单位预测的降低以及与 L2+ 项目相关的项目延迟和取消所致。然而,预计产品的快速增长将推动第四季度的季节性营业收入超出正常水平。

在第三季度业绩稳健、超出预期和上调预测的背景下,安霸在其 CV 产品系列管道中继续显示出强劲的执行力。这一成功推动了公司在不断扩大的边缘人工智能生态系统中的地位。

以下为今日6位分析师对$安霸 (AMBA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

CFRA分析师Angelo Zino下调至卖出评级。

CFRA分析师Angelo Zino下调至卖出评级。

CFRA analyst Angelo Zino downgrades to a sell rating.

CFRA analyst Angelo Zino downgrades to a sell rating.