Spotlight on AppLovin: Analyzing the Surge in Options Activity

Spotlight on AppLovin: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on AppLovin.

那些有大量资金可支配的鲸鱼们在AppLovin上采取了明显的看淡态度。

Looking at options history for AppLovin (NASDAQ:APP) we detected 120 trades.

查看AppLovin(纳斯达克:APP)的期权历史时,我们检测到120笔交易。

If we consider the specifics of each trade, it is accurate to state that 26% of the investors opened trades with bullish expectations and 55% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说26%的投资者以看好的预期开盘交易,55%则是以看淡的预期开盘交易。

From the overall spotted trades, 19 are puts, for a total amount of $999,409 and 101, calls, for a total amount of $6,888,881.

在整体检测到的交易中,19笔是看跌期权,总金额为$999,409,101笔是看涨期权,总金额为$6,888,881。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $115.0 and $410.0 for AppLovin, spanning the last three months.

在评估成交量和未平仓合约后,很明显主要市场参与者正在关注AppLovin的价格区间在$115.0到$410.0之间,跨度为过去三个月。

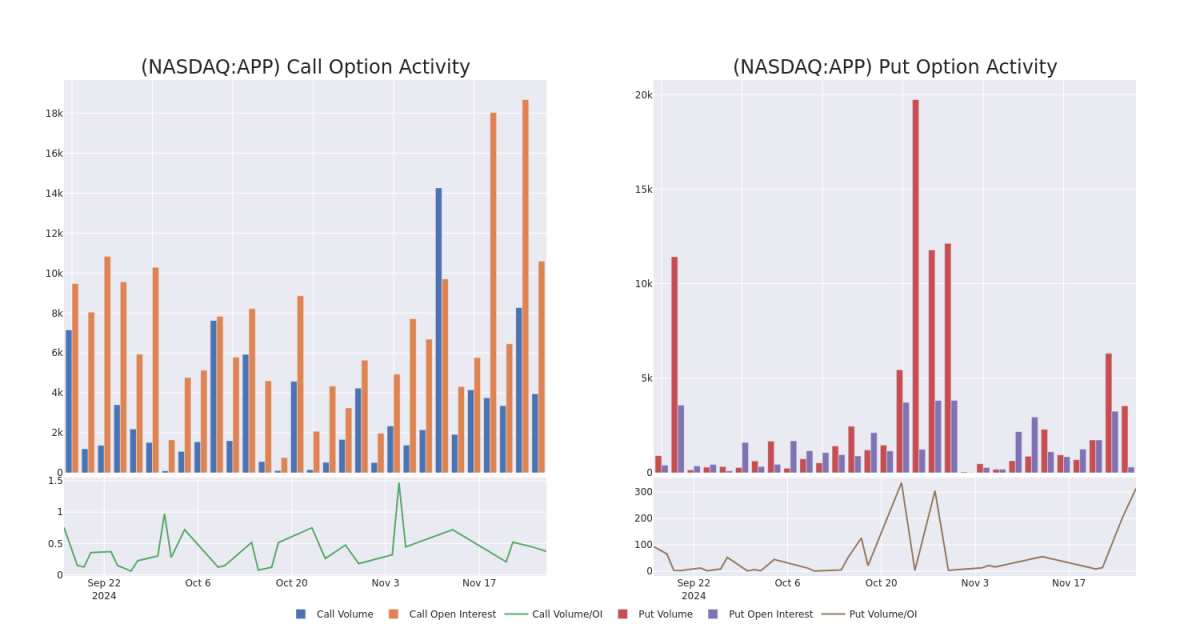

Volume & Open Interest Trends

成交量和未平仓量趋势

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in AppLovin's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to AppLovin's substantial trades, within a strike price spectrum from $115.0 to $410.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易中的一个战略步骤。这些指标揭示了在特定执行价格下,AppLovin期权的流动性和投资者兴趣。接下来的数据可视化展示了在过去30天内,与AppLovin的大额交易相关的看涨和看跌期权的成交量和未平仓合约的波动,执行价格区间从$115.0到$410.0。

AppLovin Option Activity Analysis: Last 30 Days

AppLovin期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | TRADE | NEUTRAL | 01/17/25 | $223.8 | $221.1 | $222.4 | $115.00 | $222.4K | 3.2K | 20 |

| APP | CALL | SWEEP | BEARISH | 01/17/25 | $223.9 | $222.2 | $222.2 | $115.00 | $199.9K | 3.2K | 9 |

| APP | CALL | SWEEP | BEARISH | 02/21/25 | $93.3 | $91.4 | $91.4 | $260.00 | $182.8K | 1.0K | 479 |

| APP | CALL | SWEEP | BEARISH | 02/21/25 | $93.8 | $91.6 | $91.63 | $260.00 | $156.0K | 1.0K | 628 |

| APP | CALL | SWEEP | BEARISH | 02/21/25 | $93.4 | $91.1 | $91.71 | $260.00 | $128.5K | 1.0K | 700 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 应用 | 看涨 | 交易 | 中立 | 01/17/25 | $223.8 | $221.1 | $222.4 | $115.00 | 22.24万美元 | 3.2千 | 20 |

| 应用 | 看涨 | SWEEP | 看淡 | 01/17/25 | $223.9 | $222.2 | $222.2 | $115.00 | 199.9K美元 | 3.2千 | 9 |

| 应用 | 看涨 | SWEEP | 看淡 | 02/21/25 | $93.3 | $91.4 | $91.4 | $260.00 | $182.8K | 1.0千 | 479 |

| 应用 | 看涨 | SWEEP | 看淡 | 02/21/25 | $93.8 | $91.6 | $91.63 | $260.00 | $156.0K | 1.0千 | 628 |

| 应用 | 看涨 | SWEEP | 看淡 | 02/21/25 | $93.4 | $91.1 | $91.71 | $260.00 | $128.5K | 1.0千 | 700 |

About AppLovin

关于AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company's software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

AppLovin Corp是一家移动应用程序技术公司,专注于通过支持移动应用程序开发人员的成功来增长移动应用程序生态系统。该公司的软件解决方案为移动应用程序开发人员提供工具,通过自动化和优化其应用程序的营销和货币化来增长他们的业务。

AppLovin's Current Market Status

AppLovin当前的市场地位

- Trading volume stands at 2,166,281, with APP's price up by 2.02%, positioned at $335.2.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 75 days.

- 交易量为2,166,281,APP的价格上涨2.02%,定位在$335.2。

- RSI指示股票可能已超买。

- 盈利公告预计在75天后。

What Analysts Are Saying About AppLovin

分析师对AppLovin的看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $342.2.

在过去一个月中,5位行业分析师分享了他们对这只股票的见解,提出了平均目标价为342.2美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on AppLovin with a target price of $291. * In a cautious move, an analyst from Piper Sandler downgraded its rating to Overweight, setting a price target of $400. * An analyst from Oppenheimer persists with their Outperform rating on AppLovin, maintaining a target price of $260. * An analyst from Oppenheimer persists with their Outperform rating on AppLovin, maintaining a target price of $480. * An analyst from Daiwa Capital has elevated its stance to Outperform, setting a new price target at $280.

Benzinga Edge的期权异动板块在市场动向发生之前发现潜在的市场动向。查看大资金在你喜爱的股票上持有的头寸。点击这里以获取访问权限。* 在其评估中保持一致,BTIG的一位分析师对AppLovin保持买入评级,目标价为291美元。* 在谨慎的行动中,派杰投资的一位分析师将其评级下调至增持,设定目标价为400美元。* Oppenheimer的一位分析师继续对AppLovin保持超越市场表现评级,维持目标价为260美元。* Oppenheimer的一位分析师继续对AppLovin保持超越市场表现评级,维持目标价为480美元。* 大和资本的一位分析师已将其立场提升至超越市场表现,设定新的目标价为280美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest AppLovin options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易员通过不断地教育自己,调整其策略,监控多个因子并密切关注市场趋势来管理这些风险。通过Benzinga Pro从实时警报中了解最新的AppLovin期权交易情况。

From the overall spotted trades, 19 are puts, for a total amount of $999,409 and 101, calls, for a total amount of $6,888,881.

From the overall spotted trades, 19 are puts, for a total amount of $999,409 and 101, calls, for a total amount of $6,888,881.