CVS Health's Options: A Look at What the Big Money Is Thinking

CVS Health's Options: A Look at What the Big Money Is Thinking

Benzinga's options scanner just detected over 9 options trades for CVS Health (NYSE:CVS) summing a total amount of $615,632.

Benzinga的期权扫描仪刚刚检测到西维斯健康(纽交所:CVS)超过9笔期权交易,总金额为615,632美元。

At the same time, our algo caught 2 for a total amount of 550,000.

同时,我们的量化系统捕捉到2笔,总金额为550,000。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $65.0 for CVS Health during the past quarter.

分析这些合同的成交量和未平仓合约,似乎大型玩家在过去一个季度中一直关注西维斯健康的价格区间为55.0美元到65.0美元。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

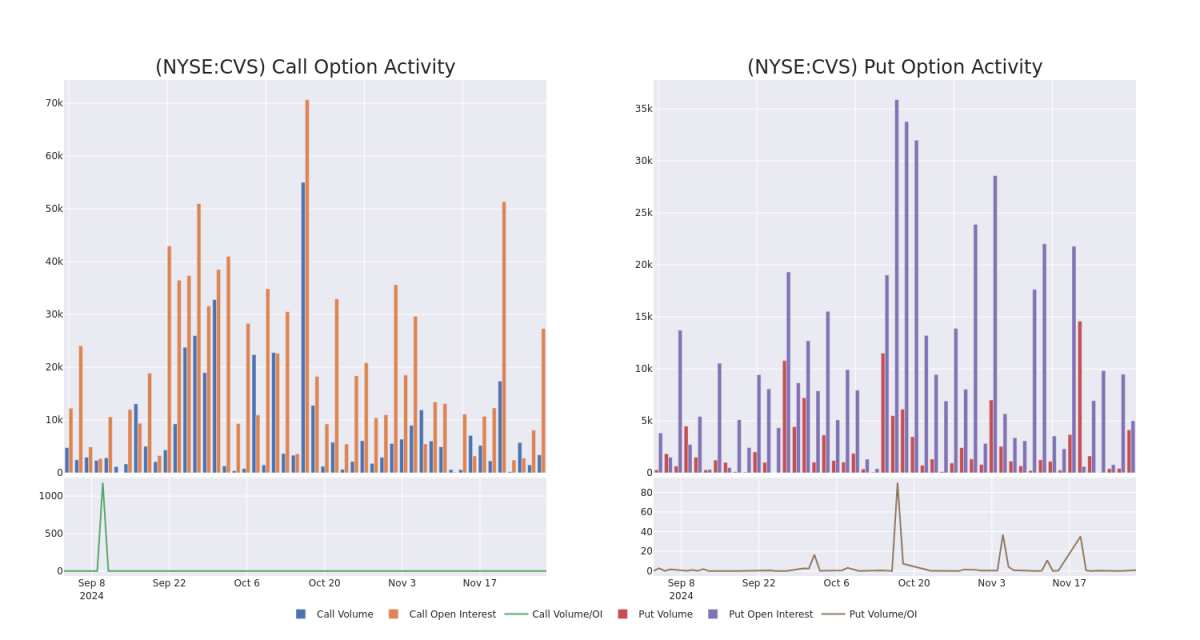

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for CVS Health's options for a given strike price.

这些数据可以帮助您跟踪西维斯健康期权在特定行使价的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CVS Health's whale activity within a strike price range from $55.0 to $65.0 in the last 30 days.

下面,我们可以观察到在过去30天内,所有西维斯健康的鲸鱼活动中,看涨和看跌期权的成交量和未平仓合约的演变,行使价格区间为55.0美元到65.0美元。

CVS Health Call and Put Volume: 30-Day Overview

西维斯健康看涨和看跌期权成交量:30天概况

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | PUT | TRADE | BULLISH | 01/16/26 | $5.5 | $4.85 | $5.0 | $55.00 | $300.0K | 5.0K | 2.9K |

| CVS | PUT | TRADE | BEARISH | 01/16/26 | $5.0 | $4.8 | $5.0 | $55.00 | $250.0K | 5.0K | 1.1K |

| CVS | CALL | SWEEP | BULLISH | 02/21/25 | $1.62 | $1.6 | $1.62 | $65.00 | $114.6K | 23.8K | 734 |

| CVS | CALL | SWEEP | BULLISH | 02/21/25 | $3.6 | $3.5 | $3.56 | $60.00 | $35.7K | 2.0K | 351 |

| CVS | CALL | SWEEP | BULLISH | 02/21/25 | $3.6 | $3.5 | $3.56 | $60.00 | $35.7K | 2.0K | 451 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | 看跌 | 交易 | BULLISH | 01/16/26 | $5.5 | $4.85 | $5.0 | $55.00 | $300.0K | 5.0K | 2.9K |

| CVS | 看跌 | 交易 | 看淡 | 01/16/26 | $5.0 | $4.8 | $5.0 | $55.00 | $250.0K | 5.0K | 1.1K |

| CVS | 看涨 | SWEEP | BULLISH | 02/21/25 | $1.62 | $1.6 | $1.62 | $65.00 | $114.6K | 23.8K | 734 |

| CVS | 看涨 | SWEEP | BULLISH | 02/21/25 | $3.6 | $3.5 | $3.56 | $60.00 | 35.7K | 2.0千 | 351 |

| CVS | 看涨 | SWEEP | BULLISH | 02/21/25 | $3.6 | $3.5 | $3.56 | $60.00 | 35.7K | 2.0千 | 451 |

About CVS Health

关于西维斯健康

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

西维斯健康提供多样化的医疗保健服务。它的根基在于零售药房业务,主要在美国运营超过9000家商店。西维斯健康还是大型药房利益管理人(通过Caremark收购),每年处理约20亿个调整过的索赔。它还经营一家顶级健康保险公司(通过Aetna收购),为约2600万名医疗会员提供服务。最近收购Oak Street为该公司添加了初级保健服务,这可能与其现有的所有业务线产生显著的协同效应。

CVS Health's Current Market Status

西维斯健康的当前市场状况

- Trading volume stands at 2,253,456, with CVS's price down by -0.01%, positioned at $59.95.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 68 days.

- 成交量为2,253,456,西维斯健康的价格下跌了-0.01%,现报$59.95。

- RSI指标显示该股票可能接近超买。

- 预计还有68天公布财报。

What The Experts Say On CVS Health

专家对西维斯健康的评价

In the last month, 5 experts released ratings on this stock with an average target price of $64.8.

在过去一个月里,5位专家对该股票发布了评级,平均目标价为64.8美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Truist Securities downgraded its action to Buy with a price target of $67. * Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on CVS Health with a target price of $64. * An analyst from Barclays has decided to maintain their Overweight rating on CVS Health, which currently sits at a price target of $71. * An analyst from UBS has decided to maintain their Neutral rating on CVS Health, which currently sits at a price target of $62. * Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on CVS Health with a target price of $60.

一位20年经验的期权交易者揭示了他的单行图表技术,显示何时买入和卖出。复制他的交易,这些交易每20天平均获得27%的利润。点击此处获取访问权限。* 来自Truist Securities的分析师将其评级下调至买入,目标价为67美元。* 在评估中保持一致,来自派杰投资的分析师对西维斯健康维持超配评级,目标价为64美元。* 来自巴克莱银行的分析师决定维持对西维斯健康的超配评级,目前目标价为71美元。* 来自瑞银的分析师决定维持对西维斯健康的中立评级,目前目标价为62美元。* 在评估中保持一致,来自富国银行的分析师对西维斯健康维持等权重评级,目标价为60美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.