Decoding Energy Transfer's Options Activity: What's the Big Picture?

Decoding Energy Transfer's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bullish stance on Energy Transfer (NYSE:ET).

拥有大量资金的投资者对energy transfer(纽交所:ET)采取了看好的态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ET, it often means somebody knows something is about to happen.

我们不知道这些投资者是机构还是富裕个人。但当energy transfer发生如此重大事件时,往往意味着有人知道即将发生某些事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 40 uncommon options trades for Energy Transfer.

今天,Benzinga的期权扫描仪发现了40笔energy transfer的不寻常期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 60% bullish and 32%, bearish.

这些大资金交易者的整体情绪在60%看好和32%看淡之间分裂。

Out of all of the special options we uncovered, 2 are puts, for a total amount of $55,800, and 38 are calls, for a total amount of $4,059,189.

在我们发现的所有特殊期权中,有2个看跌期权,总金额为55,800美元,38个看涨期权,总金额为4,059,189美元。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $27.0 for Energy Transfer over the last 3 months.

考虑到这些合约的成交量和未平仓合约情况,似乎鲸鱼在过去3个月内瞄准了energy transfer的价格区间,从10.0美元到27.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

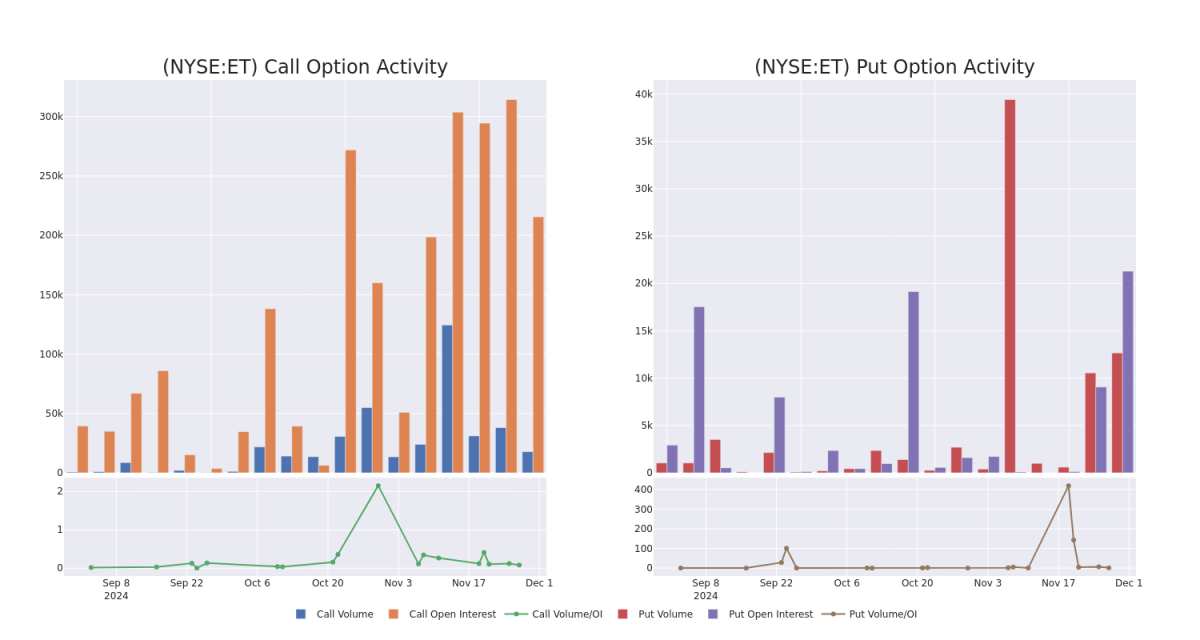

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Energy Transfer's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Energy Transfer's substantial trades, within a strike price spectrum from $10.0 to $27.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易中的一个战略步骤。这些指标为我们揭示了在特定行权价格下,投资者对energy transfer期权的流动性和兴趣。接下来的数据将可视化过去30天与energy transfer的大额交易相关的看涨期权和看跌期权的成交量和未平仓合约在10.0美元到27.0美元的行权价格区间内的波动。

Energy Transfer 30-Day Option Volume & Interest Snapshot

energy transfer 30天期权成交量与兴趣快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ET | CALL | TRADE | BULLISH | 12/19/25 | $9.9 | $8.8 | $9.9 | $10.00 | $788.0K | 12.4K | 1.0K |

| ET | CALL | TRADE | BEARISH | 01/17/25 | $4.95 | $4.75 | $4.8 | $15.00 | $480.0K | 35.4K | 1.0K |

| ET | CALL | TRADE | BEARISH | 06/20/25 | $0.91 | $0.86 | $0.87 | $21.00 | $435.0K | 4.7K | 6.0K |

| ET | CALL | SWEEP | BULLISH | 01/17/25 | $4.9 | $4.8 | $4.85 | $15.00 | $366.6K | 35.4K | 2.0K |

| ET | CALL | TRADE | BULLISH | 12/19/25 | $9.9 | $8.55 | $9.9 | $10.00 | $201.9K | 12.4K | 204 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| energy transfer | 看涨 | 交易 | BULLISH | 12/19/25 | $9.9 | $8.8 | $9.9 | $10.00 | $788.0K | 12.4K | 1.0千 |

| energy transfer | 看涨 | 交易 | 看淡 | 01/17/25 | $4.95 | $4.75 | $4.8 | $15.00 | 480.0K美元 | 35.4K | 1.0千 |

| energy transfer | 看涨 | 交易 | 看淡 | 06/20/25 | 0.91美元 | 每股0.86美元 | $0.87 | $21.00 | $435.0K | 4.7K | 6.0K |

| energy transfer | 看涨 | SWEEP | BULLISH | 01/17/25 | $4.9 | $4.8 | $4.85 | $15.00 | $366.6K | 35.4K | 2.0千 |

| energy transfer | 看涨 | 交易 | BULLISH | 12/19/25 | $9.9 | $8.55 | $9.9 | $10.00 | ¥201.9K | 12.4K | 204 |

About Energy Transfer

有关能源转移的信息

Energy Transfer owns one of the largest portfolios of crude oil, natural gas, and natural gas liquid assets in the US, primarily in Texas and the US midcontinent region. Its pipeline network totals 130,000 miles. It also owns gathering and processing facilities, one of the largest fractionation facilities in the US, fuel distribution assets, and the Lake Charles gas liquefaction facility. It combined its publicly traded limited and general partnerships in October 2018.

Energy Transfer拥有美国最大的原油、天然气和天然气液体资产组合之一,主要位于得克萨斯州和美国中部地区。其管道网络总长13万英里。它还拥有采集和加工设施、美国最大的分馏设施之一、燃料分销资产以及莱克查尔斯天然气液化设施。该公司在2018年10月合并了其公开交易的有限合伙和普通合伙。

In light of the recent options history for Energy Transfer, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到energy transfer最近的期权历史,现在重点关注公司本身是合适的。我们旨在探讨其当前表现。

Energy Transfer's Current Market Status

Energy Transfer当前的市场状况

- With a volume of 16,063,956, the price of ET is up 2.32% at $19.87.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 75 days.

- 成交量为16,063,956,Et的价格上涨2.32%,达$19.87。

- RSI因子暗示底层股票可能被超买。

- 下次财报预计将在75天后发布。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Energy Transfer with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也提供更高利润的潜力。精明的交易者通过持续的教育、战略性交易调整、利用各种因子以及紧跟市场动态来减轻这些风险。通过Benzinga Pro跟进Energy Transfer的最新期权交易,以获取实时提醒。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ET, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ET, it often means somebody knows something is about to happen.