Anhui Jianghuai Automobile Group Corp.,Ltd.'s (SHSE:600418) Last Week's 9.6% Decline Must Have Disappointed Retail Investors Who Have a Significant Stake

Anhui Jianghuai Automobile Group Corp.,Ltd.'s (SHSE:600418) Last Week's 9.6% Decline Must Have Disappointed Retail Investors Who Have a Significant Stake

Key Insights

主要见解

- Significant control over Anhui Jianghuai Automobile GroupLtd by retail investors implies that the general public has more power to influence management and governance-related decisions

- 45% of the business is held by the top 25 shareholders

- Institutions own 10% of Anhui Jianghuai Automobile GroupLtd

- 零售投资者对安徽江淮汽车集团有限公司的显著控制意味着,公众有更多权力影响管理和治理相关决策。

- 前25大股东占45%的业务。

- 机构持有安徽江淮汽车集团有限公司10%的股份。

To get a sense of who is truly in control of Anhui Jianghuai Automobile Group Corp.,Ltd. (SHSE:600418), it is important to understand the ownership structure of the business. We can see that retail investors own the lion's share in the company with 54% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

为了了解谁真正控制着安徽江淮汽车集团股份有限公司(SHSE:600418),理解业务的所有权结构是重要的。我们可以看到,零售投资者在公司中拥有54%的股份。换句话说,该集团从对公司的投资中获益最大(或损失最大)。

As market cap fell to CN¥77b last week, retail investors would have faced the highest losses than any other shareholder groups of the company.

由于市值上周降至770亿人民币,散户投资者面临的损失比公司其他股东群体要高。

Let's delve deeper into each type of owner of Anhui Jianghuai Automobile GroupLtd, beginning with the chart below.

让我们深入探讨安徽江淮汽车集团有限公司每种所有者的情况,从下面的图表开始。

What Does The Institutional Ownership Tell Us About Anhui Jianghuai Automobile GroupLtd?

机构所有权对我们揭示了安徽江淮汽车集团有限公司的什么信息?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

许多机构衡量其业绩的标准是一个近似于当地市场的指数。因此,他们通常更加关注包括在主要指数中的公司。

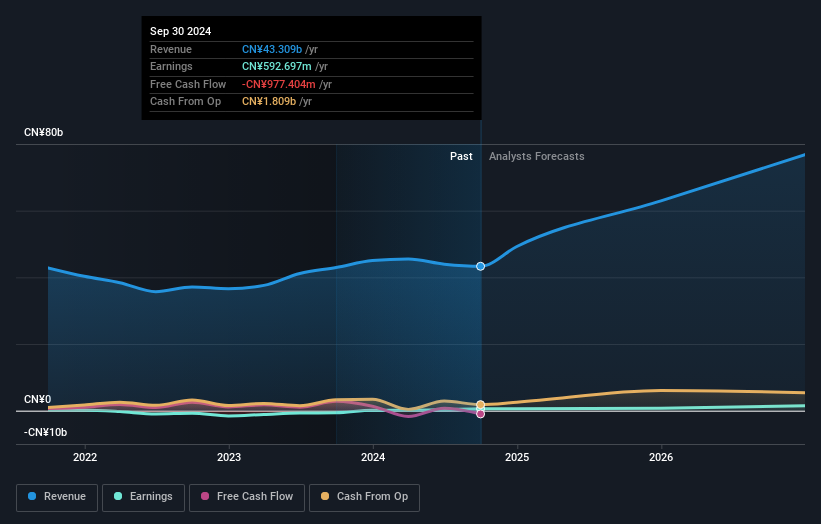

Anhui Jianghuai Automobile GroupLtd already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Anhui Jianghuai Automobile GroupLtd's earnings history below. Of course, the future is what really matters.

安徽江淮汽车集团有限公司已经在股份登记中有机构参与。确实,他们在公司中拥有可观的股份。这可能表明公司在投资界具有一定的可信度。然而,最好谨慎依赖机构投资者所带来的所谓验证,因为他们有时也会出错。如果多个机构在同一时间变更对某只股票的看法,您可能会看到股价迅速下跌。因此,查看安徽江淮汽车集团有限公司的盈利历史是值得的。当然,未来才是最重要的。

Anhui Jianghuai Automobile GroupLtd is not owned by hedge funds. The company's largest shareholder is Anhui Jianghuai Automobile Group Co., Ltd., with ownership of 28%. In comparison, the second and third largest shareholders hold about 3.0% and 2.5% of the stock.

安徽江淮汽车集团有限公司并不被对冲基金持有。 该公司的最大股东是安徽江淮汽车集团有限公司,拥有28%的股份。相比之下,第二和第三大股东分别持有约3.0%和2.5%的股票。

Our studies suggest that the top 25 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

我们的研究表明,前25大股东共控制了公司股份的不到一半,这意味着公司的股份广泛分散,没有主导股东。

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

我们的数据表明,私人公司持有公司的4.0%的股份。单单从这个事实上很难得出任何结论,因此它值得研究谁拥有这些私人公司。有时内部人或其他相关方通过单独的私营公司持有上市公司的股份。

Insider Ownership Of Anhui Jianghuai Automobile GroupLtd

安徽江淮汽车集团有限公司的内部持股

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

虽然内部人员的具体定义可能是主观的,但几乎所有人都认为董事会成员是内部人员。公司管理层应向董事会回答问题,后者应代表股东的利益。值得注意的是,有时高层管理人员也会成为董事会成员。

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

我通常认为内部人士持股是一件好事。但是,在某些情况下,它会使其他股东更难以对董事会的决定进行问责。

Our data cannot confirm that board members are holding shares personally. It is unusual not to have at least some personal holdings by board members, so our data might be flawed. A good next step would be to check how much the CEO is paid.

我们的数据无法确认董事会成员是否持有个人股份。董事会成员至少持有一些个人股份是不寻常的,因此我们的数据可能有缺陷。下一步可行的行动是检查CEO的薪资。

General Public Ownership

一般大众所有权

The general public -- including retail investors -- own 54% of Anhui Jianghuai Automobile GroupLtd. This size of ownership gives investors from the general public some collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

公众,包括散户投资者,拥有安徽江淮汽车集团股份有限公司54%的股份。这种规模的 ownership 赋予了公众投资者某种集体权力。他们可以并且可能会影响管理层薪酬、股息政策以及拟议的业务收购决策。

Private Company Ownership

私有公司的所有权

Our data indicates that Private Companies hold 34%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

我们的数据表明,私营企业持有公司股份的34%。深入了解这一点可能是值得的。如果相关方,例如内部人员,在这些私营公司之一拥有利益,则应在年度报告中披露。私营公司也可能对公司具有战略性利益。

Next Steps:

下一步:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Anhui Jianghuai Automobile GroupLtd you should know about.

我觉得了解一个公司究竟由谁拥有非常有趣。但要真正获得洞见,我们还需要考虑其他信息。比如风险。每个公司都有风险,而我们发现了一个关于安徽江淮汽车集团有限公司的警告信号,你应该知道。

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

最终,未来最重要。您可以在这份关于该公司分析师预测的免费报告中获取有关信息。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注:本文中的数据是使用最后一个财务报表日期结束的为期12个月的数据计算的。这可能与全年年度报告数据不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.