Should You Be Adding Assured Guaranty (NYSE:AGO) To Your Watchlist Today?

Should You Be Adding Assured Guaranty (NYSE:AGO) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

对于一些投机者来说,投资一家能扭转乾坤的公司的激动人心的是一个很大的吸引力,所以即使是没有营业收入、没有盈利,并且营业额不达标的公司也可以找到投资人。但现实情况是,当一家公司亏损多年后,其投资者通常会分担其中的损失。一家亏损的公司尚未证明其能带来利润,并且外部资本的流入最终可能会枯竭。

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Assured Guaranty (NYSE:AGO). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

尽管处于科技股票蓝天投资的时代,许多投资者仍然采用更传统的策略;购买像assured guaranty(纽交所:AGO)这样的盈利公司股票。虽然利润并不是投资时唯一需要考虑的指标,但值得认识到那些能够持续产生利润的业务。

How Fast Is Assured Guaranty Growing?

assured guaranty的增长速度有多快?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Assured Guaranty has achieved impressive annual EPS growth of 59%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

一般来说,盈利每股收益(EPS)增长的公司,其股票价格应会出现类似的趋势。因此,有许多投资者喜欢购买盈利每股收益(EPS)增长的公司的股票。让股东高兴的是,assured guaranty在过去三年中实现了每股收益(EPS)59%的惊人年增长率,这个复合增长率。如此快速的增长可能会短暂,但足以引起谨慎股票挑选者的兴趣。

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Assured Guaranty's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Assured Guaranty's EBIT margins have actually improved by 36.5 percentage points in the last year, to reach 61%, but, on the flip side, revenue was down 7.1%. That's not a good look.

验证公司增长的一种方式是查看其营业收入和息税前利润(EBIT)利润率的变化。我们的分析突出显示,assured guaranty的运营收入在过去12个月内并未占到其所有收入,因此我们对其利润率的分析可能无法准确反映其基础业务。assured guaranty的EBIT利润率在过去一年实际提高了36.5个百分点,达到了61%,但相反,营业收入下降了7.1%。这并不好。

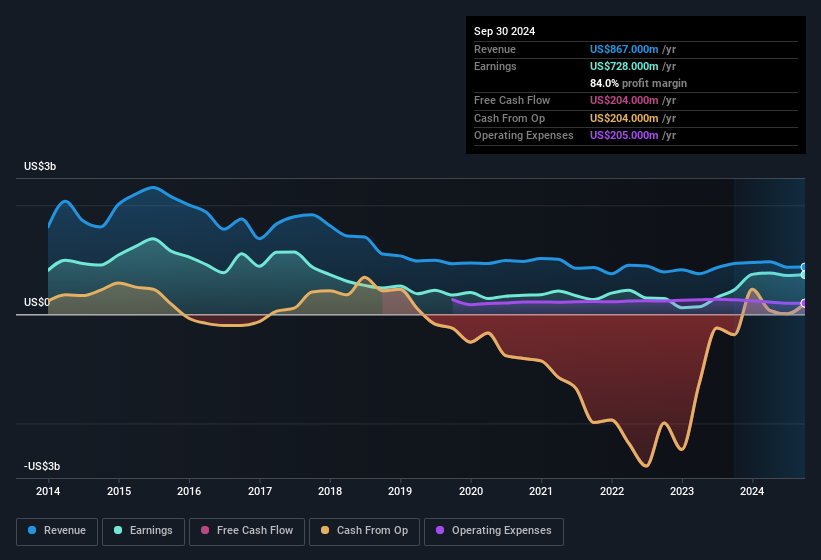

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

下面的表格显示了公司的营收和净利润如何随着时间的推移的变化。点击图表可以查看准确的数字。

Fortunately, we've got access to analyst forecasts of Assured Guaranty's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

幸运的是,我们可以获取分析师对Assured Guaranty未来 profits的预测。你可以自己进行预测,也可以看看专业人士的预测。

Are Assured Guaranty Insiders Aligned With All Shareholders?

Assured Guaranty的内部人员与所有股东一致吗?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Assured Guaranty shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$265m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

看到公司领导把自己的资金投入其中真让人高兴,这增强了经营业务的人和其真正拥有者之间的激励一致性。股东会对内部人员拥有价值可观的Assured Guaranty股票这一事实感到满意。确实,他们在其中投资了相当可观的财富,目前估值为26500万美元。这表明领导层在做决策时会非常关注股东的利益!

Is Assured Guaranty Worth Keeping An Eye On?

Assured Guaranty值得关注吗?

Assured Guaranty's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Assured Guaranty is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It is worth noting though that we have found 2 warning signs for Assured Guaranty (1 can't be ignored!) that you need to take into consideration.

Assured Guaranty的盈利以相当令人印象深刻的方式腾飞。每股收益的增长确实引人注目,且大比例的内部持股更进一步激发了我们的兴趣。有时快速的每股收益增长是业务已到达转折点的标志,因此这里存在潜在的机会。因此,从表面上看,Assured Guaranty值得加到你的自选中;毕竟,当市场低估快速成长的公司时,股东们会获得良好的回报。值得注意的是,我们发现了Assured Guaranty的两个警示信号(一个是不能忽视的!)你需要考虑这一点。

Although Assured Guaranty certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

虽然Assured Guaranty看起来确实不错,但如果内部人士购买股票,可能会吸引更多的投资者。如果你喜欢看到公司有更多的利益相关,那么请查看这份精心挑选的公司名单,这些公司不仅拥有强劲的增长,而且还拥有强大的内部支持。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文讨论的内部交易是指在相关司法管辖区中报告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Assured Guaranty's revenue

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Assured Guaranty's revenue