Goldman Sachs analyst Will Nance maintains $Affirm Holdings (AFRM.US)$ with a buy rating, and adjusts the target price from $54 to $78.

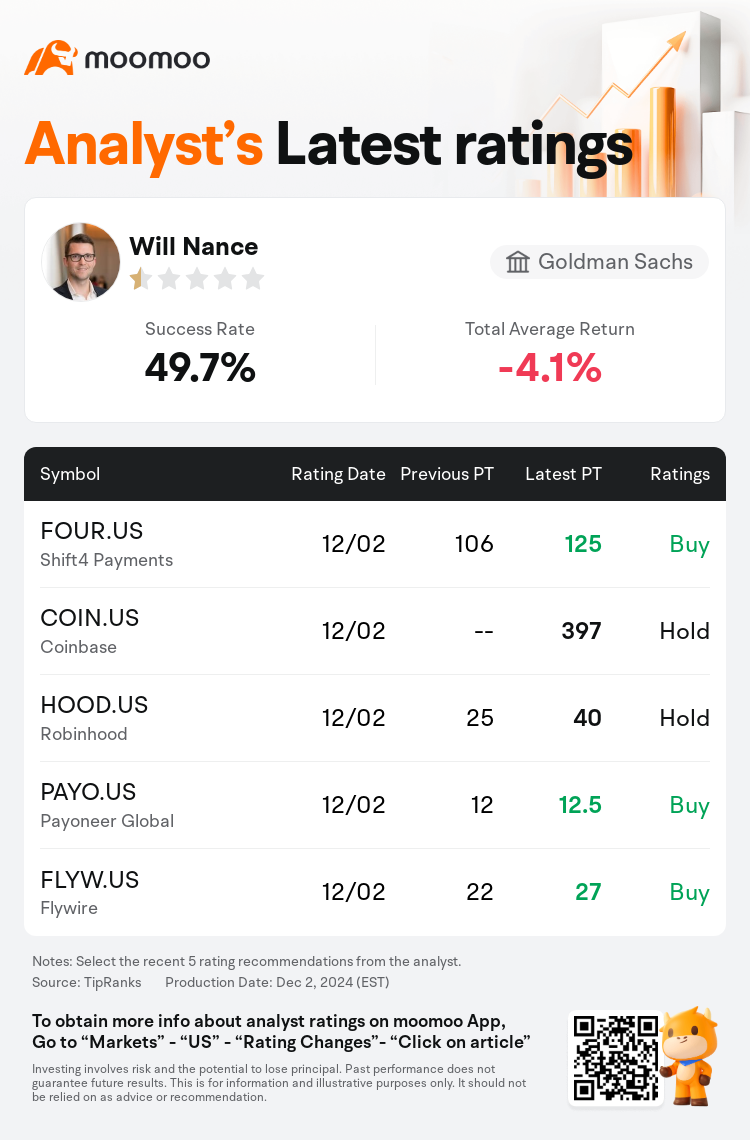

According to TipRanks data, the analyst has a success rate of 49.7% and a total average return of -4.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Affirm Holdings (AFRM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Affirm Holdings (AFRM.US)$'s main analysts recently are as follows:

Since the election, the median payment technology stock has risen by 18%, with shares exposed to higher beta growth and pro-cyclical factors outperforming significantly. Analysts believe that fintech stands to benefit from a stronger economy, inflation, and potential policy adjustments under the new administration. Nonetheless, due to more elevated valuations and limited visibility for an acceleration in fundamentals, a more selective approach is favored.

Looking ahead to 2025, lower benchmark rates alongside a more favorable third-party funding situation are expected to propel a rise in loan origination volumes and improve margins for fintech lenders. Both Shopify and Affirm are identified as pivotal holdings, with observations pointing to their revenue and volume growth either matching or surpassing levels seen during the pandemic, thus bucking the broader e-commerce trends.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

高盛集团分析师Will Nance维持$Affirm Holdings (AFRM.US)$买入评级,并将目标价从54美元上调至78美元。

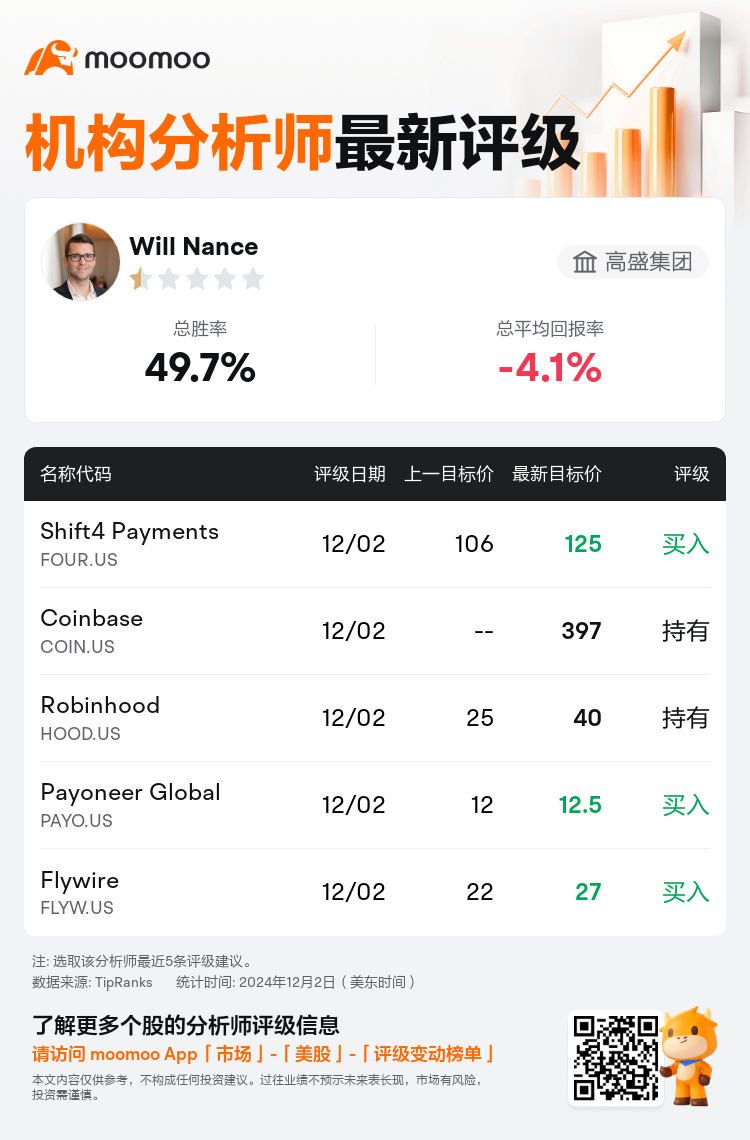

根据TipRanks数据显示,该分析师近一年总胜率为49.7%,总平均回报率为-4.1%。

此外,综合报道,$Affirm Holdings (AFRM.US)$近期主要分析师观点如下:

此外,综合报道,$Affirm Holdings (AFRM.US)$近期主要分析师观点如下:

自选举以来,支付科技股中位股价上涨了18%,受益于暴露于更高 beta 增长和顺周期因素的股票表现显着。分析师认为,金融科技有望受益于经济走强、通货膨胀和新政府下潜在的政策调整。尽管如此,受益于更高估值和基本面加速的有限可见性,更倾向于更有选择性的方法。

展望2025年,较低的基准利率以及更有利的第三方融资情况预计将推动贷款发放量的增长,并改善金融科技放贷人的利润率。 Shopify 和 Affirm 都被确定为关键持有股,观察表明,它们的营业收入和成交量增长要么与疫情期间看到的水平持平,要么超过,从而背离更广泛的电子商务趋势。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Affirm Holdings (AFRM.US)$近期主要分析师观点如下:

此外,综合报道,$Affirm Holdings (AFRM.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of