Top 3 Financial Stocks That Could Lead To Your Biggest Gains In Q4

Top 3 Financial Stocks That Could Lead To Your Biggest Gains In Q4

The most oversold stocks in the financial sector presents an opportunity to buy into undervalued companies.

金融业中超卖最多的股票为买入被低估的公司提供了机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一个动量指标,它比较股票在价格上涨的日子里的走强与价格下跌的日子的走强。与股票的价格走势相比,它可以让交易者更好地了解股票在短期内的表现。根据Benzinga Pro的数据,当相对强弱指数低于30时,资产通常被视为超卖。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是该行业主要超卖参与者的最新名单,RSI接近或低于30。

Inter & Co Inc (NASDAQ:INTR)

Inter & Co Inc(纳斯达克股票代码:INTR)

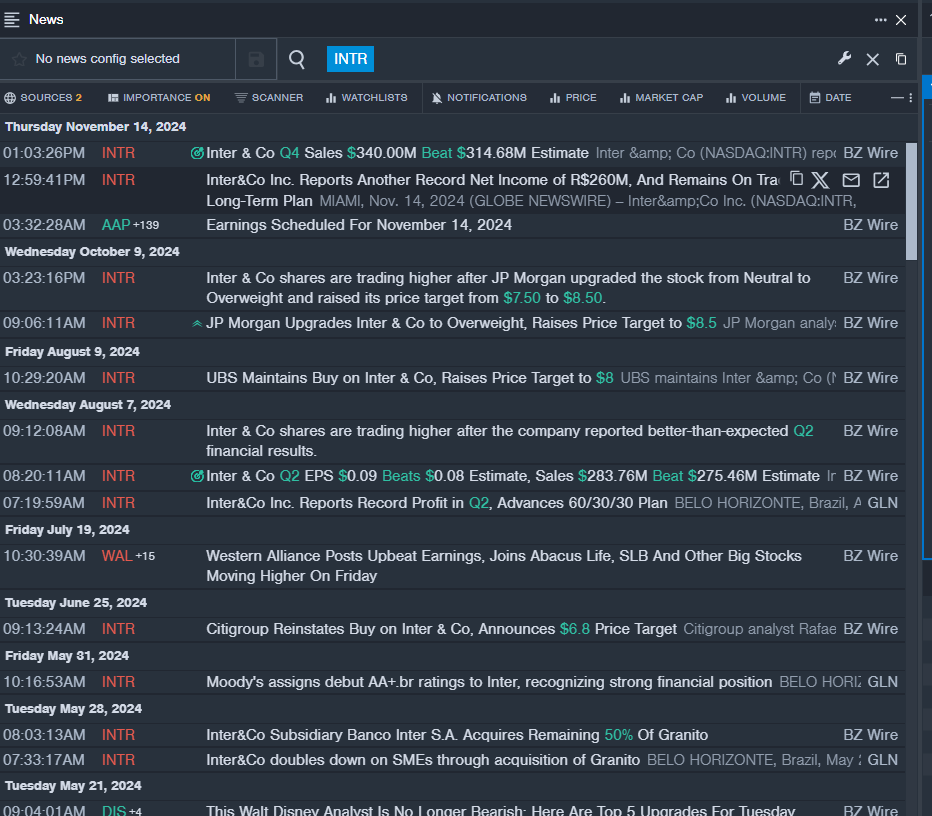

- On Nov. 14, Inter & Co posted better-than-expected quarterly sales. "We had a solid third quarter, reporting increased profitability and growth in both fee and interest income. Our focus on executing the 60/30/30 plan by increasing market share and product penetration, while we maintain efficiency gains is paying off." The company's stock fell around 29% over the past month and has a 52-week low of $4.32.

- RSI Value: 19.97

- INTR Price Action: Shares of Inter fell 1.3% to close at $4.56 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest INTR news.

- 11月14日,Inter&Co公布的季度销售额好于预期。“我们的第三季度表现稳健,盈利能力有所提高,费用和利息收入均有所增长。我们专注于通过增加市场份额和产品渗透率来执行60/30/30计划,同时保持效率的提高,这正在获得回报。”该公司的股票在过去一个月中下跌了约29%,为52周低点4.32美元。

- RSI 值:19.97

- INTR价格走势:周一,国际米兰股价下跌1.3%,收于4.56美元。

- Benzinga Pro的实时新闻提醒了最新的INTR新闻。

Nu Holdings Ltd (NYSE:NU)

Nu 控股有限公司(纽约证券交易所代码:NU)

- On Dec. 2, Citigroup downgraded its rating from Neutral to Sell on the stock and lowered its price target from $14.6 to $11. The company's stock fell around 14% over the past five days and has a 52-week low of $8.06.

- RSI Value: 26.71

- NU Price Action: Shares of Nu Holdings fell 4.2% to close at $12.00 on Monday.

- Benzinga Pro's charting tool helped identify the trend in NU stock.

- 12月2日,花旗集团将该股的评级从中性下调至卖出,并将目标股价从14.6美元下调至11美元。该公司的股票在过去五天中下跌了约14%,跌至52周低点8.06美元。

- RSI 值:26.71

- NU价格走势:Nu Holdings的股价周一下跌4.2%,收于12.00美元。

- Benzinga Pro的图表工具帮助确定了NU股票的走势。

AppTech Payments Corp (NASDAQ:APCX)

AppTech 支付公司(纳斯达克股票代码:APCX)

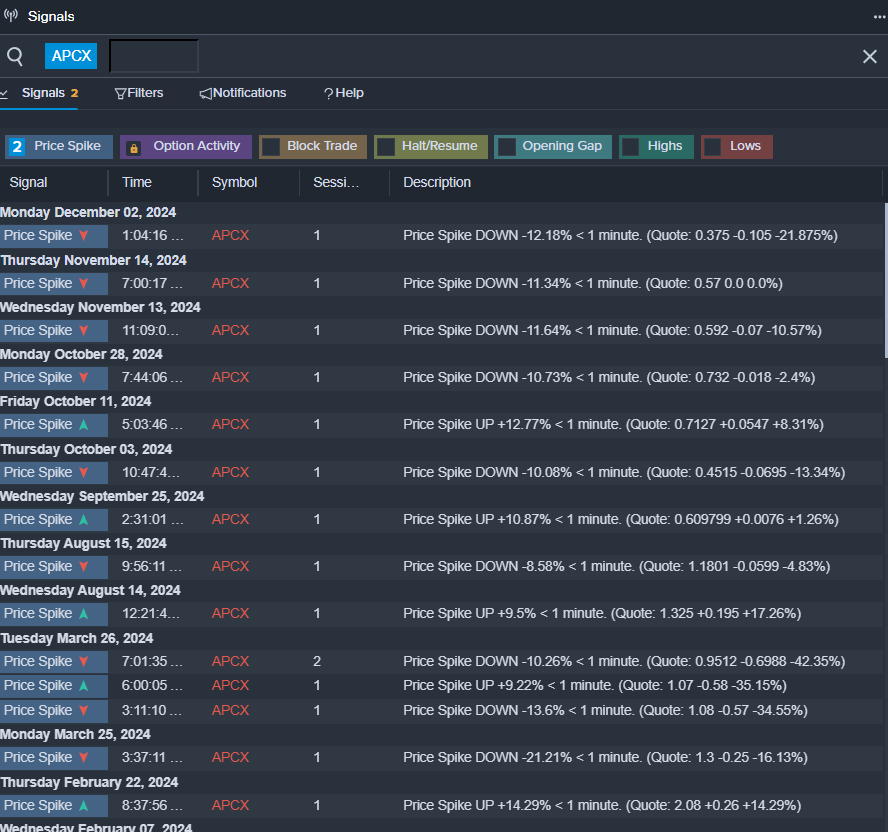

- On Nov. 15, AppTech Payments reported a quarterly loss of 8 cents per share, which missed the analyst consensus estimate of a loss of 6 cents per share. "Our Q3 results reflect our focused approach to refining digital payment solutions and advancing strategic platform development to serve key sectors better," said Luke D'Angelo, Chairman and CEO of AppTech. The company's stock fell around 37% over the past month and has a 52-week low of $0.38.

- RSI Value: 25.34

- APCX Price Action: Shares of AppTech Payments fell 12.5% to close at $0.42 on Monday.

- Benzinga Pro's signals feature notified of a potential breakout in APCX shares.

- 11月15日,AppTech Payments公布的季度每股亏损为8美分,未达到分析师普遍预期的每股亏损6美分。AppTech董事长兼首席执行官Luke D'Angelo表示:“我们的第三季度业绩反映了我们专注于完善数字支付解决方案和推进战略平台开发以更好地服务关键领域的方法。”该公司的股票在过去一个月中下跌了约37%,为52周低点0.38美元。

- RSI 值:25.34

- APCX价格走势:周一,AppTech Payments的股价下跌12.5%,收于0.42美元。

- Benzinga Pro的信号功能被告知APCX股票可能出现突破。

Read This Next:

接下来阅读这篇文章:

- This Analyst With 85% Accuracy Rate Sees More Than 8% Upside In CrowdStrike – Here Are 5 Stock Picks For November From Wall Street's Most Accurate Analysts

- 这位准确率为85%的分析师认为CrowdStrike的上行空间超过8%——以下是华尔街最准确的分析师在11月份精选的5只股票