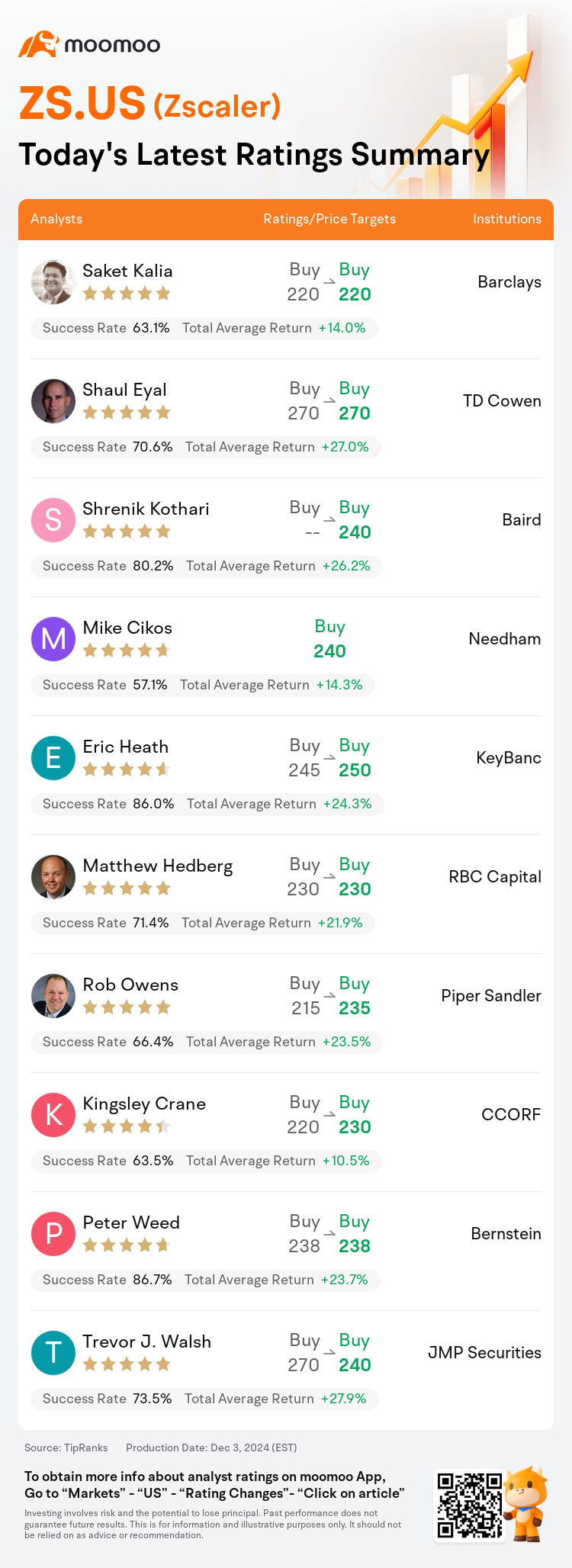

On Dec 03, major Wall Street analysts update their ratings for $Zscaler (ZS.US)$, with price targets ranging from $220 to $270.

Barclays analyst Saket Kalia maintains with a buy rating, and maintains the target price at $220.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and maintains the target price at $270.

Baird analyst Shrenik Kothari maintains with a buy rating, and sets the target price at $240.

Baird analyst Shrenik Kothari maintains with a buy rating, and sets the target price at $240.

Needham analyst Mike Cikos initiates coverage with a buy rating, and sets the target price at $240.

KeyBanc analyst Eric Heath maintains with a buy rating, and adjusts the target price from $245 to $250.

Furthermore, according to the comprehensive report, the opinions of $Zscaler (ZS.US)$'s main analysts recently are as follows:

Zscaler's fiscal Q1 outcomes were highlighted by numerous positives such as a 30% year-over-year acceleration in bookings, though billing growth fell short at 13%, which was below the buy-side expectations of mid-teens. Furthermore, the sudden retirement of CFO Remo Canessa introduces uncertainty concerning the anticipated acceleration in the second half of the fiscal year. Nonetheless, comments from Zscaler indicate that recent changes in sales leadership are leading to stabilization, potentially enhancing the company's ability to market its broader platform solutions.

Fiscal Q1 results were deemed 'fine,' though the beat on billings was not as substantial as anticipated. The fiscal year outlook continues to project a significant acceleration in the latter half. This expectation persists despite ongoing transitions within the sales organization and recent changes in the CFO position.

Ahead of the company's upcoming earnings report, expectations among investors have shown mixed signals. Initial guidance was considered "conservative" and the benchmark for Q1 billings growth is relatively "low". Nonetheless, demand continues to be robust and billings are well-positioned to improve. This scenario provides a compelling outlook for the remainder of its fiscal year. Expectations of an upward trend through FY25 are also suggested by comparisons with higher peer multiples.

Zscaler's solid Q1 results surpassed consensus estimates, bolstered by increased customer interest in emerging products and significant engagement from large customers. These results have reinforced confidence that ZScaler is well-prepared for a strong recovery in the second half of 2025 and is poised to capitalize on fiscal year 2026 as the sales approach matures and new products facilitate growth. Despite this, the unaltered guidance for the remainder of FY25 and uncertainties arising from the CFO transition might lead investors to adopt a cautious 'wait-and-see' stance. Purchasing during periods of weakness could be advisable.

Despite similar economic challenges faced by its industry peers, and significant adjustments to its sales strategies, the company maintains steady performance. The firm's billings, particularly around new sales and opportunistic renewals, have seen a growth rate of 20%. However, there are concerns about the ongoing transition in its market approach, necessitating a restructuring of its sales framework to more effectively engage and expand within its existing customer base.

Here are the latest investment ratings and price targets for $Zscaler (ZS.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

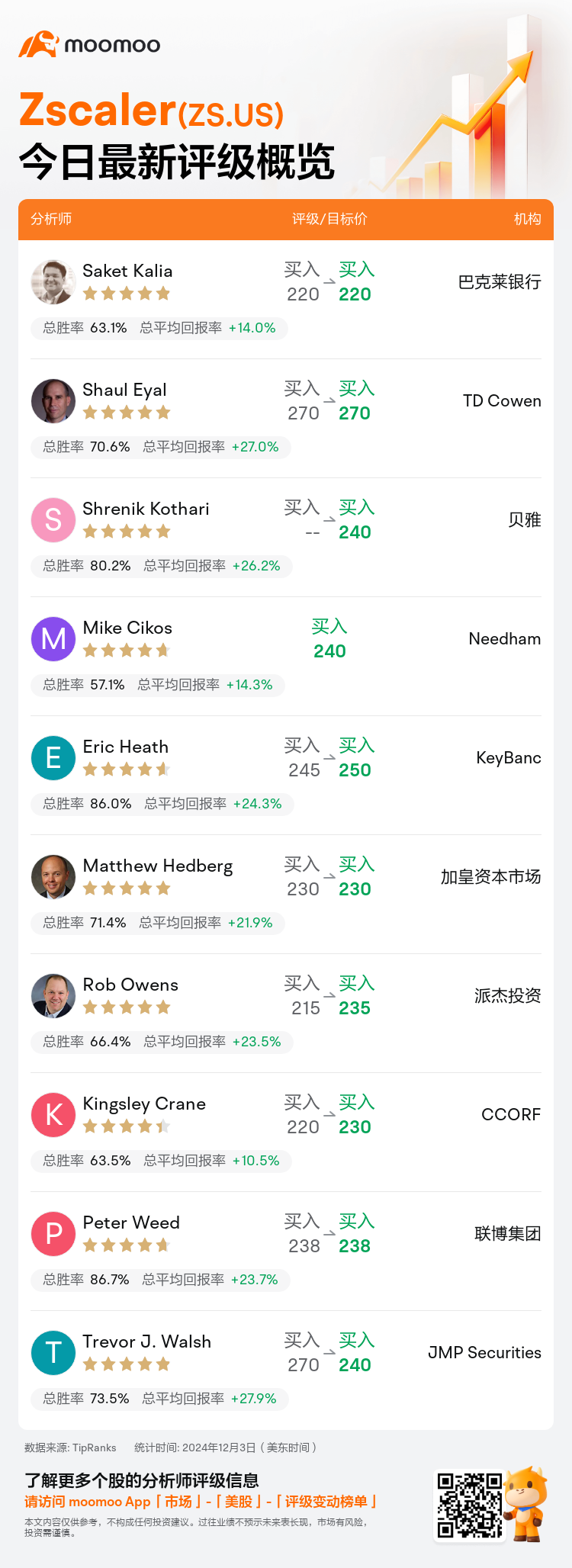

美东时间12月3日,多家华尔街大行更新了$Zscaler (ZS.US)$的评级,目标价介于220美元至270美元。

巴克莱银行分析师Saket Kalia维持买入评级,维持目标价220美元。

TD Cowen分析师Shaul Eyal维持买入评级,维持目标价270美元。

贝雅分析师Shrenik Kothari维持买入评级,目标价240美元。

贝雅分析师Shrenik Kothari维持买入评级,目标价240美元。

Needham分析师Mike Cikos首予买入评级,目标价240美元。

KeyBanc分析师Eric Heath维持买入评级,并将目标价从245美元上调至250美元。

此外,综合报道,$Zscaler (ZS.US)$近期主要分析师观点如下:

zscaler的财政第一季度结果突出了许多积极因素,例如预订量同比增长30%,尽管账单增长仅为13%,低于买方对中期水平的预期。此外,CFO雷莫·卡内萨的突然养老带来了关于财政年下半年预期加速的不确定性。尽管如此,zscaler的评论表明,近期的销售领导层变动正在导致稳定,有可能增强公司推广其更广泛平台解决方案的能力。

财政第一季度的结果被认为是“不错的”,尽管账单增长比预期的没有那么显著。财政年度的前景仍然预计下半年会有显著加速。尽管销售组织内部正在进行持续的过渡,以及CFO职位的近期变动,这一预期依然存在。

在公司即将发布的财报之前,投资者的预期显示出混合信号。初步指导被认为是“保守的”,并且第一季度账单增长的基准相对“低”。尽管如此,需求仍然强劲,账单有望改善。这种情况为其财政年度的剩余时间提供了令人信服的前景。与同行的更高倍数相比,FY25的上行趋势预期也被暗示。

zscaler的强劲第一季度结果超出了共识预期,得益于客户对新兴产品的兴趣增加以及大客户的积极参与。这些结果增强了人们的信心,即zscaler为2025年下半年强劲复苏做好了充分准备,并准备利用2026财政年,因为销售方式逐渐成熟,新产品促进了增长。尽管如此,针对FY25剩余时间的指导没有变化,以及CFO过渡带来的不确定性,可能会导致投资者保持谨慎的“观望”态度。在疲软时期购买可能是明智的选择。

尽管面临与同行业板块相似的经济挑战,并对销售策略进行了重大调整,但公司业绩保持稳定。公司的账单,特别是在新销售和机会性续约方面,增长率达到了20%。然而,对于其市场策略的持续转型存在一定的担忧,这需要对其销售框架进行重组,以更有效地与现有客户群进行互动和扩展。

以下为今日10位分析师对$Zscaler (ZS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

贝雅分析师Shrenik Kothari维持买入评级,目标价240美元。

贝雅分析师Shrenik Kothari维持买入评级,目标价240美元。

Baird analyst Shrenik Kothari maintains with a buy rating, and sets the target price at $240.

Baird analyst Shrenik Kothari maintains with a buy rating, and sets the target price at $240.