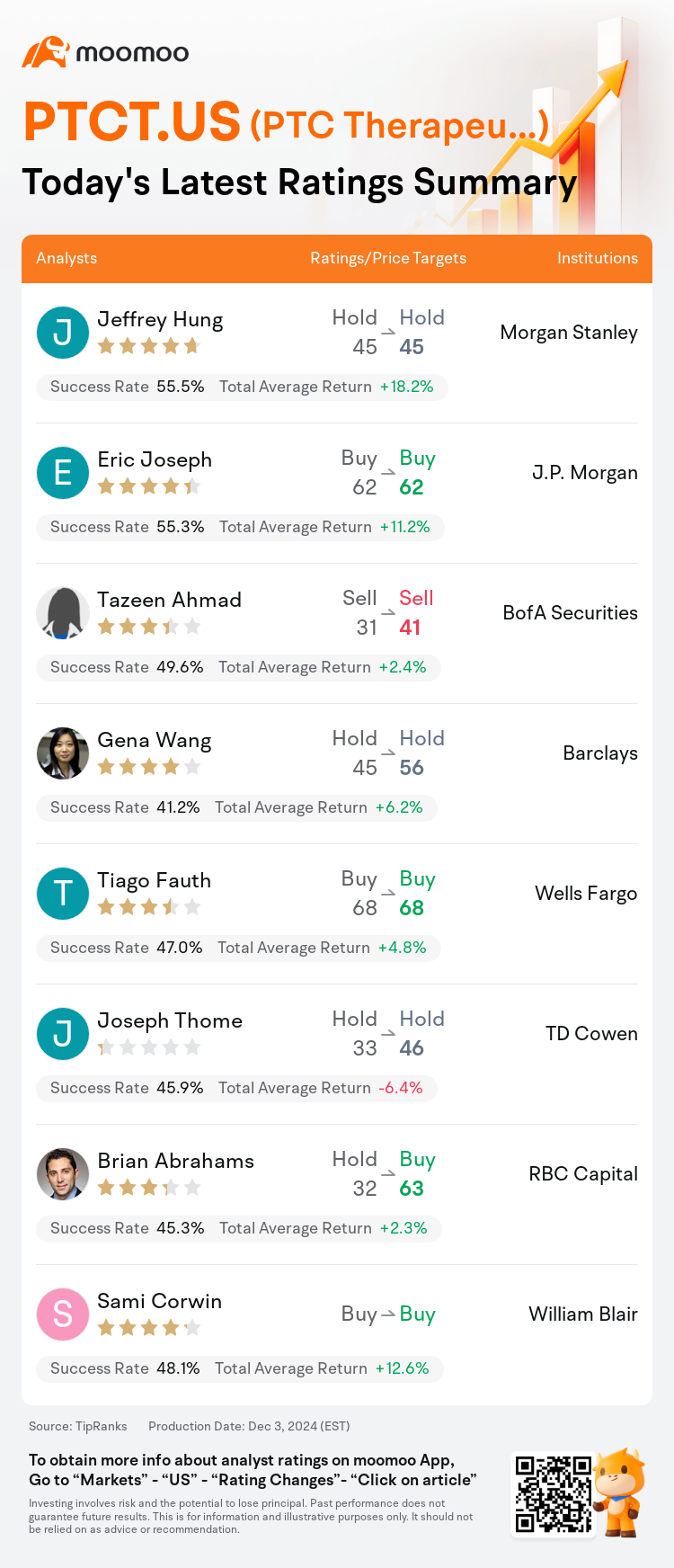

On Dec 03, major Wall Street analysts update their ratings for $PTC Therapeutics (PTCT.US)$, with price targets ranging from $41 to $68.

Morgan Stanley analyst Jeffrey Hung maintains with a hold rating, and maintains the target price at $45.

J.P. Morgan analyst Eric Joseph maintains with a buy rating, and maintains the target price at $62.

BofA Securities analyst Tazeen Ahmad maintains with a sell rating, and adjusts the target price from $31 to $41.

BofA Securities analyst Tazeen Ahmad maintains with a sell rating, and adjusts the target price from $31 to $41.

Barclays analyst Gena Wang maintains with a hold rating, and adjusts the target price from $45 to $56.

Wells Fargo analyst Tiago Fauth maintains with a buy rating, and maintains the target price at $68.

Furthermore, according to the comprehensive report, the opinions of $PTC Therapeutics (PTCT.US)$'s main analysts recently are as follows:

PTC Therapeutics recently disclosed a global licensing and collaboration pact with a major pharmaceutical company for its Huntington's Disease program. This deal comprises an immediate substantial payment to PTC and the potential for substantial additional funds contingent upon developmental, regulatory, and sales achievements. Analysts regard PTC as a robust investment proposition extending into 2025, supported by a broad rare disease portfolio with several significant upcoming events. This agreement with Novartis is viewed favorably, considering the significant upfront payment received by PTC, the retention of considerable economic interests, and the vast potential market upon successful development and approval of their program.

Following the announcement by PTC Therapeutics of a strategic license agreement with a global partner for the development in Huntington's disease, there is encouragement that this deal reduces the near-term demand for capital. Despite this development, there is emphasis on the need for regulatory alignment concerning an accelerated approval path after a promising phase 2 update, while further clarity is awaited regarding the future developmental strategies which are believed to still possess certain risks.

The company's agreement with Novartis, which includes a high upfront payment and milestones, is viewed favorably. This deal not only bolsters the company's financial position but also confirms the validity of its platform, though it also shifts development risks.

The firm believes that the new Huntington's disease collaboration with Novartis is not yet fully reflected in the stock's valuation.

Here are the latest investment ratings and price targets for $PTC Therapeutics (PTCT.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月3日,多家华尔街大行更新了$PTC Therapeutics (PTCT.US)$的评级,目标价介于41美元至68美元。

摩根士丹利分析师Jeffrey Hung维持持有评级,维持目标价45美元。

摩根大通分析师Eric Joseph维持买入评级,维持目标价62美元。

美银证券分析师Tazeen Ahmad维持卖出评级,并将目标价从31美元上调至41美元。

美银证券分析师Tazeen Ahmad维持卖出评级,并将目标价从31美元上调至41美元。

巴克莱银行分析师Gena Wang维持持有评级,并将目标价从45美元上调至56美元。

富国集团分析师Tiago Fauth维持买入评级,维持目标价68美元。

此外,综合报道,$PTC Therapeutics (PTCT.US)$近期主要分析师观点如下:

ptc therapeutics最近披露了与一家主要药品公司的全球许可与合作协议,涉及其亨廷顿病项目。该交易包括对ptc therapeutics的即时大额付款,以及基于开发、监管和销售成就的潜在额外资金。分析师认为ptc therapeutics是一个到2025年的强劲投资选择,得益于广泛的罕见病产品组合以及许多重要的即将发生的事件。与诺华的这项协议受到积极看待,考虑到ptc therapeutics获得的可观前期付款、保留的重大经济利益,以及成功开发和批准其项目后巨大的潜在市场。

在ptc therapeutics宣布与全球合作伙伴达成战略许可协议以开发亨廷顿病后,有人对此交易降低近期资本需求表示鼓舞。尽管这一进展,但仍强调需要在有前景的二期更新后就加速批准路径与监管对接,同时也在等待有关未来开发策略的进一步明确,这些策略据信仍然存在一定风险。

公司与诺华的协议包括高额的前期付款和里程碑,受到积极看待。该交易不仅增强了公司的财务状况,还证实了其平台的有效性,但也转移了开发风险。

该公司认为,与诺华的新亨廷顿病合作尚未完全反映在股价的估值中。

以下为今日8位分析师对$PTC Therapeutics (PTCT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Tazeen Ahmad维持卖出评级,并将目标价从31美元上调至41美元。

美银证券分析师Tazeen Ahmad维持卖出评级,并将目标价从31美元上调至41美元。

BofA Securities analyst Tazeen Ahmad maintains with a sell rating, and adjusts the target price from $31 to $41.

BofA Securities analyst Tazeen Ahmad maintains with a sell rating, and adjusts the target price from $31 to $41.