United States Steel's Options Frenzy: What You Need to Know

United States Steel's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bullish stance on United States Steel (NYSE:X).

有大量资金的投资者对美国钢铁(纽交所:X)采取了看好的态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with X, it often means somebody knows something is about to happen.

我们不知道这些是机构还是仅仅是富有的个人。但是当X发生这样重大的事情时,通常意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 8 uncommon options trades for United States Steel.

今天,Benzinga的期权扫描仪发现了8笔不寻常的期权交易,针对美国钢铁。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 62% bullish and 37%, bearish.

这些大资金交易者的总体情绪在62%看好和37%看淡之间。

Out of all of the special options we uncovered, 6 are puts, for a total amount of $1,709,310, and 2 are calls, for a total amount of $79,128.

在我们发现的所有特殊期权中,有6个看跌期权,总金额为1,709,310美元,和2个看涨期权,总金额为79,128美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $34.0 and $52.5 for United States Steel, spanning the last three months.

在评估交易成交量和未平仓合约后,很明显主要市场参与者关注的是美国钢铁在过去三个月内的价格区间在34.0美元到52.5美元之间。

Insights into Volume & Open Interest

成交量和持仓量分析

In terms of liquidity and interest, the mean open interest for United States Steel options trades today is 12469.25 with a total volume of 12,601.00.

就流动性和兴趣而言,今日美国钢铁期权交易的平均未平仓合约为12,469.25,成交量总计为12,601.00。

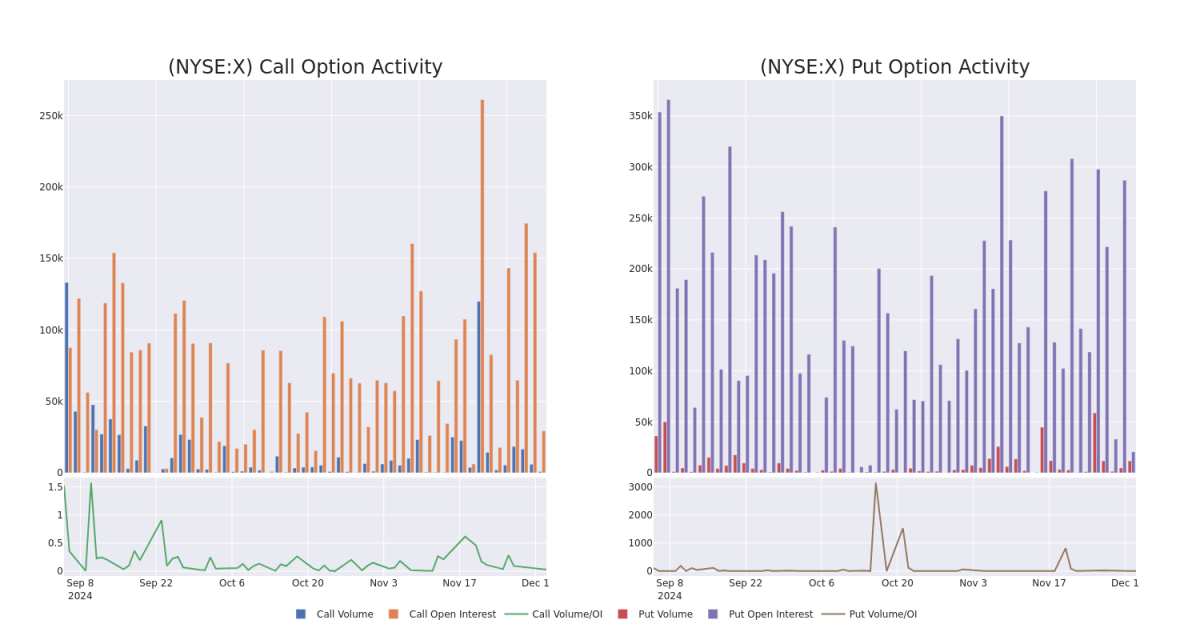

In the following chart, we are able to follow the development of volume and open interest of call and put options for United States Steel's big money trades within a strike price range of $34.0 to $52.5 over the last 30 days.

在下图中,我们能够跟踪在过去30天内美国钢铁大额交易看涨和看跌期权的成交量和未平仓合约的发展,行使价范围在34.0美元到52.5美元之间。

United States Steel Option Volume And Open Interest Over Last 30 Days

美国钢铁期权成交量和过去30天的未平仓合约

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| X | PUT | SWEEP | BEARISH | 12/20/24 | $5.35 | $5.3 | $5.35 | $40.00 | $775.2K | 19.2K | 4.0K |

| X | PUT | SWEEP | BULLISH | 12/20/24 | $6.1 | $5.2 | $5.35 | $40.00 | $429.6K | 19.2K | 815 |

| X | PUT | SWEEP | BEARISH | 12/20/24 | $5.35 | $5.3 | $5.35 | $40.00 | $268.0K | 19.2K | 2.5K |

| X | PUT | SWEEP | BEARISH | 12/20/24 | $6.4 | $4.4 | $5.3 | $40.00 | $172.7K | 19.2K | 2.0K |

| X | CALL | SWEEP | BULLISH | 12/20/24 | $1.36 | $1.0 | $1.36 | $47.00 | $54.1K | 4.8K | 407 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| X | 看跌 | SWEEP | 看淡 | 12/20/24 | $5.35 | $5.3 | $5.35 | $40.00 | $775.2K | 19.2K | 4.0K |

| X | 看跌 | SWEEP | BULLISH | 12/20/24 | $6.1 | $5.2 | $5.35 | $40.00 | $429.6K | 19.2K | 815 |

| X | 看跌 | SWEEP | 看淡 | 12/20/24 | $5.35 | $5.3 | $5.35 | $40.00 | $268.0K | 19.2K | 2.5K |

| X | 看跌 | SWEEP | 看淡 | 12/20/24 | 6.4美元 | $4.4 | $5.3 | $40.00 | $172.7K | 19.2K | 2.0千 |

| X | 看涨 | SWEEP | BULLISH | 12/20/24 | $1.36 | $1.0 | $1.36 | $47.00 | $54.1千美元 | 4.8K | 407 |

About United States Steel

关于美国钢铁

United States Steel Corp operates primarily in the United States but also has a steelmaking capacity in Slovakia. The company's operating segments include North American Flat-Rolled (Flat-Rolled), Mini Mill, U. S. Steel Europe (USSE), and Tubular Products (Tubular). The Flat-Rolled segment includes U. S. Steel's integrated steel plants and equity investees in North America involved in the production of slabs, strip mill plates, sheets, and tin mill products, as well as all iron ore and coke production facilities in the United States. It primarily serves North American customers in the service center, conversion, transportation, construction, container, and appliance, and electrical markets.

美国钢铁公司主要在美国运营,但也在斯洛伐克拥有炼钢能力。该公司的营运板块包括北美平板轧制(平板轧制)、Mini Mill、美国钢铁欧洲(USSE)和管材制品(管材)。平板轧制板块包括美国钢铁的综合钢铁厂和在生产板坯、带钢轧制板、薄钢板和镀锡产品方面涉及北美的股权投资公司,以及美国的全部铁矿石和焦炭生产设备。主要服务于在服务中心、转换、运输、建筑、容器、电器市场的北美客户。

Current Position of United States Steel

美国钢铁的当前位置

- Trading volume stands at 792,588, with X's price down by -6.96%, positioned at $38.1.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 58 days.

- 交易成交量为792,588,X的价格下跌了-6.96%,当前价格为38.1美元。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 预计在58天内公布收益报告。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for United States Steel with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也带来了更高利润的潜力。精明的交易者通过持续的教育、战略性的交易调整、利用各种因子,并保持对市场动态的关注来降低这些风险。使用Benzinga Pro跟踪美国钢铁的最新期权交易,获取实时提醒。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with X, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with X, it often means somebody knows something is about to happen.