'American Exceptionalism Trade' Gains Steam As Dollar, S&P 500 Surge In Lockstep: Bank Of America

'American Exceptionalism Trade' Gains Steam As Dollar, S&P 500 Surge In Lockstep: Bank Of America

The "American exceptionalism" trade is making a roaring comeback, fueled by the potential resurgence of "America First" policies under the upcoming Trump administration, according to Bank of America.

根据美国银行的说法,"美国例外主义" 交易正在强势回归,这一局面受到即将到来的特朗普政府可能复兴"美国优先"政策的推动。

Bank of America analyst Ohsung Kwon highlighted Tuesday the sharp rise in the three-month correlation between the S&P 500 and the U.S. dollar, which has surged to its highest level since 2017.

美国银行分析师Ohsung Kwon在周二强调,标准普尔500指数与美元之间的三个月相关性 sharply 上升,已跃升至2017年以来的最高水平。

Correlation Between U.S. Stocks, Dollar Hits Highest Since 2017

美国股票与美元的相关性达到2017年以来的最高水平

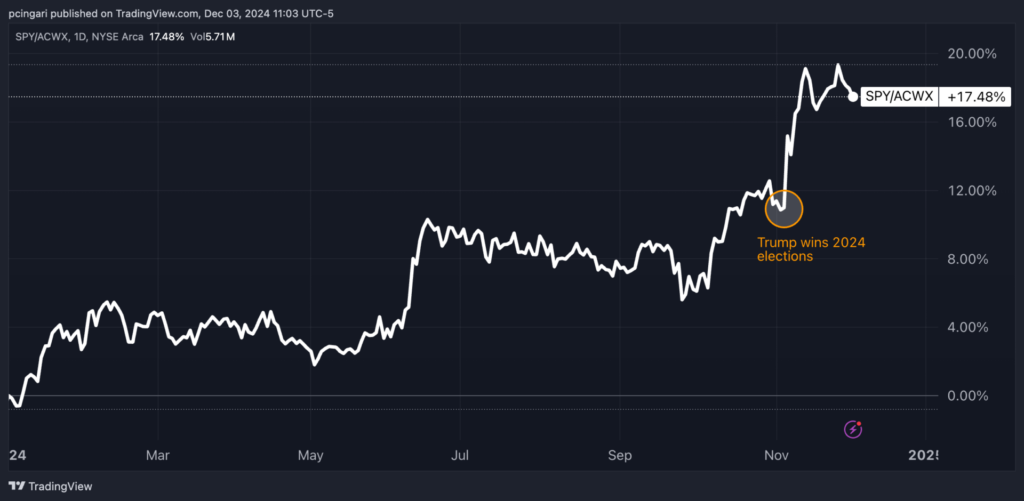

Since the election, U.S. equities have outperformed international stocks by three percentage points, while the U.S. dollar has appreciated 2.9%, signaling renewed investor confidence in America's economic resilience.

自选举以来,美国股票的表现超过国际股票三个百分点,而美元上涨了2.9%,这表明投资者对美国经济韧性的信心重新回升。

The correlation between international equities and the dollar has declined, creating a spread that reached its second-highest level in history, only behind the spike following Trump's 2016 election victory, the analyst said.

分析师表示,国际股票与美元之间的相关性已经下降,形成了一个差距,达到了历史第二高的水平,仅次于特朗普2016年当选后飙升的时期。

"The recent strength in the U.S. dollar suggests the U.S. economic outlook is improving relative to other countries, which is also driving U.S. equities higher versus the rest of the world," said Kwon.

Kwon表示:“近期美元的强势表明,与其他国家相比,美国的经济前景正在改善,这也促使美国股票相对于世界其他地区上涨。”

Between the 2016 election and the end of 2017, the S&P 500, as tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), gained 25%, outperforming international stocks, tracked by the iShares MSCI ACWI EX U.S. ETF (NYSE:ACWX), by 7.6 percentage points.

在2016年选举和2017年底之间,标准普尔500指数(由SPDR S&P 500 ETF Trust(纽交所:SPY)追踪)上涨了25%,超过由iShares MSCI ACWI EX U.S. ETF(纽交所:ACWX)追踪的国际股票7.6个百分点。

The post-election rally this year — while more modest — still sees the S&P 500 ahead by three percentage points.

尽管今年的选后反弹较为温和,但标准普尔500指数仍领先三个百分点。

Chart: U.S. Stocks Sharply Outperform Rest Of The World In 2024

图表:2024年美国股票大幅跑赢全球其他市场

Jobs Report: The Next Catalyst For Markets?

就业报告:市场的下一个催化剂?

The next test for the "American exceptionalism" trade could come Friday, with the release of the November employment report.

对于"美国例外主义"交易的下一个考验可能在星期五到来,届时将发布11月份就业报告。

Bank of America economist Stephen Juneau said the report will likely be noisy, reflecting temporary factors like the end of the Boeing Co. (NYSE:BA) strike and hurricane-related recovery.

美国银行经济学家斯蒂芬·朱诺表示,该报告可能会比较嘈杂,反映出波音公司(纽交所:BA)罢工结束和与飓风相关的复苏等临时因素。

BofA expects nonfarm payrolls to jump by 240,000, bolstered by these one-off effects. To get a clearer sense of the labor market's health, Juneau suggested looking at the two-month average of payroll gains.

美国银行预计非农就业人数将增加24万人,这些一次性因素将助力这一增长。为了更清晰地了解劳动市场的健康状况,朱诺建议关注就业人数增长的两个月平均值。

Adding to the strong labor market narrative, October job openings surprised to the upside. According to the official report released on Tuesday, job openings increased by 372,000 to 7.744 million in October, surpassing market expectations of 7.48 million.

十月的职位空缺数量再次超出预期,进一步验证了强劲的劳动市场叙述。根据周二发布的官方报告,十月职位空缺增加了37.2万个,达到了774.4万,超过了市场预期的748万。

The market reaction to the jobs report may be muted, with S&P options pricing in just an 86-basis-point implied move — the smallest expected reaction since July.

市场对就业报告的反应可能较为温和,S&P期权市场仅显现出86个基点的隐含变动——这是自七月份以来预期反应最小的一次。

Analysts attribute this to a combination of waning macro volatility. "Likely a combination of high data volatility, extreme forecasting challenges, and the Fed's 'data-dependent' posture," Juneau wrote, adding that the SPY's flat reaction to last month's surprising inflation data "was not encouraging"

分析师将此归因于宏观波动减弱的综合影响。"很可能是数据波动性高、预报挑战极大以及美联储的'数据依赖'立场的综合结果,"Juneau写道,并补充说,SPY对上个月意外通胀数据的平坦反应"并不令人鼓舞。"

Photo: Shutterstock

Photo: shutterstock

The correlation between international equities and the dollar has declined, creating a spread that reached its second-highest level in history, only behind the spike following Trump's 2016 election victory, the analyst said.

The correlation between international equities and the dollar has declined, creating a spread that reached its second-highest level in history, only behind the spike following Trump's 2016 election victory, the analyst said.