'Big Short' Trader Danny Moses Gives Up On Shorting Tesla, Says It Is 'Very Difficult To Short A Name That Is Not Trading On Fundamentals'

'Big Short' Trader Danny Moses Gives Up On Shorting Tesla, Says It Is 'Very Difficult To Short A Name That Is Not Trading On Fundamentals'

Moses Ventures founder and "Big Short" fame trader Danny Moses said on Tuesday that he does not have a short position in Tesla Inc. (NASDAQ:TSLA) anymore.

摩西 Ventures 创始人以及因《开空》而闻名的交易员丹尼·摩西在周二表示,他在特斯拉公司(纳斯达克:TSLA)不再持有空头头寸。

What Happened: Moses has been short on Tesla at various times since Nov. 2016 when Tesla bought SolarCity, which he deemed to be an "awful deal."

发生了什么:自2016年11月特斯拉收购SolarCity以来,摩西多次对特斯拉采取空头,认为这是一个"可怕的交易"。

However, in the first quarter of this year, Tesla started to trade on fundamentals after a long time, Moses said.

然而,摩西表示,在今年第一季度,特斯拉在很长时间后开始按基本面进行交易。

After the quarter's performance dropped, the company made promises of autonomous driving and robotaxis and company CEO Elon Musk started developing a relationship with President-elect Donald Trump, Moses noted in an appearance on CNBC.

摩西在CNBC的一次露面中指出,在本季度的表现下滑后,公司承诺实现自动驾驶和机器人出租车,公司的首席执行官埃隆·马斯克开始与当选总统特朗普建立关系。

"When the story moves from non-fundamentals to technicals... that's when I leave the story," Moses said.

"当故事从非基本面转向技术面时……我就会离开这个故事,"摩西说。

"It's very difficult to short a name that is not trading on fundamentals. It's also hard to go long a name when it's all on promises."

"很难做空一个不是基于基本面交易的名字。当一切都只是承诺时,做多也很困难。"

Moses added that Musk has "promised things in the past that never came to fruition" and now he's talking about cutting $2 trillion from the federal budget. "You're not gonna be able to do that."

摩西补充说,马斯克在过去"承诺过的事情从未实现过",现在他谈论的是从联邦预算中削减2万亿。"你将无法做到这一点。"

Why It Matters: Tesla shares closed down 1.6% at $351.42 on Tuesday. The stock is up by nearly 41% year-to-date, particularly after the stock rallied following Trump's victory in the Presidential elections.

重要性:特斯拉的股票在周二收盘时下跌了1.6%,至351.42美元。今年迄今,该股票上涨了近41%,特别是在特朗普在总统选举中获胜后,股票出现反弹。

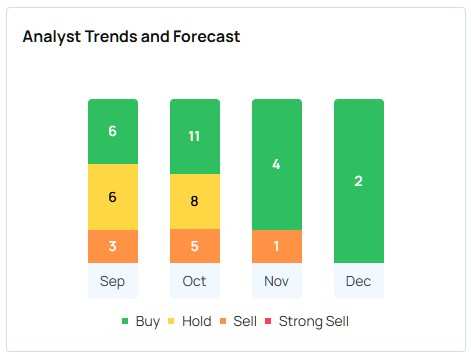

Overall, analysts have a consensus rating of "Buy" on Tesla stock, with the highest price target being $411.

总体来看,分析师对特斯拉股票的共识评级为“买入”,最高目标价为411美元。

Earlier this week, Roth MKM analyst Craig Irwin raised Tesla's price target by 347% from $85 to $380 and upgraded the rating to a "buy" from "neutral."

本周早些时候,Roth MKM的分析师Craig Irwin将特斯拉的目标价从85美元上调347%至380美元,并将评级从“中立”上调至“买入”。

A long-time Tesla bear, Irwin turned bullish on Tesla on Monday noting the benefits that Tesla might reap out of its CEO's new association and support for Trump.

长年来看空特斯拉的Irwin在周一看好特斯拉,提到特斯拉可能从其CEO新近的合作和对特朗普的支持中受益。

Price Action: Tesla stock closed at $351.42 on Tuesday, down 1.6% for the day. Year-to-date, Tesla's shares have risen 41.5%, according to Benzinga Pro data.

价格动态:特斯拉股票在星期二收于351.42美元,跌幅1.6%。截至目前,特斯拉的股票已上涨41.5%,根据Benzinga Pro数据。

Overall, analysts have a consensus rating of "Buy" on the Tesla stock, with the highest price target being $411. The most recent analyst ratings by Roth MKM, Stifel, and UBS have an average price target of $339, implying a 3.5% downside.

总体来看,分析师对特斯拉股票的共识评级为“买入”,最高目标价为411美元。最近的分析师评级来自Roth MKm、Stifel和UBS,平均目标价为339美元,意味着下跌幅度为3.5%。

Check out more of Benzinga's Future Of Mobility coverage by following this link.

查看更多Benzinga的未来出行报道,请点击此链接。

- Ford UK Chair Calls For 'Substantial' Incentives To Boost EV Demand: 'We Need And Want To Sell Electric Vehicles'

- 福特英国主席呼吁提供“实质性”激励措施以促进新能源汽车需求:"我们需要并希望出售新能源汽车"

Image made via photos on Shutterstock

使用shutterstock图片制作而成

After the quarter's performance dropped, the company made promises of autonomous driving and robotaxis and company CEO

After the quarter's performance dropped, the company made promises of autonomous driving and robotaxis and company CEO