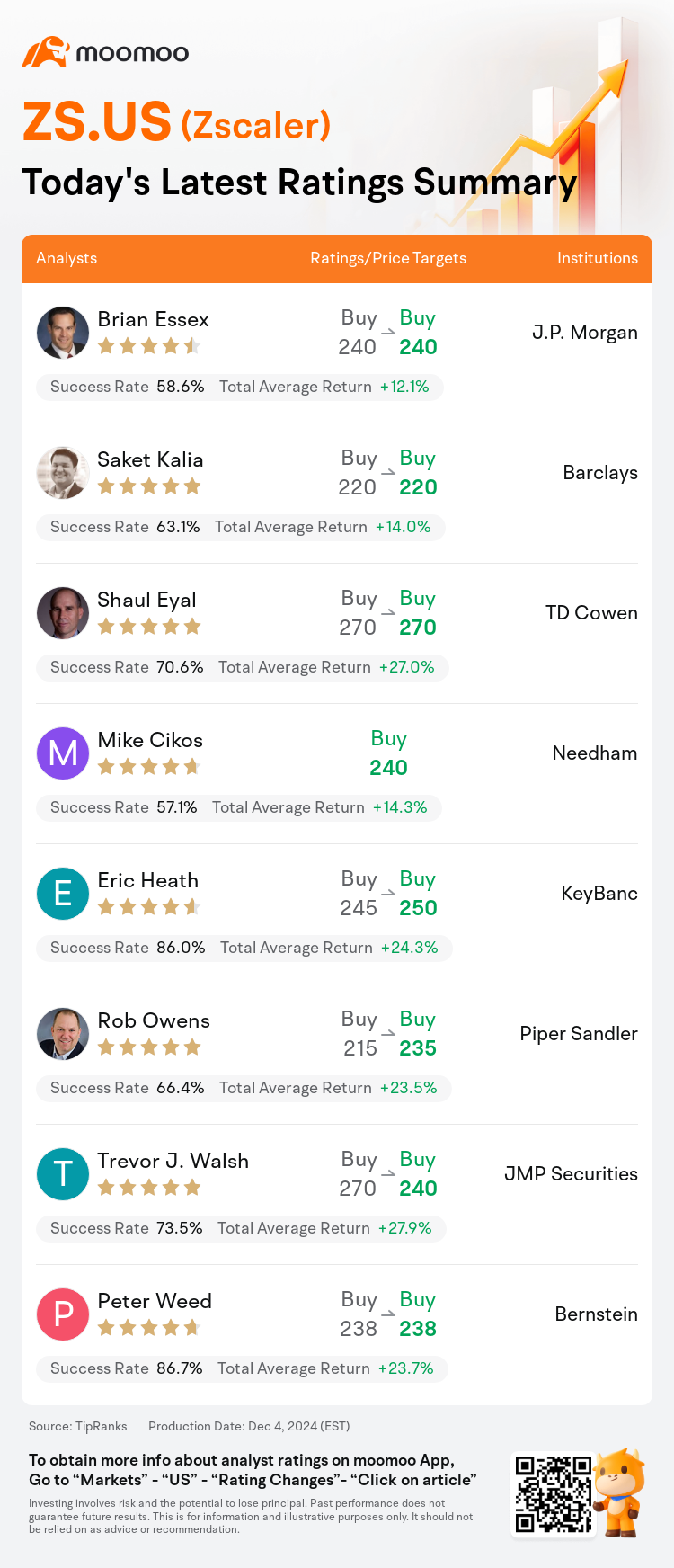

On Dec 04, major Wall Street analysts update their ratings for $Zscaler (ZS.US)$, with price targets ranging from $220 to $270.

J.P. Morgan analyst Brian Essex maintains with a buy rating, and maintains the target price at $240.

Barclays analyst Saket Kalia maintains with a buy rating, and maintains the target price at $220.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and maintains the target price at $270.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and maintains the target price at $270.

Needham analyst Mike Cikos initiates coverage with a buy rating, and sets the target price at $240.

KeyBanc analyst Eric Heath maintains with a buy rating, and adjusts the target price from $245 to $250.

Furthermore, according to the comprehensive report, the opinions of $Zscaler (ZS.US)$'s main analysts recently are as follows:

Following the fiscal Q1 report, it was noted that the company experienced a notable beat in billings and a reacceleration of bookings growth, alongside strong profitability improvements. However, it was also mentioned that these results may not resolve ongoing debates about the company's stock, as concerns remain regarding 'still-back-end weighted sales execution risk' and Q2 billings projections falling below consensus.

Zscaler's Q1 operating margins, billings, and revenue exceeded consensus estimates. Although Zscaler is regarded as a leader in SSE, there is increased caution surrounding the stock as its growth opportunities may primarily hinge on larger customers while competitors' SASE products evolve in the downmarket.

Following Zscaler's report of a 'healthy' Q1, including billings and revenue growth of 13% and 26% respectively, which surpassed market expectations, estimates have been adjusted upwards. Nonetheless, the potential for heightened competition, along with risks to financial projections and challenges regarding the execution of new initiatives, may impede stock performance.

Zscaler's fiscal Q1 results unveiled numerous positive aspects, notably bookings that surged 30% year-over-year, though the billings growth fell short at 13%, deviating from expectations which anticipated a figure closer to the mid-teens. Additionally, the unexpected retirement of CFO Remo Canessa raises concerns about the forecasted acceleration in the second half of the fiscal year. Nonetheless, the company's adjustments in sales leadership are believed to be stabilizing, potentially bolstering its ability to market its comprehensive platform solutions.

Zscaler's fiscal Q1 results were described as adequate, yet the modest outperformance in billings fell short of expectations. The projections for the fiscal year still anticipate a considerable acceleration in the latter half, coinciding with transitions in the sales organization and the departure of the CFO.

Here are the latest investment ratings and price targets for $Zscaler (ZS.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

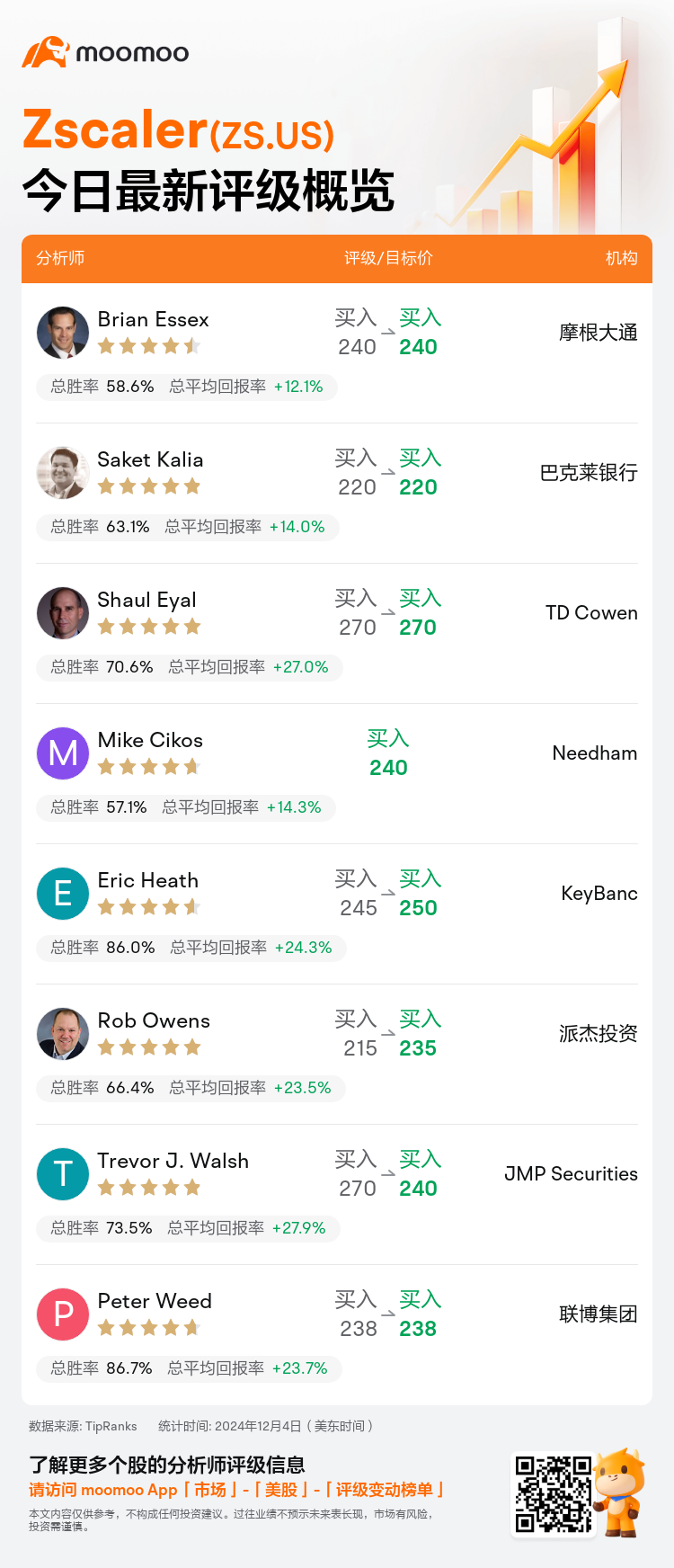

美东时间12月4日,多家华尔街大行更新了$Zscaler (ZS.US)$的评级,目标价介于220美元至270美元。

摩根大通分析师Brian Essex维持买入评级,维持目标价240美元。

巴克莱银行分析师Saket Kalia维持买入评级,维持目标价220美元。

TD Cowen分析师Shaul Eyal维持买入评级,维持目标价270美元。

TD Cowen分析师Shaul Eyal维持买入评级,维持目标价270美元。

Needham分析师Mike Cikos首予买入评级,目标价240美元。

KeyBanc分析师Eric Heath维持买入评级,并将目标价从245美元上调至250美元。

此外,综合报道,$Zscaler (ZS.US)$近期主要分析师观点如下:

根据财政第一季度报告,公司在账单和预订增长上表现出显著的超出预期,伴随着强劲的盈利能力改善。然而,也提到这些结果可能无法解决关于公司股票的持续争论,因为“仍然存在后端销售执行风险”和第二季度账单预测低于市场共识的担忧仍然存在。

Zscaler第一季度的运营利润率、账单和营业收入均超出市场预期。尽管Zscaler被视为SSE的领先者,但由于其增长机会可能主要依赖于大客户,竞争对手的SASE产品在下游市场的发展令市场对该股票更加谨慎。

在Zscaler发布了一份“健康”的第一季度报告后,包括账单和营业收入增长分别达到13%和26%,超出市场预期,因此预计已经上调。然而,潜在的竞争加剧、财务预测的风险以及执行新计划的挑战,可能会阻碍股票表现。

Zscaler的财政第一季度业绩显现出许多积极方面,特别是预订同比激增30%,尽管账单增长仅为13%,未达到预期,市场原本预期接近中位数。除此之外,CFO Remo Canessa的意外退休引发了对财政年度下半年预计加速的担忧。然而,公司的销售领导层调整被认为正在稳定,这有可能增强其市场销售全面平台解决方案的能力。

Zscaler的财政第一季度结果被描述为合格,然而在账单方面的适度超出预期仍未达到市场预期。财政年度的预测依然期待在后半段出现显著加速,这与销售组织的变动及CFO的离职相吻合。

以下为今日8位分析师对$Zscaler (ZS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Shaul Eyal维持买入评级,维持目标价270美元。

TD Cowen分析师Shaul Eyal维持买入评级,维持目标价270美元。

TD Cowen analyst Shaul Eyal maintains with a buy rating, and maintains the target price at $270.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and maintains the target price at $270.