Looking At Meta Platforms's Recent Unusual Options Activity

Looking At Meta Platforms's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Meta Platforms.

拥有大量资金的鲸鱼们对meta platforms采取了明显的看好态度。

Looking at options history for Meta Platforms (NASDAQ:META) we detected 85 trades.

查看meta platforms (纳斯达克:META)的期权历史,我们检测到85笔交易。

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 36% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说44%的投资者以看好的预期开盘交易,36%是以看淡的预期开盘交易。

From the overall spotted trades, 10 are puts, for a total amount of $547,806 and 75, calls, for a total amount of $11,053,985.

在所有发现的交易中,有10笔是看跌期权,总金额为547,806美元,而75笔是看涨期权,总金额为11,053,985美元。

What's The Price Target?

目标价是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $1030.0 for Meta Platforms, spanning the last three months.

在评估交易量和未平仓合约后,很明显,主要市场动向者专注于meta platforms的价格区间为50.0美元到1030.0美元,这一趋势持续了过去三个月。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

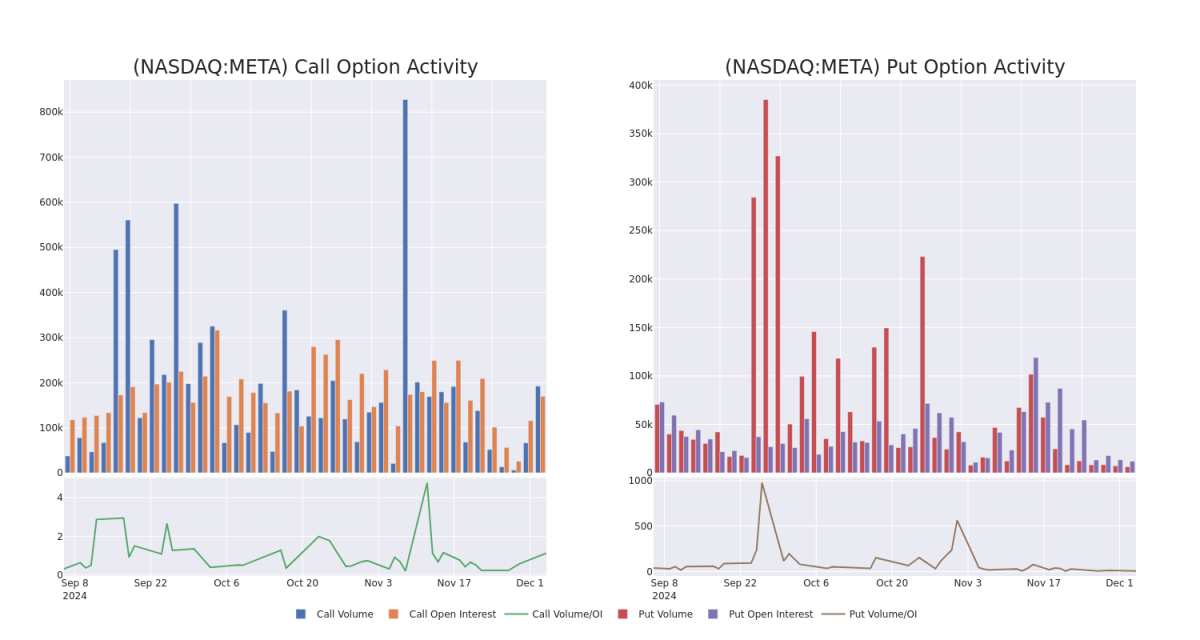

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Meta Platforms's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Meta Platforms's substantial trades, within a strike price spectrum from $50.0 to $1030.0 over the preceding 30 days.

评估成交量和未平仓合约是进行期权交易的战略步骤。这些指标揭示了meta platforms在特定行权价的期权流动性和投资者兴趣。接下来的数据将可视化过去30天内与meta platforms的重大交易相关的看涨期权和看跌期权的成交量和未平仓合约波动,行权价区间为50.0美元至1030.0美元。

Meta Platforms Option Activity Analysis: Last 30 Days

Meta Platforms期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | CALL | SWEEP | BULLISH | 06/18/26 | $89.9 | $89.65 | $89.9 | $700.00 | $952.9K | 596 | 430 |

| META | CALL | SWEEP | BULLISH | 06/18/26 | $89.9 | $89.45 | $90.0 | $700.00 | $666.4K | 596 | 138 |

| META | CALL | SWEEP | BEARISH | 01/17/25 | $565.5 | $562.85 | $564.7 | $50.00 | $451.7K | 1.3K | 10 |

| META | CALL | SWEEP | BEARISH | 01/17/25 | $565.35 | $563.15 | $564.44 | $50.00 | $451.4K | 1.3K | 42 |

| META | CALL | SWEEP | NEUTRAL | 01/17/25 | $564.25 | $562.7 | $563.99 | $50.00 | $451.1K | 1.3K | 246 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| meta platforms | 看涨 | SWEEP | BULLISH | 06/18/26 | $89.9 | $89.65 | $89.9 | $700.00 | ¥952.9K | 596 | 430 |

| meta platforms | 看涨 | SWEEP | BULLISH | 06/18/26 | $89.9 | $89.45 | $90.0 | $700.00 | $666.4K | 596 | 138 |

| meta platforms | 看涨 | SWEEP | 看淡 | 01/17/25 | $565.5 | $562.85 | $564.7 | $50.00 | $451.7K | 1.3千 | 10 |

| meta platforms | 看涨 | SWEEP | 看淡 | 01/17/25 | $565.35 | $563.15 | $564.44 | $50.00 | $451.4K | 1.3千 | 42 |

| meta platforms | 看涨 | SWEEP | 中立 | 01/17/25 | $564.25 | $562.7 | $563.99 | $50.00 | $451.1K | 1.3千 | 246 |

About Meta Platforms

关于meta平台

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm's "Family of Apps," its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta's overall sales.

Meta是全球最大的社交媒体公司,拥有近40亿月活跃用户。该公司的“应用家族”,即其核心业务,包括Facebook、Instagram、Messenger和WhatsApp。最终用户可以利用这些应用程序进行各种不同的用途,从与朋友保持联系到关注名人和免费运行数字业务。Meta打包客户数据,从其应用生态系统中收集数据并向数字广告商出售广告。虽然该公司一直在大量投资其Reality Labs业务,但这仍然是Meta整体销售额中的一小部分。

Having examined the options trading patterns of Meta Platforms, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Meta平台的期权交易模式之后,我们现在的关注点直接转向了该公司。这个转变使我们能够深入研究它的现有市场位置和表现。

Current Position of Meta Platforms

meta platforms的当前位置

- With a volume of 2,281,294, the price of META is down -0.04% at $613.43.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 57 days.

- META的成交量为2,281,294,价格下跌了-0.04%,为$613.43。

- RSI指标暗示该股票可能要超买了。

- 下一次财报公布还有57天。

Professional Analyst Ratings for Meta Platforms

Meta平台的专业分析师评级

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $675.0.

在过去30天中,共有1位专业分析师对该股票进行了评价,设定了675.0美元的平均价格目标。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Raymond James downgraded its action to Strong Buy with a price target of $675.

Benzinga Edge的飞凡期权板块在市场动向发生之前发现潜在的市场推进因素。查看大资金在您喜欢的股票上采取了什么头寸。点击此处以获取访问权限。* 一位来自Raymond James的分析师将其评级下调至强劲买入,价格目标为675美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Meta Platforms with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也能带来更高利润的潜力。精明的交易者通过持续教育、战略交易调整、利用各种因子以及保持对市场动态的敏感来减轻这些风险。通过Benzinga Pro查看meta platforms的最新期权交易情况,获取实时警报。

From the overall spotted trades, 10 are puts, for a total amount of $547,806 and 75, calls, for a total amount of $11,053,985.

From the overall spotted trades, 10 are puts, for a total amount of $547,806 and 75, calls, for a total amount of $11,053,985.