Top 3 Industrials Stocks You'll Regret Missing In December

Top 3 Industrials Stocks You'll Regret Missing In December

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

工业板块中最超卖的股票提供了一个买入被低估的公司的机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

Himalaya Shipping Ltd (NYSE:HSHP)

喜马拉雅航运有限公司 (纽交所:HSHP)

- The company's stock fell around 17% over the past five days and has a 52-week low of $5.45.

- RSI Value: 24.93

- HSHP Price Action: Shares of Himalaya Shipping fell 5.9% to close at $5.54 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest HSHP news.

- 该公司的股票在过去五天里下跌了约17%,并且有52周的最低价为5.45美元。

- 相对强弱指数 (RSI) 值: 24.93

- HSHP价格走势: 喜马拉雅航运的股票在周三下跌5.9%,收于5.54美元。

- Benzinga Pro的实时资讯提醒了最新的HSHP资讯。

Star Bulk Carriers Corp (NASDAQ:SBLK)

star bulk carriers公司 (纳斯达克:SBLK)

- On Nov. 19, Star Bulk Carriers posted downbeat quarterly earnings. The company's stock fell around 14% over the past month and has a 52-week low of $16.78.

- RSI Value: 23.02

- SBLK Price Action: Shares of Star Bulk Carriers fell 2.1% to close at $16.86 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in SBLK stock.

- 11月19日,star bulk carriers公布了不尽如人意的季度业绩。该公司股票在过去一个月下跌了约14%,并且52周低点为16.78美元。

- 相对强弱指标值:23.02

- SBLK价格动作:star bulk carriers的股票在周三下跌2.1%,收于16.86美元。

- Benzinga Pro的图表工具帮助识别了SBLK股票的趋势。

Pyxis Tankers Inc (NASDAQ:PXS)

pyxis tankers inc (纳斯达克:PXS)

- On Nov. 22, Pyxis Tankers reported quarterly earnings of 31 cents per share, up from 26 cents per share from the same period last year. Valentios Valentis, our Chairman and Chief Executive Officer, commented, "We are pleased to report solid results for the third fiscal quarter of 2024 with revenues, net of $13.8 million and net income attributable to common shareholders of $3.6 million with basic earnings per share of $0.34 basic and $0.31 diluted. In the quarter ended September 30, 2024, the product tanker sector continued to experience a healthy chartering environment driven by global demand for transportation fuels, tight inventories of many petroleum products, supportive refinery activity, combined with the significant effects of the ongoing conflicts in Ukraine and the Middle East which has led to continued market dislocation of shifting trade patterns and ton-mile expansion of seaborne cargo transportation." The company's stock fell around 15% over the past month and has a 52-week low of $3.62.

- RSI Value: 26.11

- PXS Price Action: Shares of Pyxis Tankers fell 2.4% to close at $3.71 on Wednesday.

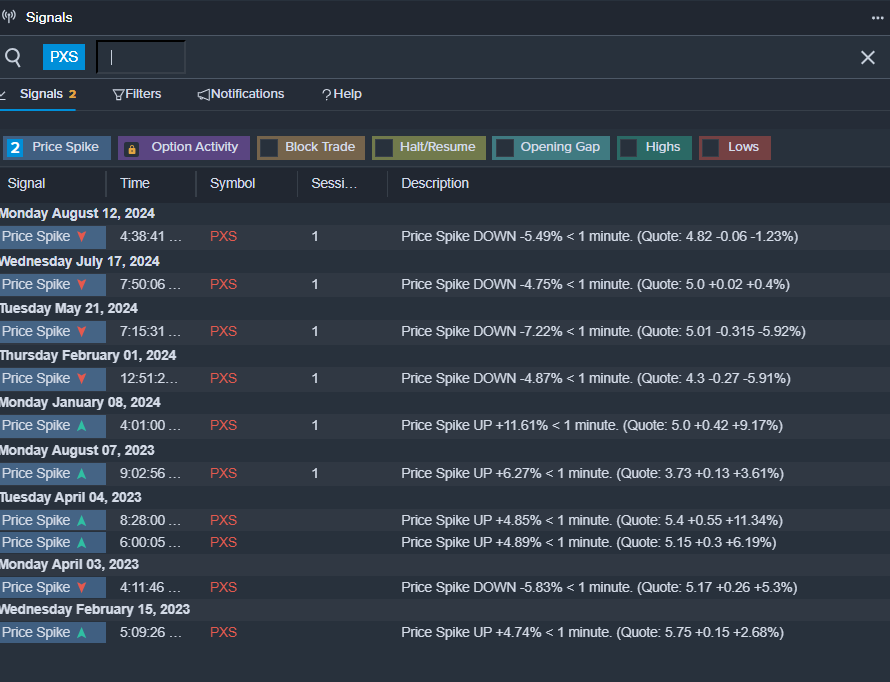

- Benzinga Pro's signals feature notified of a potential breakout in PXS shares.

- 在11月22日,pyxis tankers报告了每股31美分的季度收益,高于去年同期的每股26美分。我们的董事长兼首席执行官Valentios Valentis评论道:“我们很高兴地报告2024财年第三季度的稳健业绩,收入净额为1380万, attributable to common shareholders的净利润为360万,基本每股收益为0.34美分,稀释每股收益为0.31美分。在截至2024年9月30日的季度,成品油运输板块继续经历健康的租船环境,这受全球对运输燃料的需求、许多石油产品的库存紧张、支持性炼油活动,以及乌克兰和中东持续冲突的重大影响所驱动,导致市场持续错位、贸易模式转变和海运货物运输的吨英里扩展。”该公司的股票在过去一个月下跌了大约15%,52周低点为3.62美元。

- 相对强弱指数(RSI)值:26.11

- PXS价格走势:pyxis tankers的股票在周三下跌了2.4%,收于3.71美元。

- Benzinga Pro的信号功能提示PXS股票可能会出现突破。

Read This Next:

Read This Next:

- Top 3 Tech And Telecom Stocks That May Implode This Quarter

- 本季度可能崩溃的前3大科技与电信股票