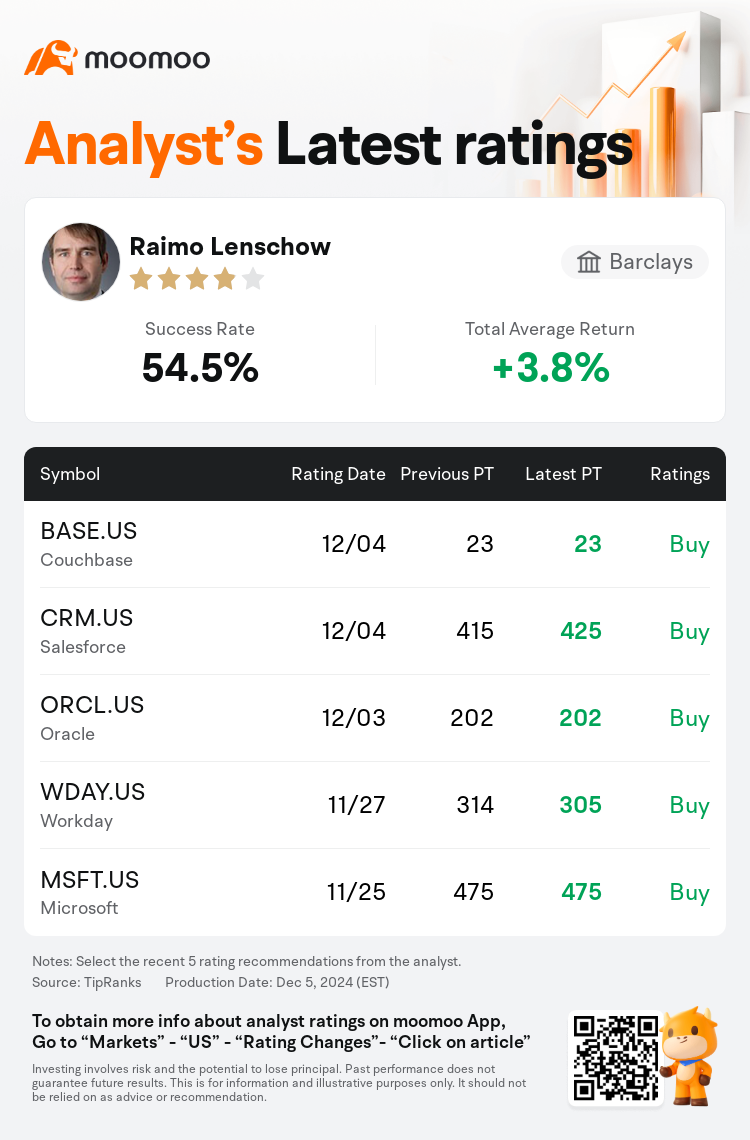

Barclays analyst Raimo Lenschow maintains $Couchbase (BASE.US)$ with a buy rating, and maintains the target price at $23.

According to TipRanks data, the analyst has a success rate of 54.5% and a total average return of 3.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Couchbase (BASE.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Couchbase (BASE.US)$'s main analysts recently are as follows:

Following a subdued beginning to the year, Couchbase has reported its second consecutive quarter matching expectations. Despite this, an in-line ARR result and repeated guidance for Q4 ARR are deemed insufficient as investors express concerns about the projected strong turnaround in guidance. Nevertheless, growing traction with Capella, a more evenly distributed FY26 renewal base, and a value considered reasonable are factors that contribute to a cautiously optimistic outlook.

Following a strong financial quarter where revenue and operating income surpassed expectations, and ARR met forecasts, it is believed that the ongoing shift towards NoSQL technologies and increasing momentum with Capella will enable sustained mid-to-high teens ARR growth and enhanced profitability. However, a return to growth rates above 20% is seen as unlikely until Capella migrations significantly pick up pace.

The company reported a quarter in line with expectations, highlighted by ongoing traction with Capella. Third-quarter Annual Recurring Revenue (ARR) fell within the guidance range, and despite a narrowed full-year ARR outlook, management remains confident in hitting these targets.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

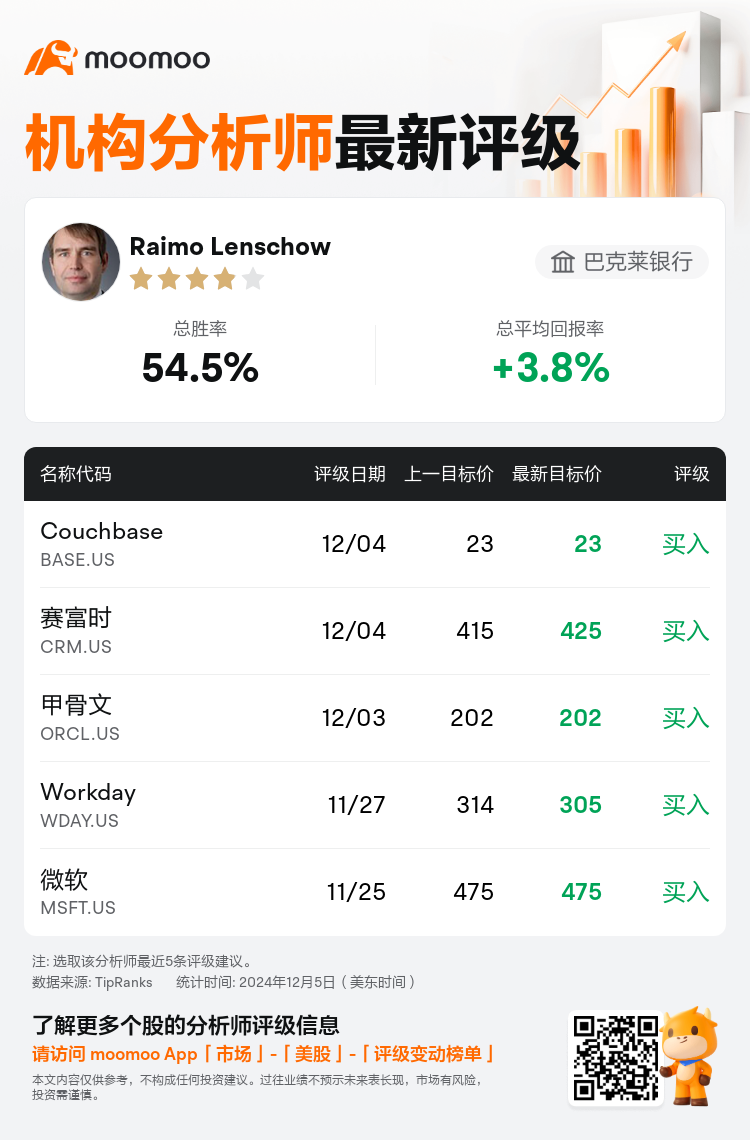

巴克莱银行分析师Raimo Lenschow维持$Couchbase (BASE.US)$买入评级,维持目标价23美元。

根据TipRanks数据显示,该分析师近一年总胜率为54.5%,总平均回报率为3.8%。

此外,综合报道,$Couchbase (BASE.US)$近期主要分析师观点如下:

此外,综合报道,$Couchbase (BASE.US)$近期主要分析师观点如下:

在年初表现平淡之后,Couchbase报告了连续第二个季度符合预期。尽管如此,ARR结果持平和对第四季度ARR的重复指导被认为不足,因为投资者对预计的强劲转机表示担忧。尽管如此,Capella日益增长的吸引力、更加均匀分布的FY26续约基础以及被视为合理的价值,都是促使谨慎乐观前景的因素。

在一个强劲的财务季度中,营业收入和营业利润超出预期,而ARR符合预测,人们相信持续向NoSQL技术的转变以及Capella的增长势头将使中高单位ARR增长和增强盈利能力成为可能。然而,在Capella迁移显著加快之前,恢复20%以上的增长率被认为不太可能。

公司报告的季度符合预期,以Capella的持续吸引力为重点。第三季度的年度经常性收入(ARR)在指导区间内,尽管全年ARR前景缩小,但管理层对实现这些目标仍然充满信心。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Couchbase (BASE.US)$近期主要分析师观点如下:

此外,综合报道,$Couchbase (BASE.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of