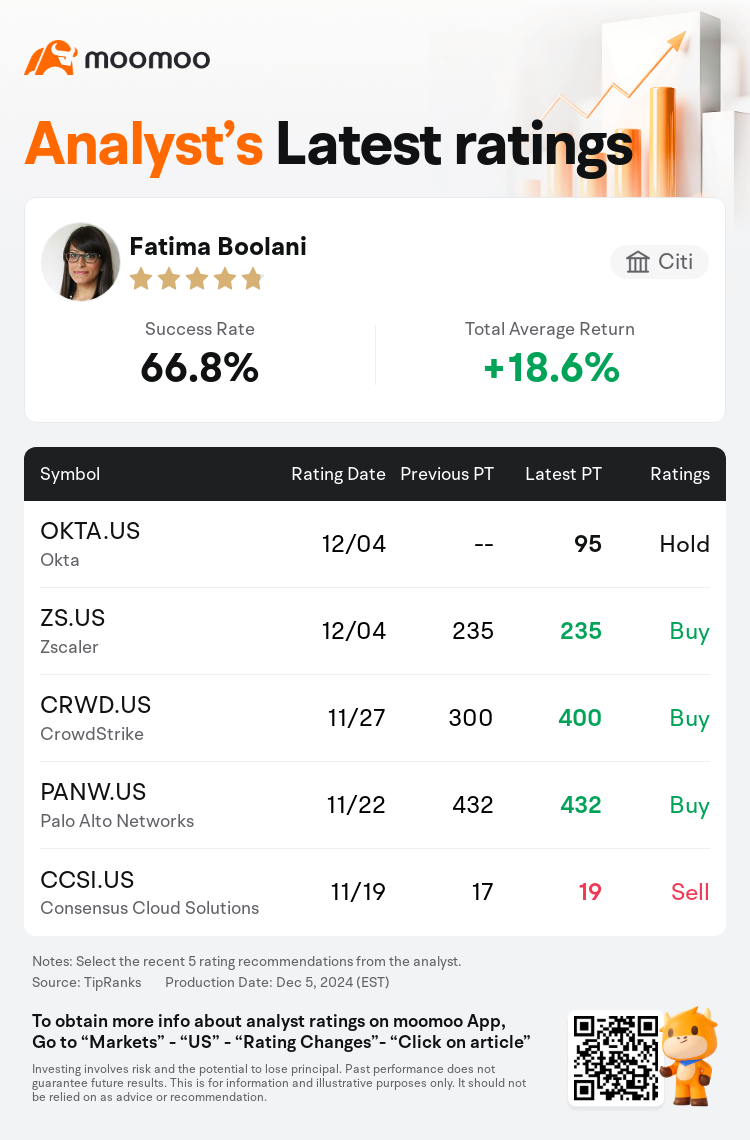

Citi analyst Fatima Boolani maintains $Zscaler (ZS.US)$ with a buy rating, and maintains the target price at $235.

According to TipRanks data, the analyst has a success rate of 66.8% and a total average return of 18.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Zscaler (ZS.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Zscaler (ZS.US)$'s main analysts recently are as follows:

Following the fiscal Q1 report, the company highlighted a billings beat, reacceleration in bookings growth, and strong profitability improvements. However, there's an ongoing debate concerning the company's shares as some points of concern focus on the 'still back-end weighted sales execution risk' and implied Q2 billings that do not meet the consensus expectations.

Zscaler's Q1 operating margins, billings, and revenue surpassed consensus estimates. Analysts acknowledge Zscaler as a leading entity in SSE while expressing incremental caution because the firm's growth opportunity may predominantly hinge on larger customers as competitors' SASE products evolve and capture the downmarket.

Following the company's 'healthy' Q1 results, including billings and revenue growth of 13% and 26% respectively, which surpassed Street estimates, the analyst has raised their estimates. The 'strong quarter' is acknowledged; however, concerns remain about increased competition and potential risks related to estimates and execution of new initiatives that could restrict stock performance.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

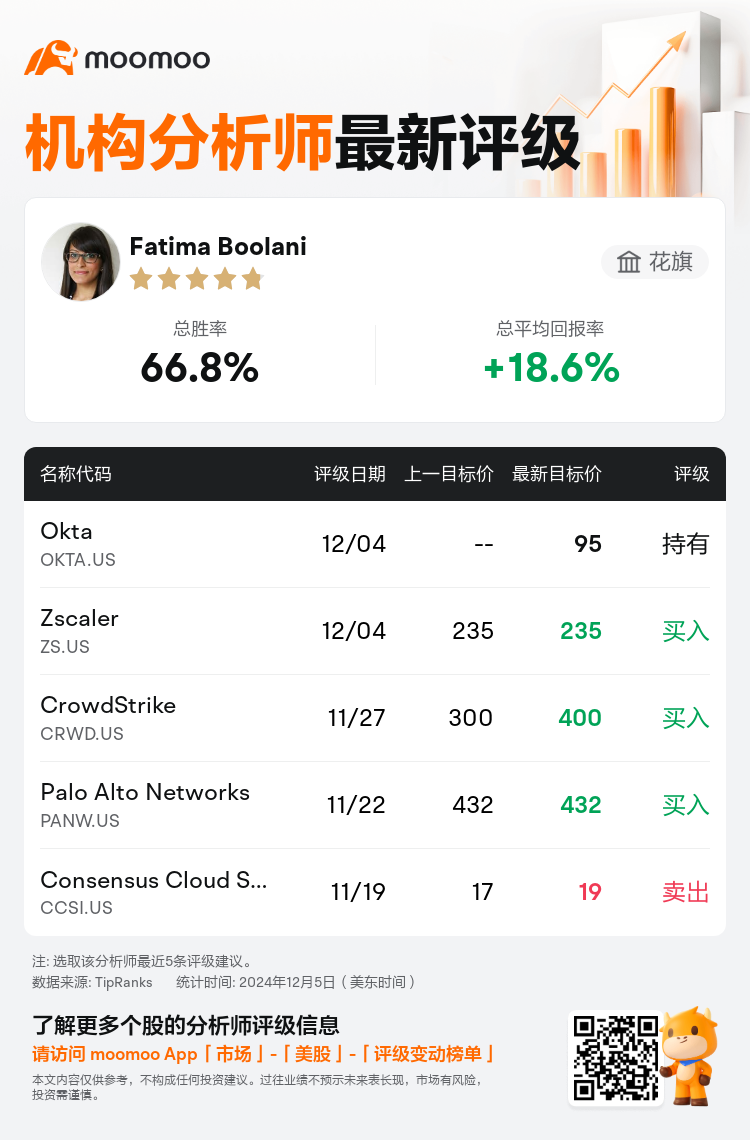

花旗分析师Fatima Boolani维持$Zscaler (ZS.US)$买入评级,维持目标价235美元。

根据TipRanks数据显示,该分析师近一年总胜率为66.8%,总平均回报率为18.6%。

此外,综合报道,$Zscaler (ZS.US)$近期主要分析师观点如下:

此外,综合报道,$Zscaler (ZS.US)$近期主要分析师观点如下:

在2023财年第一季度报告之后,公司强调了账单超出预期、预定增长的再加速以及强劲的盈利改善。然而,对于公司股票的讨论仍在持续,一些担忧点集中在“仍然存在后端加重的销售执行风险”以及暗示的第二季度账单未能达到共识预期。

zscaler在第一季度的运营利润率、账单和营业收入都超出了共识预期。分析师承认zscaler是安全服务边缘(SSE)领域的领先实体,但表达了逐渐增强的谨慎,因为公司的增长机会可能主要依赖于更大的客户,随着竞争对手的SASE产品的发展并向下市场扩展。

在公司“健康”的第一季度业绩公布后,账单和营业收入分别增长了13%和26%,超出了华尔街的预期,因此分析师提高了他们的预期。虽然承认这是一个“强劲的季度”,但对于竞争加剧和与新项目的预期和执行相关的潜在风险仍然存在担忧,这可能会限制股票表现。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Zscaler (ZS.US)$近期主要分析师观点如下:

此外,综合报道,$Zscaler (ZS.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of