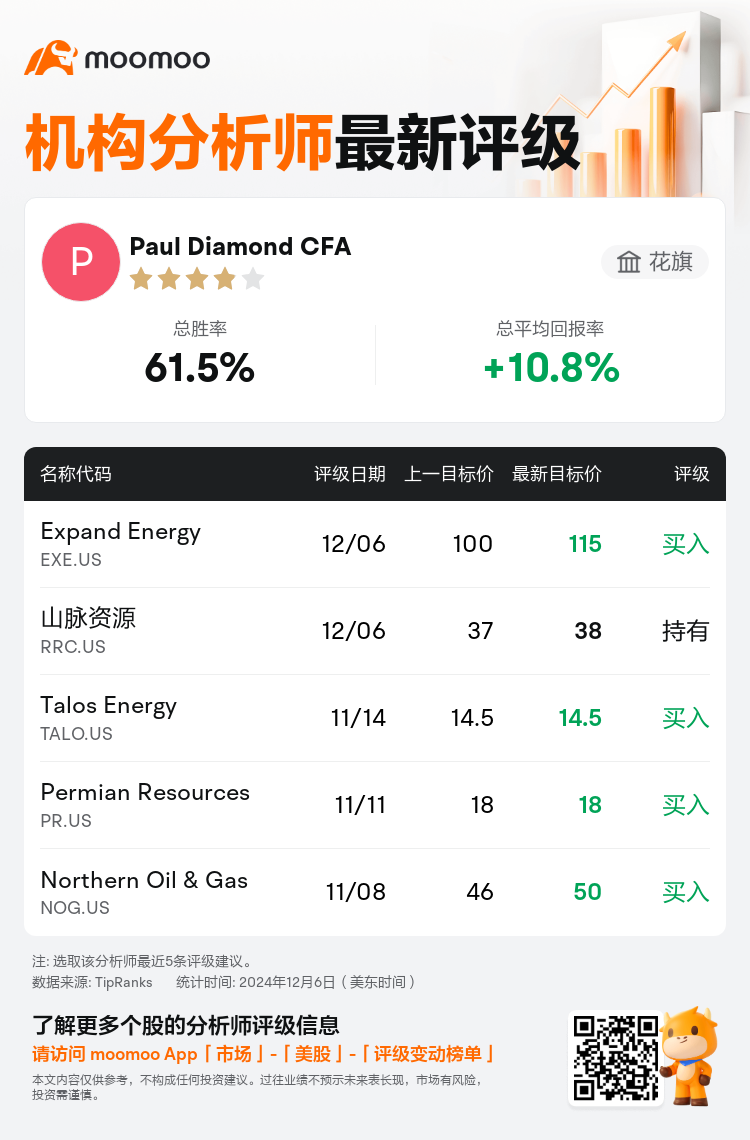

Citi analyst Paul Diamond CFA maintains $Range Resources (RRC.US)$ with a hold rating, and adjusts the target price from $37 to $38.

According to TipRanks data, the analyst has a success rate of 61.5% and a total average return of 10.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Range Resources (RRC.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Range Resources (RRC.US)$'s main analysts recently are as follows:

The midstream performance outlook for 2024 indicates that the energy sector may be gaining solid investable ground again. In contrast, exploration and production sectors face ongoing challenges as crude markets remain amply supplied. While it might seem too soon to have a strong positive outlook on crude leverage, the current business climate along with buybacks could serve as stabilizers if crude prices were to decline.

By 2025, natural gas producers are anticipated to benefit from three prominent secular demand trends: the expansion of considerable liquefied natural gas export capacities, heightened power demand due to electrification, and the transition from coal to gas. The updated exploration and production models extending through 2030 underline a perspective that anticipates long-term gas prices to remain above $3.50 per MMBtu. This adjustment reflects the necessary price increase to encourage further supply growth from the Haynesville and other higher-cost gas basins. Furthermore, expectations are set for the oil market to transition from balanced conditions in 2024 to a surplus by 2025 due to supply increments, prompting a shift towards a more defensive market stance.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

花旗分析师Paul Diamond CFA维持$山脉资源 (RRC.US)$持有评级,并将目标价从37美元上调至38美元。

根据TipRanks数据显示,该分析师近一年总胜率为61.5%,总平均回报率为10.8%。

此外,综合报道,$山脉资源 (RRC.US)$近期主要分析师观点如下:

此外,综合报道,$山脉资源 (RRC.US)$近期主要分析师观点如下:

2024年中游脑机的业绩展望表明,能源板块可能再次获得稳固的投资基础。相比之下,勘探和生产板块面临持续挑战,因为原油市场供应充裕。虽然现在对原油杠杆有强劲的积极展望似乎为时过早,但当前的商业氛围以及股票回购在原油价格下跌时可能起到稳定作用。

到2025年,天然气生产商预计将受益于三大显著的长期需求趋势:可观液化天然气出口能力的扩大,由于电气化而带来的电力需求增加,以及由煤转向天然气。延伸至2030年的更新后的勘探和生产模型强调了一种预计长期天然气价格将保持在每百万英热单位以上3.50美元的观点。这一调整反映了必要的价格增长,以鼓励Haynesville和其他成本较高的天然气盆地进一步供应增长。此外,预期石油市场将从2024年的平衡状态过渡到2025年的供应增加,促使朝着更具防御性的市场立场转变。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$山脉资源 (RRC.US)$近期主要分析师观点如下:

此外,综合报道,$山脉资源 (RRC.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of