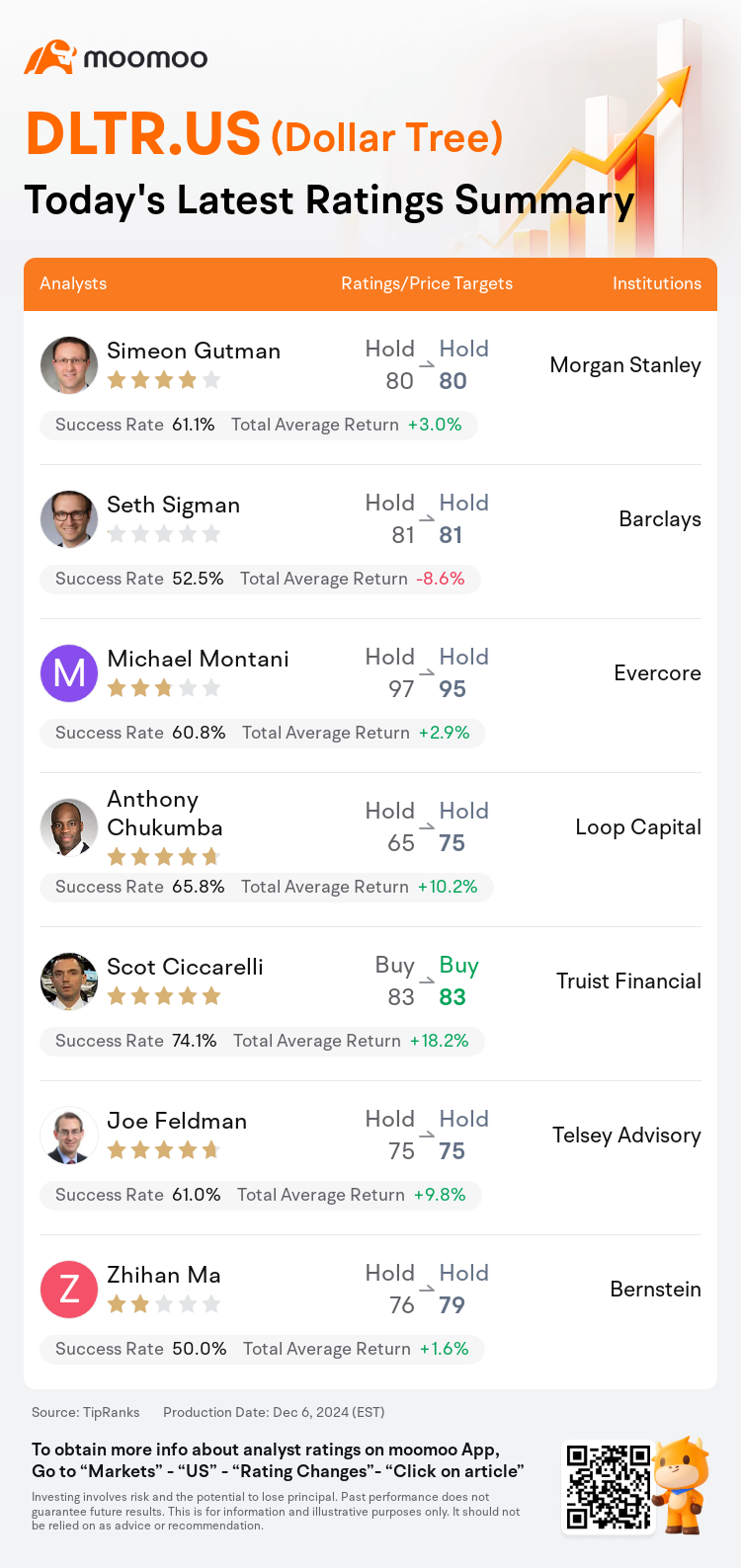

On Dec 06, major Wall Street analysts update their ratings for $Dollar Tree (DLTR.US)$, with price targets ranging from $75 to $95.

Morgan Stanley analyst Simeon Gutman maintains with a hold rating, and maintains the target price at $80.

Barclays analyst Seth Sigman maintains with a hold rating, and maintains the target price at $81.

Evercore analyst Michael Montani maintains with a hold rating, and adjusts the target price from $97 to $95.

Evercore analyst Michael Montani maintains with a hold rating, and adjusts the target price from $97 to $95.

Loop Capital analyst Anthony Chukumba maintains with a hold rating, and adjusts the target price from $65 to $75.

Truist Financial analyst Scot Ciccarelli maintains with a buy rating, and maintains the target price at $83.

Furthermore, according to the comprehensive report, the opinions of $Dollar Tree (DLTR.US)$'s main analysts recently are as follows:

The sales performance improvement was attributed to better Family Dollar comps. However, there is little reason to adopt a more constructive stance on the shares.

The recent quarterly performance and outlook for the final quarter offered a break from earlier underwhelming results, yet comparable sales growth remains below expectations. The ongoing development of the latest business model is anticipated to spur an increase in comparable sales within the next 18 to 24 months, thereby presenting an advantageous risk/reward scenario given the modest company valuation.

The stock experienced a modest relief rally subsequent to the company's in-line Q3 results, which was seen as a 'welcome change' following recent guidance cuts and misses. However, comparable sales weakened again in November across both banners. Additionally, the lift in comparable sales from the company's multi-price conversions also showed sequential deterioration.

Dollar Tree's Q3 results didn't stand out significantly, yet it was viewed positively that the company ended its series of earnings and guidance disappointments. There was also a positive note on the improved performance in the Family Dollar segment, albeit with concerns that these improvements might come too late in the context of the ongoing strategic review for the unit.

Dollar Tree's Q3 performance surpassed expectations, mainly due to robust Family Dollar comparative sales of 1.9% against the projected 0.7%, positively impacting both discretionary and consumable products. The company also refined its fiscal 2024 guidance while forecasting Q4 results that align with current market expectations. However, ongoing uncertainties such as potential management changes, the impact of tariffs, and the organizational structure of Family Dollar continue to pose concerns.

Here are the latest investment ratings and price targets for $Dollar Tree (DLTR.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月6日,多家华尔街大行更新了$美元树公司 (DLTR.US)$的评级,目标价介于75美元至95美元。

摩根士丹利分析师Simeon Gutman维持持有评级,维持目标价80美元。

巴克莱银行分析师Seth Sigman维持持有评级,维持目标价81美元。

Evercore分析师Michael Montani维持持有评级,并将目标价从97美元下调至95美元。

Evercore分析师Michael Montani维持持有评级,并将目标价从97美元下调至95美元。

Loop Capital分析师Anthony Chukumba维持持有评级,并将目标价从65美元上调至75美元。

储亿银行分析师Scot Ciccarelli维持买入评级,维持目标价83美元。

此外,综合报道,$美元树公司 (DLTR.US)$近期主要分析师观点如下:

销售业绩的提升归因于更好的Family Dollar销售额。然而,目前没有足够的理由对股票采取更积极的态度。

最近一季的表现和最终季度的展望让人耳目一新,打破了此前让人失望的结果,但同店销售增长仍低于预期。预计最新业务模式的持续发展将在未来18至24个月内推动同店销售增长,因此鉴于适度的公司估值,呈现出有利的风险/回报情景。

该股票在公司Q3业绩符合预期后经历了一场适度的反弹,这被视为近期指引下调和失利后的"受欢迎变化"。然而,11月份两个品牌的同店销售再次下滑。此外,公司的多价格转换所带来的同店销售增长也呈现了逐步恶化的趋势。

美元树公司的Q3业绩并没有明显突出,但公司结束了一系列盈利和指引失望的情况被认为是积极的。对Family Dollar业绩提升的乐观看法也值得肯定,尽管人们担心这些改善可能来得太晚,考虑到单位正在进行的战略审视。

美元树公司的Q3表现超出预期,主要归因于Family Dollar强劲的同比销售增长,为1.9%,高于预期的0.7%,对自愿和消费品均产生了积极影响。公司还调整了其2024财年展望,同时预测Q4业绩与当前市场预期相符。然而,潜在的管理变更、关税影响以及Family Dollar的组织结构等持续的不确定性仍然引发担忧。

以下为今日7位分析师对$美元树公司 (DLTR.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Evercore分析师Michael Montani维持持有评级,并将目标价从97美元下调至95美元。

Evercore分析师Michael Montani维持持有评级,并将目标价从97美元下调至95美元。

Evercore analyst Michael Montani maintains with a hold rating, and adjusts the target price from $97 to $95.

Evercore analyst Michael Montani maintains with a hold rating, and adjusts the target price from $97 to $95.