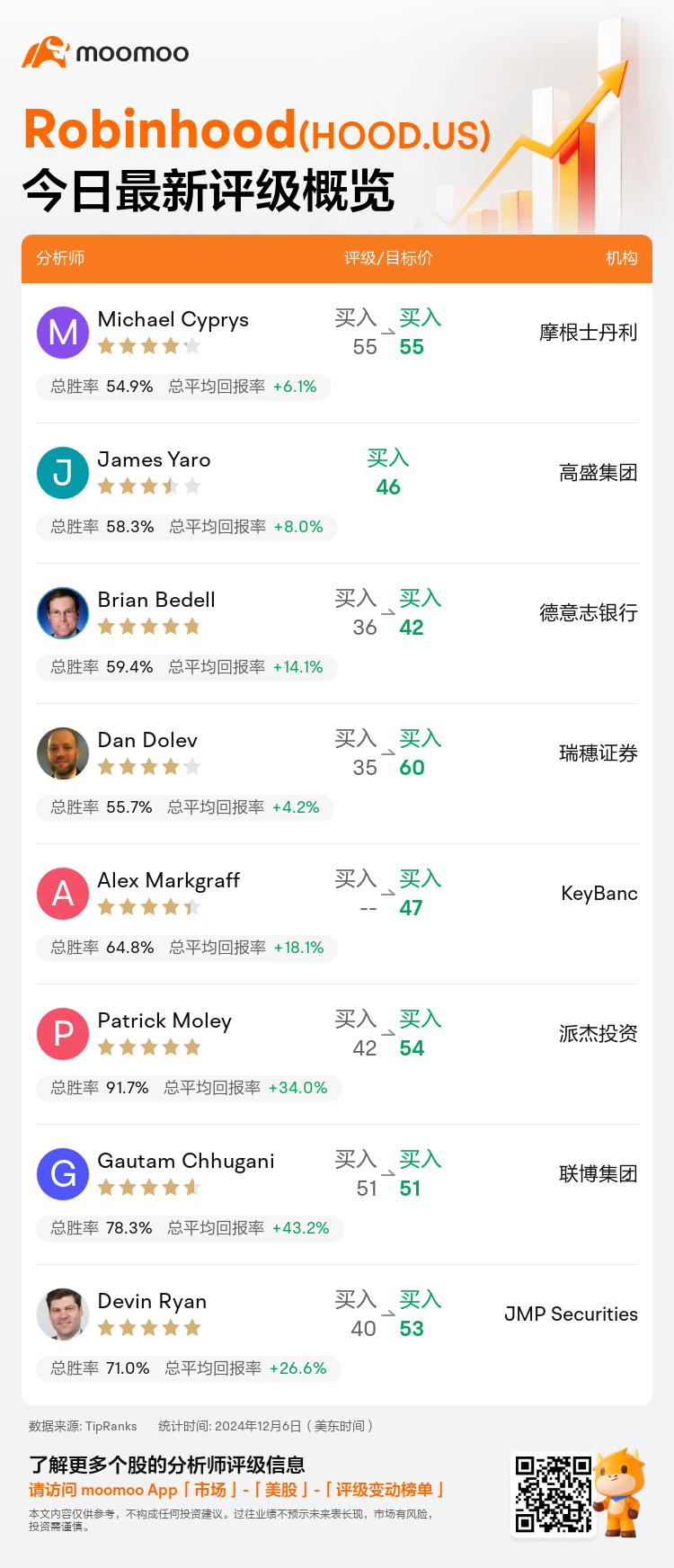

On Dec 06, major Wall Street analysts update their ratings for $Robinhood (HOOD.US)$, with price targets ranging from $42 to $60.

Morgan Stanley analyst Michael Cyprys maintains with a buy rating, and maintains the target price at $55.

Goldman Sachs analyst James Yaro initiates coverage with a buy rating, and sets the target price at $46.

Deutsche Bank analyst Brian Bedell maintains with a buy rating, and adjusts the target price from $36 to $42.

Deutsche Bank analyst Brian Bedell maintains with a buy rating, and adjusts the target price from $36 to $42.

Mizuho Securities analyst Dan Dolev maintains with a buy rating, and adjusts the target price from $35 to $60.

KeyBanc analyst Alex Markgraff maintains with a buy rating, and sets the target price at $47.

Furthermore, according to the comprehensive report, the opinions of $Robinhood (HOOD.US)$'s main analysts recently are as follows:

Following an investor day, it's reported that Robinhood shared an ambitious 10-year business outlook. The company aims to be a leader in active trading, increase its wallet share penetration among the next generation, and secure a significant role within the global financial ecosystem. Analysts noted that management provided greater clarity on the acceleration of its product roadmap, including a robust launch of event contracts next year and enhancements in futures, index options, an advanced desktop trading platform, expanded crypto offerings, wealth advisory services, and gradual growth in credit card services. The presentation left attendees more optimistic about Robinhood's prospects for long-term revenue and earnings growth.

After attending the inaugural investor day of Robinhood, it was noted that management discussed the strategic direction of the platform extending over the next decade and provided insights into near-term product and geographical priorities. While the details on forward-looking financials were somewhat sparse, indications were given of expecting double-digit revenue growth, with expense growth tracking below that of revenue, and anticipating double-digit EPS growth 'over time'. This framework suggests considerable flexibility.

Here are the latest investment ratings and price targets for $Robinhood (HOOD.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月6日,多家华尔街大行更新了$Robinhood (HOOD.US)$的评级,目标价介于42美元至60美元。

摩根士丹利分析师Michael Cyprys维持买入评级,维持目标价55美元。

高盛集团分析师James Yaro首予买入评级,目标价46美元。

德意志银行分析师Brian Bedell维持买入评级,并将目标价从36美元上调至42美元。

德意志银行分析师Brian Bedell维持买入评级,并将目标价从36美元上调至42美元。

瑞穗证券分析师Dan Dolev维持买入评级,并将目标价从35美元上调至60美元。

KeyBanc分析师Alex Markgraff维持买入评级,目标价47美元。

此外,综合报道,$Robinhood (HOOD.US)$近期主要分析师观点如下:

在一次投资者日活动后,报道称Robinhood分享了其雄心勃勃的10年业务展望。该公司旨在成为主动交易的领导者,提高其在下一代中的钱包份额渗透率,并在全球金融生态系统中占据重要角色。分析师指出,管理层对其产品路线图的加速提供了更清晰的阐述,包括明年大力推出事件合约以及在期货、指数期权、爱文思控股桌面交易平台、扩大加密货币产品、财富咨询服务以及信用卡服务的逐步增长方面的增强。这次演示让与会者对Robinhood长期营业收入和每股收益的增长前景感到更加乐观。

在参加Robinhood的首届投资者日后,注意到管理层讨论了这个平台在未来十年的战略方向,并提供了近期产品和地理优先事项的见解。虽然关于前瞻性财务的细节略显稀缺,但已经给出预期双位数营业收入增长的指示,且支出增长预计低于营业收入,预计将“随着时间的推移”实现双位数的每股收益增长。这个框架暗示了相当大的灵活性。

以下为今日8位分析师对$Robinhood (HOOD.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

德意志银行分析师Brian Bedell维持买入评级,并将目标价从36美元上调至42美元。

德意志银行分析师Brian Bedell维持买入评级,并将目标价从36美元上调至42美元。

Deutsche Bank analyst Brian Bedell maintains with a buy rating, and adjusts the target price from $36 to $42.

Deutsche Bank analyst Brian Bedell maintains with a buy rating, and adjusts the target price from $36 to $42.