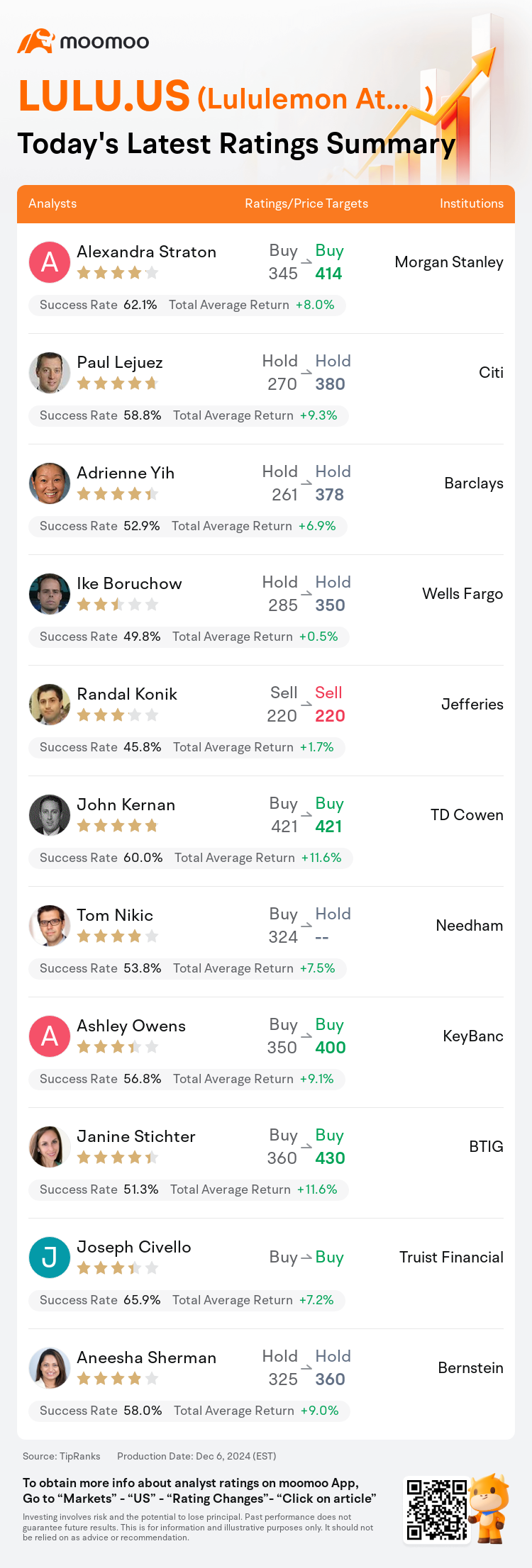

On Dec 06, major Wall Street analysts update their ratings for $Lululemon Athletica (LULU.US)$, with price targets ranging from $220 to $430.

Morgan Stanley analyst Alexandra Straton maintains with a buy rating, and adjusts the target price from $345 to $414.

Citi analyst Paul Lejuez maintains with a hold rating, and adjusts the target price from $270 to $380.

Barclays analyst Adrienne Yih maintains with a hold rating, and adjusts the target price from $261 to $378.

Barclays analyst Adrienne Yih maintains with a hold rating, and adjusts the target price from $261 to $378.

Wells Fargo analyst Ike Boruchow maintains with a hold rating, and adjusts the target price from $285 to $350.

Jefferies analyst Randal Konik maintains with a sell rating, and maintains the target price at $220.

Furthermore, according to the comprehensive report, the opinions of $Lululemon Athletica (LULU.US)$'s main analysts recently are as follows:

The recent performance update and heightened guidance from Lululemon support the optimistic view, accentuated by signs of stabilization in the U.S., advancements in the China market, improvement in women's product lines, and controlled promotional activities, which collectively undermine negative speculations.

The direction of the company's Americas growth rate from here has major implications for Lululemon's long-term earnings outlook and its P/E ratio. The stock is expected to be rangebound until the market can determine if Lululemon can deliver on its promised innovation pipeline and return its U.S. business to growth.

The company's Q3 sales and earnings surpassed expectations, supported by increased international sales and a stronger gross margin. Despite a 2% decrease in Americas comp, management observes a positive response from customers to new offerings in women's categories, anticipating a notable improvement in the U.S. market by Q1 of 2025.

Lululemon reported better-than-expected results for Q3, surpassing expectations on comparable sales, gross margin, operating margin, and earnings. The company has set conservative guidance for Q4, which may leave room for potential outperformance.

Following Lululemon's third-quarter earnings report, which surpassed projections, an analyst noted the company's solid financial performance. The fiscal year 2024 earnings per share forecast was marginally increased, though fourth-quarter predictions are largely maintained, taking into account the swift onset of the holiday season amidst economic uncertainties. The positioning for the brand and company is regarded as highly effective and resilient.

Here are the latest investment ratings and price targets for $Lululemon Athletica (LULU.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月6日,多家华尔街大行更新了$Lululemon Athletica (LULU.US)$的评级,目标价介于220美元至430美元。

摩根士丹利分析师Alexandra Straton维持买入评级,并将目标价从345美元上调至414美元。

花旗分析师Paul Lejuez维持持有评级,并将目标价从270美元上调至380美元。

巴克莱银行分析师Adrienne Yih维持持有评级,并将目标价从261美元上调至378美元。

巴克莱银行分析师Adrienne Yih维持持有评级,并将目标价从261美元上调至378美元。

富国集团分析师Ike Boruchow维持持有评级,并将目标价从285美元上调至350美元。

富瑞集团分析师Randal Konik维持卖出评级,维持目标价220美元。

此外,综合报道,$Lululemon Athletica (LULU.US)$近期主要分析师观点如下:

最近Lululemon的业绩更新和提升的指导支持了乐观的观点,令人振奋的是美国市场的稳定迹象、中国市场的进展、女性产品线的改善以及控制的促销活动,这些都共同削弱了负面的猜测。

公司在美洲的增长率的方向对Lululemon的长期盈利前景及其市盈率具有重大影响。股票预计会在区间内波动,直到市场能够判断Lululemon是否能实现其承诺的创新管道,并使其在美国的业务恢复增长。

公司的第三季度销售和收益超过了预期,国际销售的增加和更强的毛利率提供了支持。尽管美洲的同店销售下降了2%,管理层观察到客户对女性类新产品的积极反应,预计到2025年第一季度美国市场将显著改善。

Lululemon报告了超过预期的第三季度业绩,在可比销售、毛利率、营业利润率和收益方面均超出预期。公司为第四季度设定了保守的指导,这可能留有潜在超预期的空间。

在Lululemon超过预期的第三季度收益报告后,一位分析师指出公司的财务表现强劲。2024财政年度的每股收益预测略有上调,但第四季度的预测基本保持不变,考虑到经济不确定性下假期季节的快速来临。品牌和公司的定位被认为是高度有效和有韧性的。

以下为今日11位分析师对$Lululemon Athletica (LULU.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Adrienne Yih维持持有评级,并将目标价从261美元上调至378美元。

巴克莱银行分析师Adrienne Yih维持持有评级,并将目标价从261美元上调至378美元。

Barclays analyst Adrienne Yih maintains with a hold rating, and adjusts the target price from $261 to $378.

Barclays analyst Adrienne Yih maintains with a hold rating, and adjusts the target price from $261 to $378.