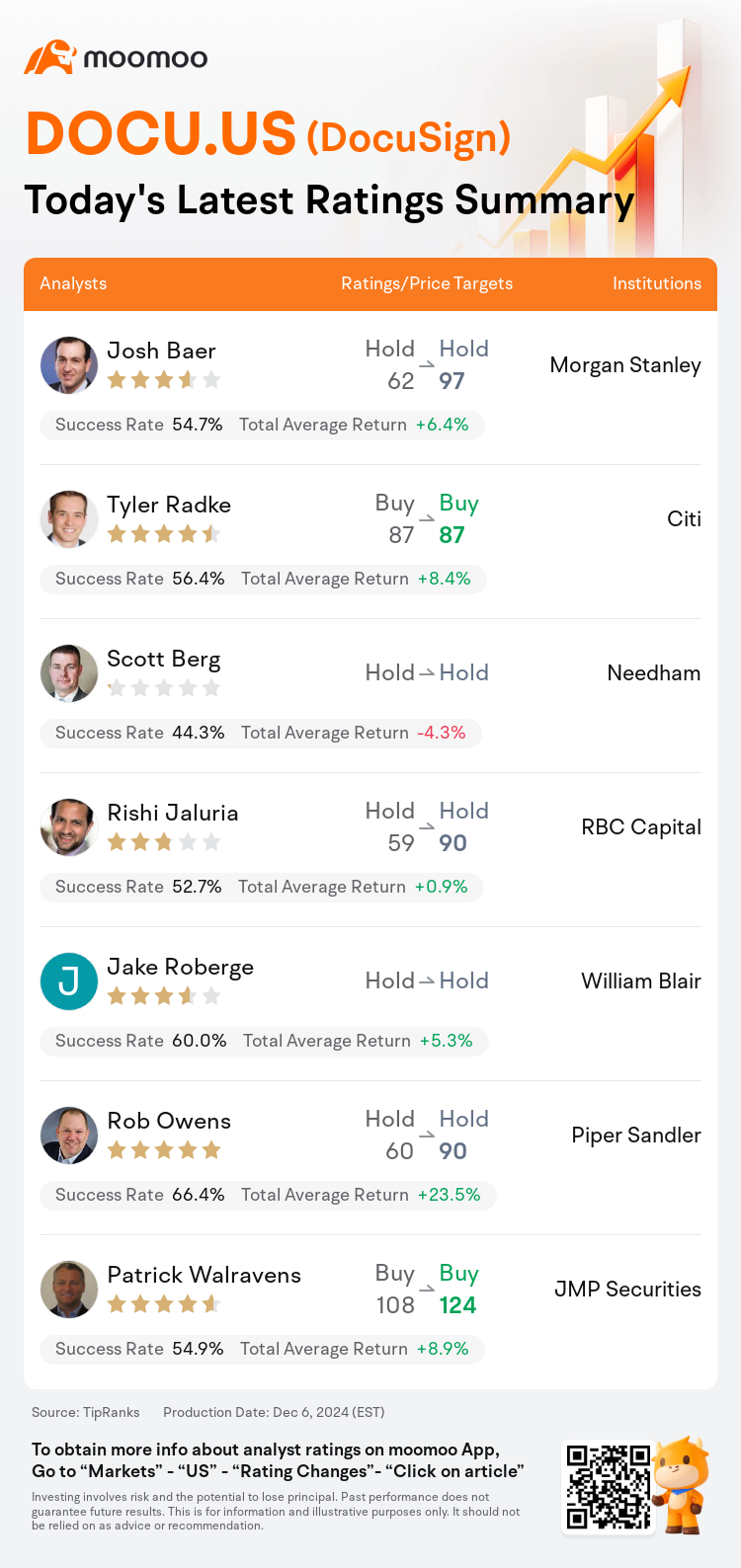

On Dec 06, major Wall Street analysts update their ratings for $DocuSign (DOCU.US)$, with price targets ranging from $87 to $124.

Morgan Stanley analyst Josh Baer maintains with a hold rating, and adjusts the target price from $62 to $97.

Citi analyst Tyler Radke maintains with a buy rating, and maintains the target price at $87.

Needham analyst Scott Berg maintains with a hold rating.

Needham analyst Scott Berg maintains with a hold rating.

RBC Capital analyst Rishi Jaluria maintains with a hold rating, and adjusts the target price from $59 to $90.

William Blair analyst Jake Roberge maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $DocuSign (DOCU.US)$'s main analysts recently are as follows:

DocuSign is following its strategic plan effectively, displaying 'several encouraging trends' that led to strong performance in Q3 and positively surprising Q4 billings forecasts. The primary indicators and company discussions showed either stability or enhancements, and the significant rise in stock value and its current standing in the afterhours indicate that the optimistic future trajectory is already accounted for in the current share prices.

DocuSign showcased a robust quarter following two consecutive quarters of mixed outcomes, marked by a significant billings beat and the CEO expressing confidence in achieving a growth rate exceeding 10%. The company indicated that its core business is stabilizing, and noted a slight improvement in the operational environment, while issues previously attributed to 'deal timing' and challenging macroeconomic conditions were not mentioned.

DocuSign posted a 'very strong' third quarter, notably exceeding expectations and showing accelerating subscription revenue. The company signals various positive growth trends that continue to encourage optimism among investors.

DocuSign exhibited solid gains in FQ3, with improvements noted across revenue, margins, and billings. Notably, the growth rate in subscription revenue accelerated to 8% compared to 7% in the preceding quarter, and the Net Revenue Retention (NRR) also improved to 100%, indicating a potential turnaround from recent declines.

DocuSign's recent financial performance was characterized by a notable increase in both top line and billings growth, propelled by early renewals, stabilization in its core operations, and promising momentum in IAM. Despite significant stock price appreciation since fiscal Q2, it remains appealingly valued in comparison to its industry peers.

Here are the latest investment ratings and price targets for $DocuSign (DOCU.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月6日,多家华尔街大行更新了$DocuSign (DOCU.US)$的评级,目标价介于87美元至124美元。

摩根士丹利分析师Josh Baer维持持有评级,并将目标价从62美元上调至97美元。

花旗分析师Tyler Radke维持买入评级,维持目标价87美元。

Needham分析师Scott Berg维持持有评级。

Needham分析师Scott Berg维持持有评级。

加皇资本市场分析师Rishi Jaluria维持持有评级,并将目标价从59美元上调至90美元。

威廉博莱分析师Jake Roberge维持持有评级。

此外,综合报道,$DocuSign (DOCU.US)$近期主要分析师观点如下:

docusign正在有效地执行其战略计划,显示出“多个令人鼓舞的趋势”,这导致其在第三季度表现强劲,并且对第四季度的账单预测令人感到意外。主要因子和公司的讨论显示出稳定或提升,而股票价值的显著上涨及其在盘后交易中的现状表明乐观的未来轨迹已经反映在目前的分享价格中。

docusign在经历了连续两个季度的混合结果后,展示了一个强劲的季度,账单超出预期,CEO表达了对实现超过10%增长率的信心。公司表示其核心业务正在稳定,并注意到运营环境略有改善,而以前归因于“交易时机”和艰难的宏观经济条件的问题并未被提及。

docusign发布了“非常强劲”的第三季度,明显超出预期并显示出加速的订阅营业收入。公司传达出多种积极的增长趋势,继续让投资者充满乐观。

docusign在第三财季显示出稳固的增长,营业收入、利润率和账单均有所改善。值得注意的是,订阅营业收入的增长率从前一季度的7%加速到8%,而净营业收入保持率(NRR)也改善到100%,指向从近期下降中潜在的反转。

docusign最近的财务表现以营业收入和账单增长的显著增加为特征,得益于提前续约、核心业务的稳定以及iam中有希望的势头。尽管自财政第二季度以来股票价格显著上涨,但与其行业板块的同行相比,仍然具备吸引力。

以下为今日7位分析师对$DocuSign (DOCU.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Needham分析师Scott Berg维持持有评级。

Needham分析师Scott Berg维持持有评级。

Needham analyst Scott Berg maintains with a hold rating.

Needham analyst Scott Berg maintains with a hold rating.