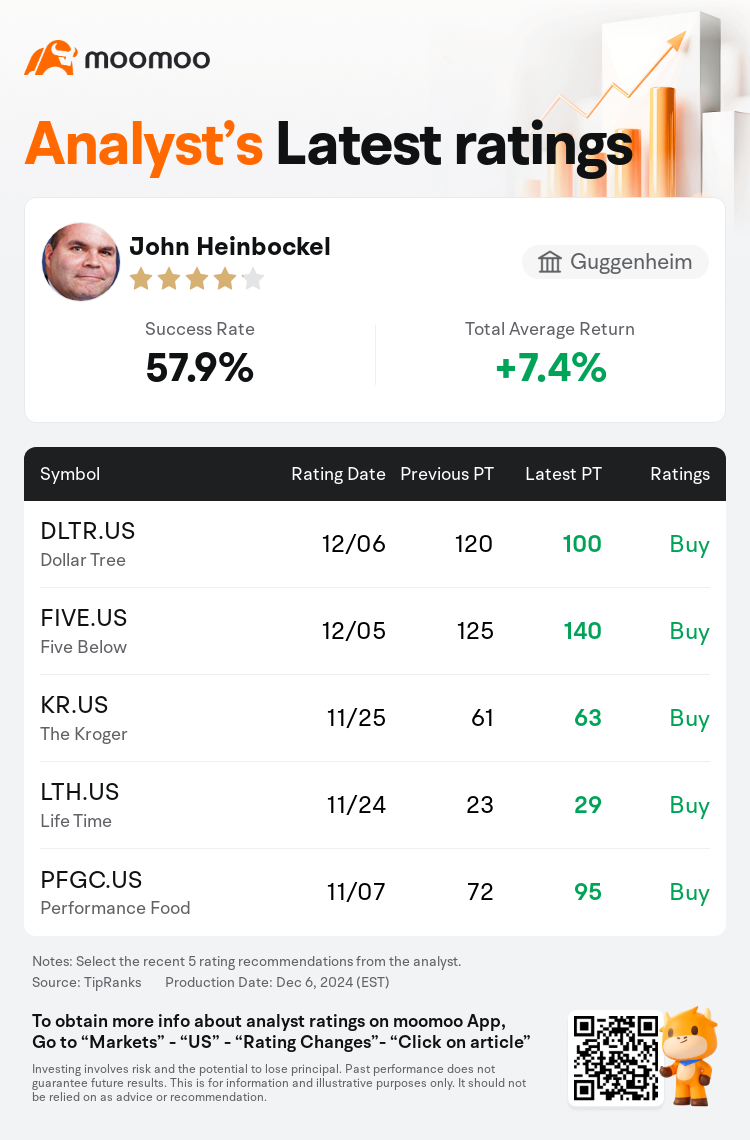

Guggenheim analyst John Heinbockel maintains $Dollar Tree (DLTR.US)$ with a buy rating, and adjusts the target price from $120 to $100.

According to TipRanks data, the analyst has a success rate of 57.9% and a total average return of 7.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Dollar Tree (DLTR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Dollar Tree (DLTR.US)$'s main analysts recently are as follows:

The recent improvement in sales was attributed to stronger comparable sales at Family Dollar. Despite this positive trend, there remains limited rationale for a more optimistic view on the stock's future performance.

Dollar Tree's recent quarterly results and forthcoming quarterly guidance provided a much-needed break from the earlier poor performances. However, the company's comparable sales momentum remains below expectations. The development and maturation of the latest store format are expected to accelerate comparable sales over the next 18-24 months, paired with a reasonable valuation, presenting an attractive risk/reward scenario.

Dollar Tree's stock experienced a modest relief rally subsequent to the company's Q3 results, which aligned with expectations and marked a 'welcome change' following recent guidance reductions and misses. Nevertheless, comparable store sales witnessed a decline in November across both banners, and the sequential deterioration in comp lift from Dollar Tree's multi-price point conversions also raises concerns.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

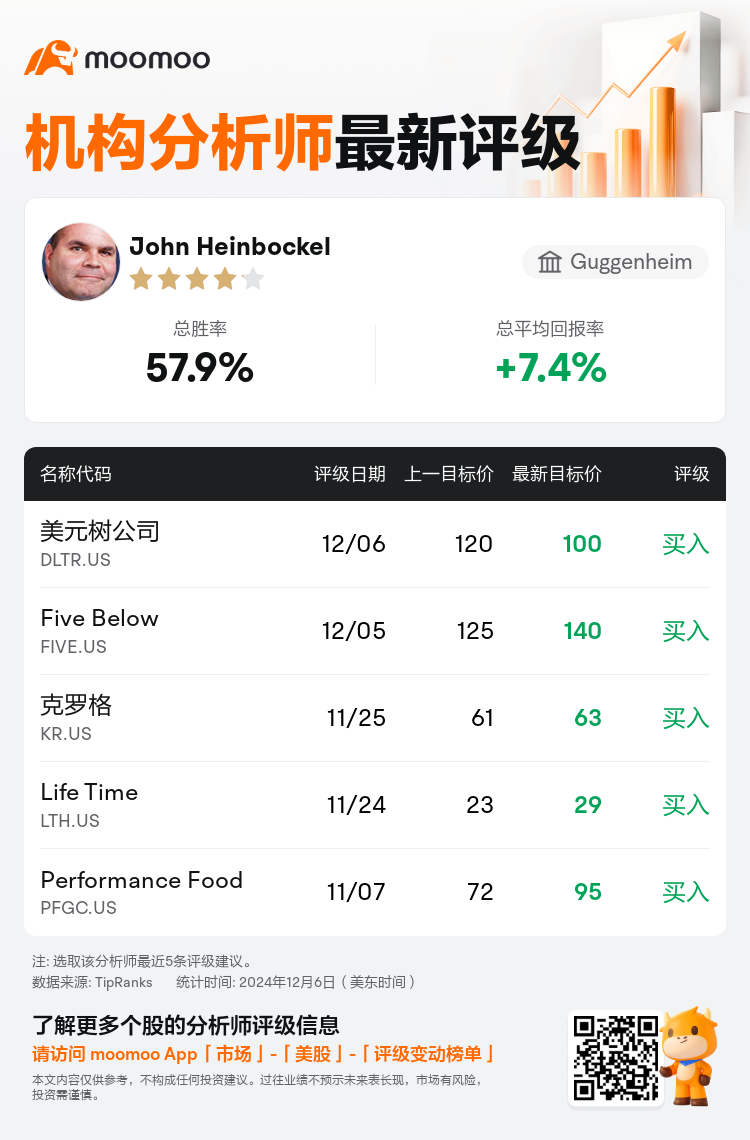

Guggenheim分析师John Heinbockel维持$美元树公司 (DLTR.US)$买入评级,并将目标价从120美元下调至100美元。

根据TipRanks数据显示,该分析师近一年总胜率为57.9%,总平均回报率为7.4%。

此外,综合报道,$美元树公司 (DLTR.US)$近期主要分析师观点如下:

此外,综合报道,$美元树公司 (DLTR.US)$近期主要分析师观点如下:

近期销售的改善归因于美国家庭美元公司更强的可比销售。尽管这一积极趋势存在,但对股票未来表现的更乐观看法仍然缺乏合理依据。

美元树公司的最新季度业绩和即将发布的季度指导为早期的糟糕表现提供了急需的缓解。然而,该公司的可比销售动能仍低于预期。最新商店格式的发展和成熟预计将在接下来的18-24个月内加速可比销售,结合合理的估值,呈现出一个具有吸引力的风险/回报场景。

美元树公司的股票在公司第三季度业绩发布后经历了一次小幅反弹,这与预期一致,并标志着在近期的指导减少和失利之后的'欢迎变化'。然而,11月份两家品牌的可比店销售却出现了下降,而美元树公司多价位转化后的可比提升的Sequential恶化也引发了担忧。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$美元树公司 (DLTR.US)$近期主要分析师观点如下:

此外,综合报道,$美元树公司 (DLTR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of