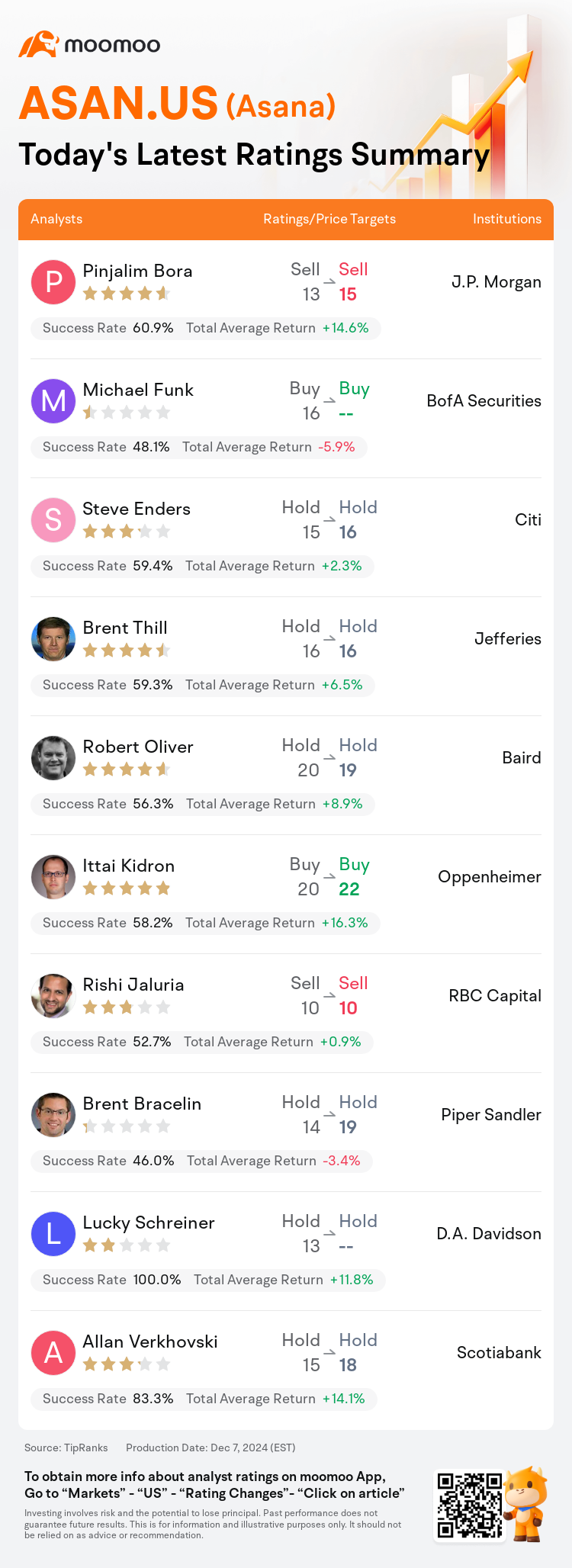

On Dec 07, major Wall Street analysts update their ratings for $Asana (ASAN.US)$, with price targets ranging from $10 to $22.

J.P. Morgan analyst Pinjalim Bora maintains with a sell rating, and adjusts the target price from $13 to $15.

BofA Securities analyst Michael Funk maintains with a buy rating.

Citi analyst Steve Enders maintains with a hold rating, and adjusts the target price from $15 to $16.

Citi analyst Steve Enders maintains with a hold rating, and adjusts the target price from $15 to $16.

Jefferies analyst Brent Thill maintains with a hold rating, and maintains the target price at $16.

Baird analyst Robert Oliver maintains with a hold rating, and adjusts the target price from $20 to $19.

Furthermore, according to the comprehensive report, the opinions of $Asana (ASAN.US)$'s main analysts recently are as follows:

Stable results along with some metrics indicating improvement helped in building the scenario for accelerated growth and significant margin expansion. However, these positives seem to be already reflected in the stock's after-hours pricing.

Asana's recent Q3 results exceeded expectations paired with stable sales guidance. Management provided promising perspectives on early AI Studio engagement and the potential for considerable gains from Technology Crossover Ventures as the company transitions to a hybrid pricing model. The results are viewed positively, highlighting an appealing prospect in AI and work execution, expected to gradually improve over multiple quarters.

Asana reported a solid quarter with an upside to Q3 revenue and Q4 guidance that aligns with current market expectations.

The analysis suggests signs of stabilization in Asana along with encouraging early responses to AI Studio. However, it's noted that broader market conditions remain a challenge and Asana is experiencing competitive pressure, losing market share to rivals such as Monday.com and Smartsheet.

The recent quarterly performance of Asana was viewed as solid but not exceptional, showing strong follow-through in shares. The post-earnings rally, along with developments in Asana's artificial intelligence product extensions, stabilizing retention rates, and the appointment of a new CFO who is expected to bring efficiency improvements to the model, contributed to this optimistic perspective.

Here are the latest investment ratings and price targets for $Asana (ASAN.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月7日,多家华尔街大行更新了$阿莎娜 (ASAN.US)$的评级,目标价介于10美元至22美元。

摩根大通分析师Pinjalim Bora维持卖出评级,并将目标价从13美元上调至15美元。

美银证券分析师Michael Funk维持买入评级。

花旗分析师Steve Enders维持持有评级,并将目标价从15美元上调至16美元。

花旗分析师Steve Enders维持持有评级,并将目标价从15美元上调至16美元。

富瑞集团分析师Brent Thill维持持有评级,维持目标价16美元。

贝雅分析师Robert Oliver维持持有评级,并将目标价从20美元下调至19美元。

此外,综合报道,$阿莎娜 (ASAN.US)$近期主要分析师观点如下:

稳定的业绩以及一些指标显示改进,有助于建立加速增长和显著利润扩张的场景。然而,这些积极因素似乎已经反映在了股票的盘后交易价格中。

阿莎娜最近的第三季度业绩超出预期,并伴随着稳定的销售指导。管理层对早期人工智能工作室的参与和来自科技交叉投资的重大收益潜力提供了鼓舞人心的前景,因为公司正在过渡到混合定价模式。这些结果被视为积极的,突显出在人工智能和工作执行领域的吸引前景,预计将在多个季度逐步改善。

阿莎娜报告了一个稳健的季度,第三季度的营业收入超出预期,第四季度的指导与当前市场预期一致。

分析表明,阿莎娜出现了稳定的迹象,同时对于人工智能工作室的早期反馈也令人鼓舞。然而,注意到更广泛的市场条件仍然是一个挑战,阿莎娜正面临竞争压力,正在失去市场份额给竞争对手如Monday.com和smartsheet。

阿莎娜最近的季度表现被视为稳健但并不特别,显示出股票的强劲跟进。财报之后的反弹,以及阿莎娜的人工智能产品扩展的发展、稳定的留存率以及新任首席财务官的任命,预计将为模型带来效率改善,这些因素都促成了这种乐观的观点。

以下为今日10位分析师对$阿莎娜 (ASAN.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

花旗分析师Steve Enders维持持有评级,并将目标价从15美元上调至16美元。

花旗分析师Steve Enders维持持有评级,并将目标价从15美元上调至16美元。

Citi analyst Steve Enders maintains with a hold rating, and adjusts the target price from $15 to $16.

Citi analyst Steve Enders maintains with a hold rating, and adjusts the target price from $15 to $16.