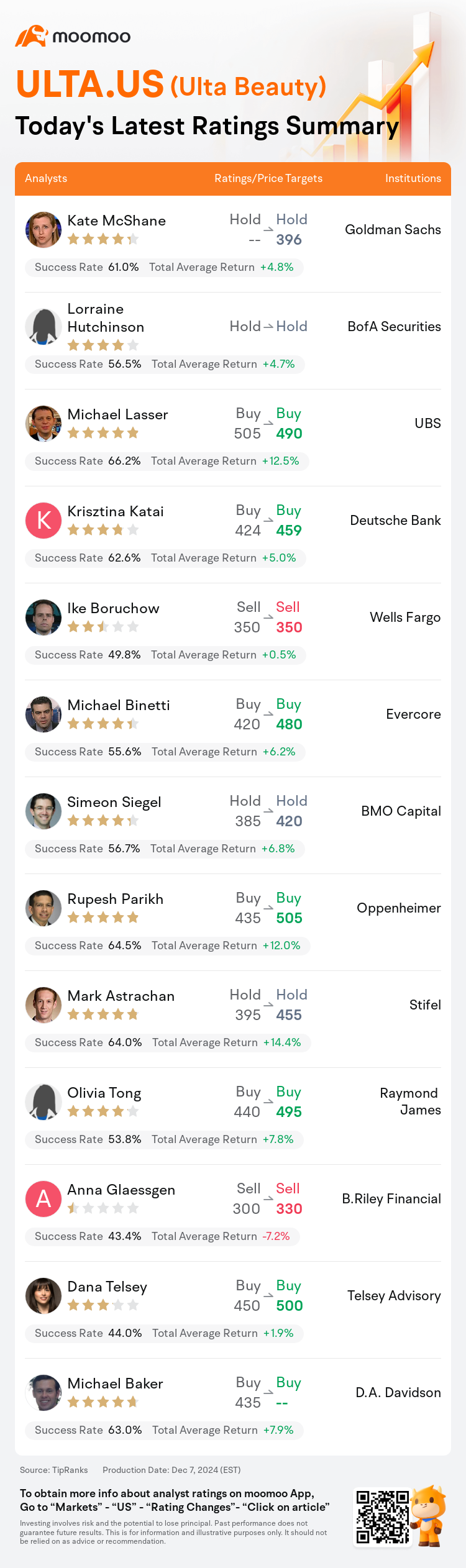

On Dec 07, major Wall Street analysts update their ratings for $Ulta Beauty (ULTA.US)$, with price targets ranging from $330 to $505.

Goldman Sachs analyst Kate McShane maintains with a hold rating, and sets the target price at $396.

BofA Securities analyst Lorraine Hutchinson maintains with a hold rating.

UBS analyst Michael Lasser maintains with a buy rating, and adjusts the target price from $505 to $490.

UBS analyst Michael Lasser maintains with a buy rating, and adjusts the target price from $505 to $490.

Deutsche Bank analyst Krisztina Katai maintains with a buy rating, and adjusts the target price from $424 to $459.

Wells Fargo analyst Ike Boruchow maintains with a sell rating, and maintains the target price at $350.

Furthermore, according to the comprehensive report, the opinions of $Ulta Beauty (ULTA.US)$'s main analysts recently are as follows:

Ulta Beauty's third quarter outcomes highlighted improvements in sales and a stabilization of margins. Even though external pressures persist, it's believed that the company has strategies to return to positive comparable sales growth soon. Moreover, the market is likely to find the earnings per share estimates for 2025 attainable.

The improvement in comparable sales for Ulta Beauty occurred earlier than market expectations, contributing to an increase in the company's stock value. Although the forecast for Q4 is seen as conservative, challenges still persist due to a competitive market and sector-specific headwinds.

The flip to slightly positive comps and year-over-year promotional margins for Ulta Beauty, which are better than anticipated for Q3 and still an improvement over 2019, were highlighted by analysts as critical factors dispelling ongoing structural bear concerns. They indicated that Ulta's strategic positioning looking towards 2025 remains promising.

Ulta Beauty surpassed sales and earnings expectations in Q3 and raised its fiscal 2024 projections for all metrics due to this outperformance. Nonetheless, challenges are anticipated for Q4, with expectations of a decline in comparable sales.

Ulta Beauty's recent financial reports exceeded expectations due to improved comparable store sales, gross margins, and expenditures which collectively contributed to a significant beat in earnings per share. Although Ulta operates within an appealing industry, clarity regarding competition and distribution is required to better determine the potentials of sales and margin stability.

Here are the latest investment ratings and price targets for $Ulta Beauty (ULTA.US)$ from 13 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月7日,多家华尔街大行更新了$Ulta美容 (ULTA.US)$的评级,目标价介于330美元至505美元。

高盛集团分析师Kate McShane维持持有评级,目标价396美元。

美银证券分析师Lorraine Hutchinson维持持有评级。

瑞士银行分析师Michael Lasser维持买入评级,并将目标价从505美元下调至490美元。

瑞士银行分析师Michael Lasser维持买入评级,并将目标价从505美元下调至490美元。

德意志银行分析师Krisztina Katai维持买入评级,并将目标价从424美元上调至459美元。

富国集团分析师Ike Boruchow维持卖出评级,维持目标价350美元。

此外,综合报道,$Ulta美容 (ULTA.US)$近期主要分析师观点如下:

ulta美容第三季度的业绩突显了销售的改善和利润率的稳定。虽然外部压力依然存在,但相信公司有策略能够迅速恢复正的可比销售增长。此外,市场可能会认为2025年的每股收益预期是可以实现的。

ulta美容的可比销售改善发生在市场预期之前,导致公司股票价值的增加。尽管对第四季度的预测被视为保守,但由于竞争激烈的市场和行业特定的逆风,挑战仍然存在。

对于ulta美容而言,稍微正向的可比销售和年同比的促销利润率的转变,超过了第三季度的预期,并且仍然比2019年有所改善,分析师强调这是消除持续结构性熊市担忧的关键因素。他们指出,ulta在面向2025年的战略定位仍然充满希望。

ulta美容在第三季度超越了销售和盈利预期,并提高了对所有指标的2024财年预测。尽管如此,预计第四季度将面临挑战,同时可比销售有下降的预期。

ulta美容最近的财务报告由于可比门店销售、毛利率和支出的改善而超过预期,这些因素共同导致每股收益显著超出预期。尽管ulta在一个吸引人的行业内运营,但需要更清晰的竞争和分销情况以更好地判断销售和利润稳定的潜力。

以下为今日13位分析师对$Ulta美容 (ULTA.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

瑞士银行分析师Michael Lasser维持买入评级,并将目标价从505美元下调至490美元。

瑞士银行分析师Michael Lasser维持买入评级,并将目标价从505美元下调至490美元。

UBS analyst Michael Lasser maintains with a buy rating, and adjusts the target price from $505 to $490.

UBS analyst Michael Lasser maintains with a buy rating, and adjusts the target price from $505 to $490.