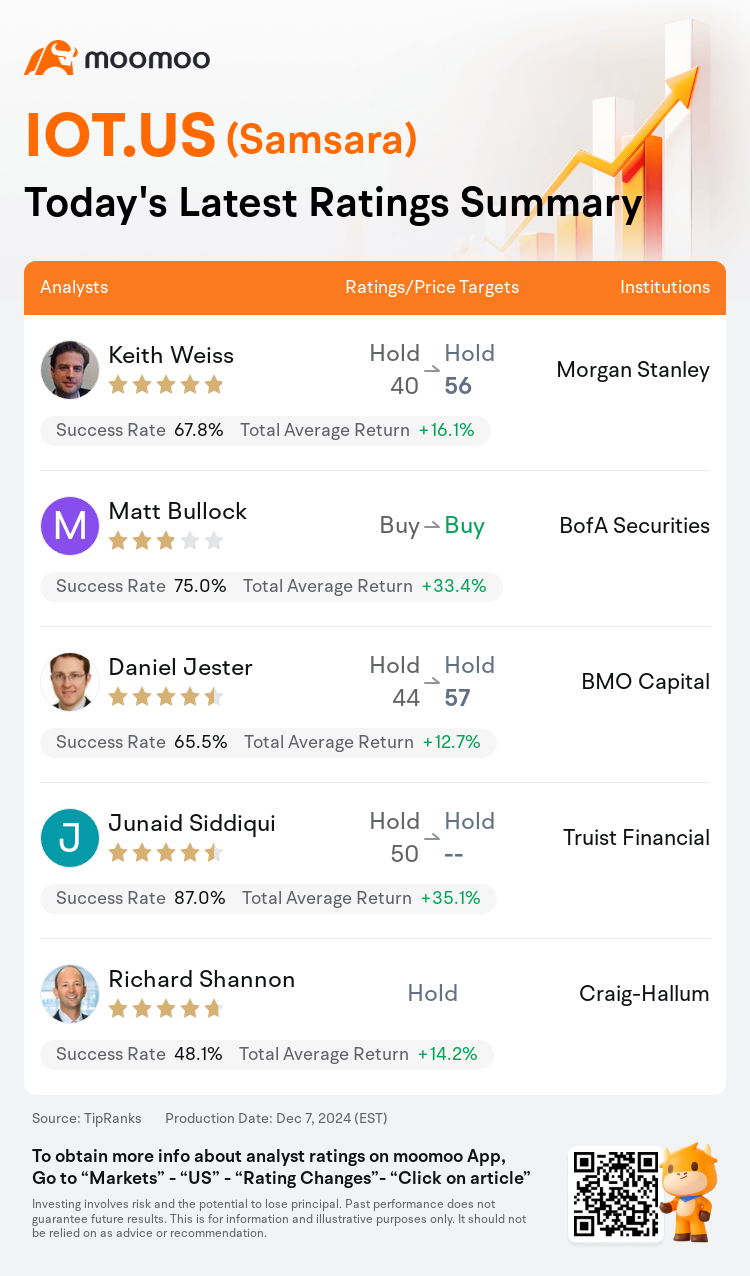

On Dec 07, major Wall Street analysts update their ratings for $Samsara (IOT.US)$, with price targets ranging from $56 to $57.

Morgan Stanley analyst Keith Weiss maintains with a hold rating, and adjusts the target price from $40 to $56.

BofA Securities analyst Matt Bullock maintains with a buy rating.

BMO Capital analyst Daniel Jester maintains with a hold rating, and adjusts the target price from $44 to $57.

BMO Capital analyst Daniel Jester maintains with a hold rating, and adjusts the target price from $44 to $57.

Truist Financial analyst Junaid Siddiqui maintains with a hold rating.

Craig-Hallum analyst Richard Shannon initiates coverage with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Samsara (IOT.US)$'s main analysts recently are as follows:

Samsara exhibited strong performance during Q3, demonstrating robust growth, better operational efficiency, and enhanced cash generation capabilities. However, the weaker-than-expected new annual recurring revenue growth and a somewhat cautious Q4 revenue outlook in light of high market expectations might lead to a tapering off of the recent stock gains. The potential incorporation of emerging AI applications leveraging Samsara's advanced computer vision technology could continue to drive momentum following other recent product launches such as Asset Tags and Connected Forms.

Samsara delivered a clean third-quarter result, but there is an expectation of near-term market concerns due to the unchanged guidance for the fourth quarter, despite previous quarter overperformance and valuation multiples, according to an analyst.

The company is anticipated to surpass its revenue forecast of $311M, which is at the upper end of its guidance. This optimism is rooted in the recent business momentum, encouraging signs observed during industry checks this quarter, and discussions prior to the quiet period. Additionally, the upcoming Q3 results are expected to showcase key growth drivers, such as a strategic move upmarket, robust performance in 'frontier markets,' considerable momentum from large customers, new client acquisitions, international expansion, and margin improvements.

Here are the latest investment ratings and price targets for $Samsara (IOT.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月7日,多家华尔街大行更新了$Samsara (IOT.US)$的评级,目标价介于56美元至57美元。

摩根士丹利分析师Keith Weiss维持持有评级,并将目标价从40美元上调至56美元。

美银证券分析师Matt Bullock维持买入评级。

BMO资本市场分析师Daniel Jester维持持有评级,并将目标价从44美元上调至57美元。

BMO资本市场分析师Daniel Jester维持持有评级,并将目标价从44美元上调至57美元。

储亿银行分析师Junaid Siddiqui维持持有评级。

Craig-Hallum分析师Richard Shannon首予持有评级。

此外,综合报道,$Samsara (IOT.US)$近期主要分析师观点如下:

Samsara在第三季度表现强劲,展示了稳健的增长、更好的运营效率以及增强的现金生成能力。然而,低于预期的新年度经常性收入增长以及在高市场预期下对第四季度收入的谨慎展望可能会导致近期股票涨幅的减缓。潜在的结合新兴人工智能应用,利用Samsara的先进计算机视觉科技,可能在其他近期产品发布如资产标签和连接表单之后,继续推动势头。

Samsara公布了干净的第三季度结果,但预计由于未变的第四季度指引,加上分析师所说的前一季度的超预期表现和估值倍数,短期市场担忧将持续存在。

预计该公司的营业收入将超过31100万的预测,这一数值位于其指引的上限。这一乐观情绪源于近期的业务势头、在本季度行业检查中观察到的积极迹象以及在静默期之前的讨论。此外,即将发布的第三季度结果预计将展示关键的增长驱动力,例如向高端市场的战略转型、在“前沿市场”的强劲表现、来自大型客户的显著势头、新客户的获取、国际扩张以及利润率的改善。

以下为今日5位分析师对$Samsara (IOT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

BMO资本市场分析师Daniel Jester维持持有评级,并将目标价从44美元上调至57美元。

BMO资本市场分析师Daniel Jester维持持有评级,并将目标价从44美元上调至57美元。

BMO Capital analyst Daniel Jester maintains with a hold rating, and adjusts the target price from $44 to $57.

BMO Capital analyst Daniel Jester maintains with a hold rating, and adjusts the target price from $44 to $57.