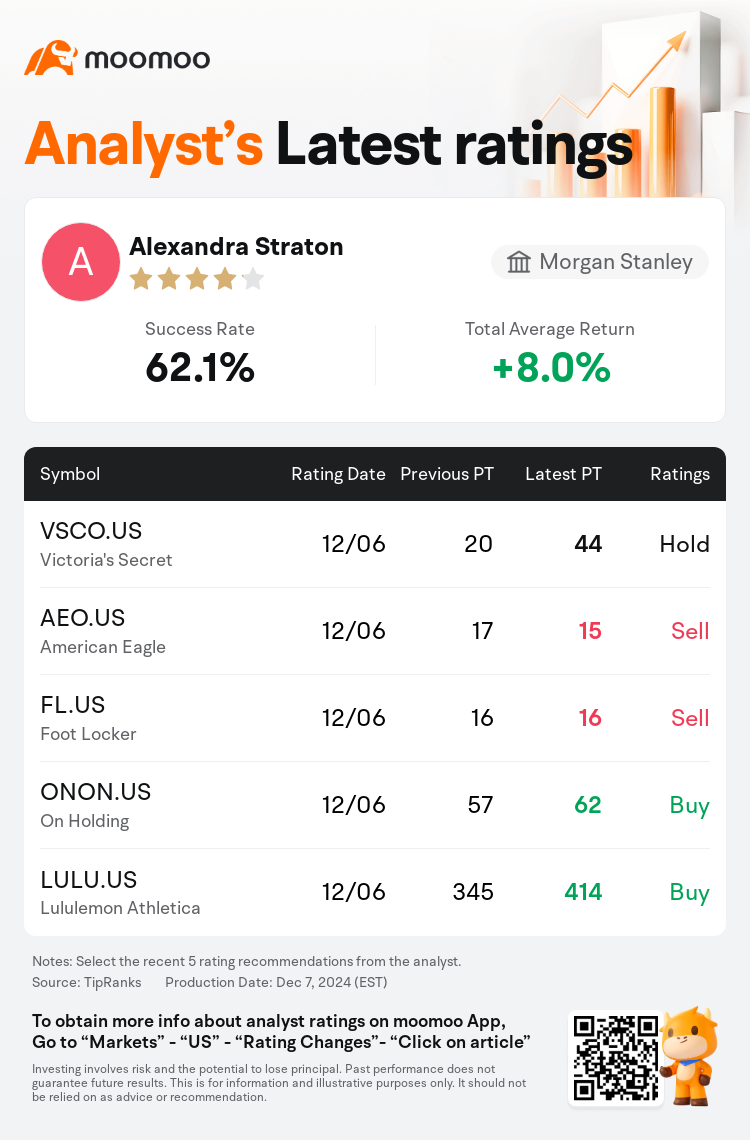

Morgan Stanley analyst Alexandra Straton maintains $Victoria's Secret (VSCO.US)$ with a hold rating, and adjusts the target price from $20 to $44.

According to TipRanks data, the analyst has a success rate of 62.1% and a total average return of 8.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Victoria's Secret (VSCO.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Victoria's Secret (VSCO.US)$'s main analysts recently are as follows:

Following the Q3 report, it was observed that the company outperformed in adjusted earnings, primarily due to spending leverage, although this was somewhat mitigated by a lower gross margin. Sales surpassed consensus expectations, showing robustness both in North America and internationally. However, it's noted that the company's margins are still being impacted by increased promotional activities and transportation expenses.

Following Victoria's Secret's third quarter performance exceeding expectations, near-term revenue trends are mildly impacted by broader economic challenges, potentially overshadowing the company's brand rehabilitation initiatives. Analysts note that despite a non-linear path to recovery, the long-term prospects are viewed as stable, with the company positioned to regain previous sales levels and improve margins.

The latest quarterly results from Victoria's Secret have offered numerous positive indicators, including growth in North America, gains in market share, and expansion of PINK apparel. However, these were partially tempered by a minor shortfall in gross margin. Notably, the company is now experiencing growth in operating income, and management has indicated that the momentum seen in Q3 persisted through the Black Friday and Cyber Monday period.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

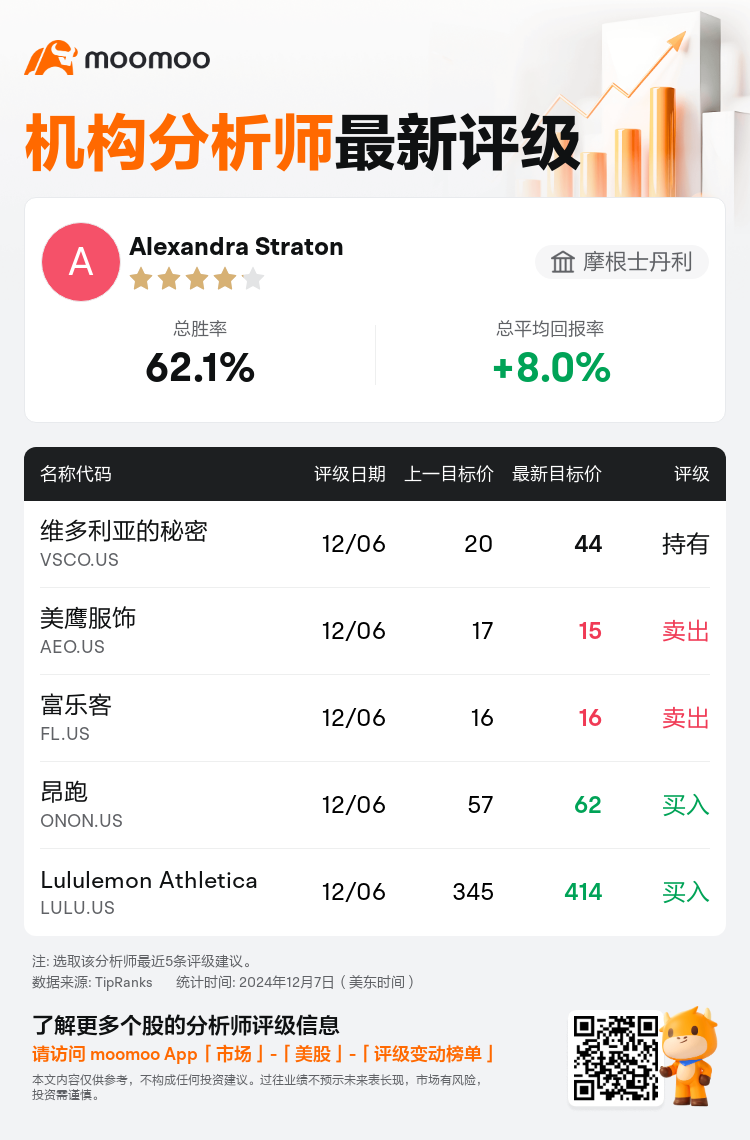

摩根士丹利分析师Alexandra Straton维持$维多利亚的秘密 (VSCO.US)$持有评级,并将目标价从20美元上调至44美元。

根据TipRanks数据显示,该分析师近一年总胜率为62.1%,总平均回报率为8.0%。

此外,综合报道,$维多利亚的秘密 (VSCO.US)$近期主要分析师观点如下:

此外,综合报道,$维多利亚的秘密 (VSCO.US)$近期主要分析师观点如下:

在第三季度报告发布后,观察到该公司在调整后的盈利上表现优异,主要得益于支出杠杆,尽管这受到毛利率下降的影响有所减轻。销售额超出市场共识预期,在北美和国际市场均显示出强劲表现。然而,值得注意的是,该公司的毛利率仍受到了促销活动增加和运输费用上升的影响。

在维多利亚的秘密第三季度业绩超出预期后,近期营业收入趋势受到更广泛经济挑战的轻微影响,这可能会遮蔽公司的品牌修复举措。分析师指出,尽管复苏路径并不线性,但长期前景被视为稳定,公司有望恢复之前的销售水平并改善毛利率。

维多利亚的秘密最新的季度业绩提供了多个积极因子,包括北美的增长、市场份额的增加以及PINk服装的扩展。然而,这些部分被毛利率的轻微下滑所抵消。值得注意的是,该公司现在的营业收入正在增长,管理层表示,第三季度的势头一直持续到黑色星期五和网络星期一期间。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$维多利亚的秘密 (VSCO.US)$近期主要分析师观点如下:

此外,综合报道,$维多利亚的秘密 (VSCO.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of