Robinhood Markets Options Trading: A Deep Dive Into Market Sentiment

Robinhood Markets Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Robinhood Markets.

拥有大量资金的鲸鱼在Robinhood Markets上采取了明显的看好态度。

Looking at options history for Robinhood Markets (NASDAQ:HOOD) we detected 27 trades.

查看Robinhood Markets(纳斯达克:HOOD)的期权历史,我们检测到27笔交易。

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 33% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说55%的投资者以看涨的预期开设了交易,33%则是以看跌的预期。

From the overall spotted trades, 4 are puts, for a total amount of $162,980 and 23, calls, for a total amount of $3,621,624.

从整体检测到的交易中,4笔为看跌期权,总金额为$162,980;23笔为看涨期权,总金额为$3,621,624。

What's The Price Target?

价格目标是什么?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $60.0 for Robinhood Markets over the recent three months.

根据交易活动,似乎这些重要投资者的目标价格区间在过去三个月间为Robinhood Markets的$15.0至$60.0。

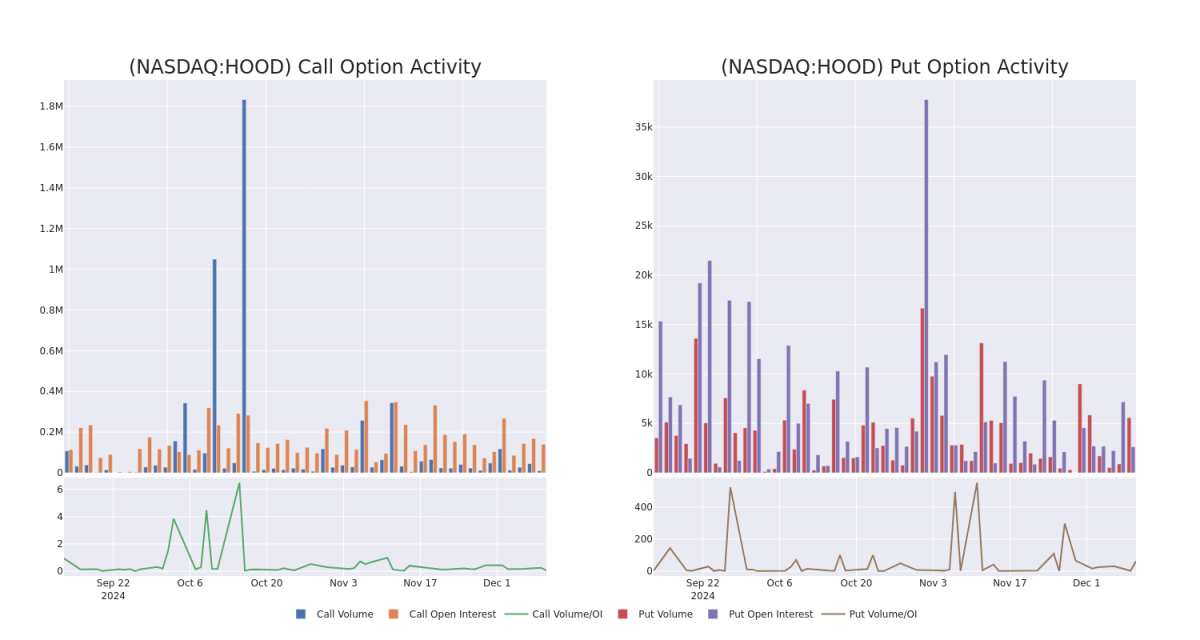

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In today's trading context, the average open interest for options of Robinhood Markets stands at 7924.72, with a total volume reaching 15,436.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Robinhood Markets, situated within the strike price corridor from $15.0 to $60.0, throughout the last 30 days.

在今天的交易环境中,Robinhood Markets期权的平均未平仓合约数量为7924.72,成交量达到15436.00。附图描绘了Robinhood Markets在过去30天内高价值交易中看涨和看跌期权的成交量及未平仓合约的变化,位于$15.0至$60.0的行使价格区间内。

Robinhood Markets Option Volume And Open Interest Over Last 30 Days

罗宾汉市场过去30天的期权成交量和持仓量

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | TRADE | BULLISH | 01/16/26 | $22.8 | $22.7 | $22.8 | $20.00 | $456.0K | 19.6K | 2.0K |

| HOOD | CALL | TRADE | BULLISH | 01/16/26 | $22.8 | $22.7 | $22.8 | $20.00 | $456.0K | 19.6K | 1.8K |

| HOOD | CALL | TRADE | BULLISH | 01/16/26 | $22.8 | $22.7 | $22.8 | $20.00 | $456.0K | 19.6K | 1.4K |

| HOOD | CALL | SWEEP | BULLISH | 01/16/26 | $6.5 | $6.35 | $6.45 | $60.00 | $322.2K | 161 | 501 |

| HOOD | CALL | SWEEP | BULLISH | 01/16/26 | $8.65 | $8.55 | $8.65 | $50.00 | $303.6K | 8.2K | 374 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | 看涨 | 交易 | 看好 | 01/16/26 | $22.8 | $22.7 | $22.8 | $20.00 | 456,000美元 | 19,600 | 2,000 |

| HOOD | 看涨 | 交易 | 看好 | 01/16/26 | $22.8 | $22.7 | $22.8 | $20.00 | 45.6万美元 | 1.96万 | 1.8K |

| HOOD | 看涨 | 交易 | 看好 | 01/16/26 | $22.8 | $22.7 | $22.8 | $20.00 | 45.6万美元 | 1.96万 | 1.4K |

| HOOD | 看涨 | 扫单 | 看好 | 01/16/26 | $6.5 | $6.35 | $6.45 | $60.00 | 322.2K美元 | 161 | 501 |

| HOOD | 看涨 | 扫单 | 看好 | 01/16/26 | $8.65 | $8.55 | $8.65 | $50.00 | $303.6K | 8.2K | 374 |

About Robinhood Markets

关于Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

Robinhood Markets Inc 正在创建一个现代金融服务平台。它设计自己的产品和服务,并通过一个基于应用程序的云平台交付这些服务,支持专有技术。其垂直整合的平台使得新产品和服务的推出成为可能,如数字货币交易、股息再投资、碎股、定期投资和IPO访问。它通过在执行订单时将用户订单的期权、股票和数字货币路由到做市商来赚取基于交易的收入。

Robinhood Markets's Current Market Status

Robinhood Markets 当前市场状态

- Trading volume stands at 6,591,787, with HOOD's price down by -0.43%, positioned at $39.37.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 63 days.

- 交易量为6,591,787,HOOD的价格下跌了-0.43%,目前为$39.37。

- 相对强弱指数(RSI)因子显示该股票可能接近超买状态。

- 预计在63天后宣布财报。

Professional Analyst Ratings for Robinhood Markets

Robinhood Markets的专业分析师评级

In the last month, 5 experts released ratings on this stock with an average target price of $44.2.

在过去一个月里,有5位专家对该股票发布了评级,平均目标价为44.2美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Consistent in their evaluation, an analyst from Deutsche Bank keeps a Buy rating on Robinhood Markets with a target price of $35. * An analyst from Morgan Stanley has elevated its stance to Overweight, setting a new price target at $55. * An analyst from Bernstein has decided to maintain their Outperform rating on Robinhood Markets, which currently sits at a price target of $51. * An analyst from JMP Securities persists with their Market Outperform rating on Robinhood Markets, maintaining a target price of $40. * Showing optimism, an analyst from Needham upgrades its rating to Buy with a revised price target of $40.

20年期权专业交易员揭示了他的一条图表技术,该技术显示何时买入和卖出。复制他的交易,这些交易每20天平均获利27%。点击这里获取访问权限。* 在评价中保持一致,德意志银行的一位分析师对Robinhood Markets维持了买入评级,目标价为35美元。* 摩根士丹利的一位分析师将其评级提高至增持,设定新的目标价为55美元。* 伯恩斯坦的一位分析师决定维持他们对Robinhood Markets的表现优于大盘评级,目前的目标价为51美元。* JMP Securities的一位分析师持续对Robinhood Markets保持市场表现优于大盘评级,维持目标价为40美元。* 表现出乐观,Needham的一位分析师将其评级升级为买入,并修订目标价为40美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

From the overall spotted trades, 4 are puts, for a total amount of $162,980 and 23, calls, for a total amount of $3,621,624.

From the overall spotted trades, 4 are puts, for a total amount of $162,980 and 23, calls, for a total amount of $3,621,624.