Tyra Biosciences (NASDAQ:TYRA) Is In A Good Position To Deliver On Growth Plans

Tyra Biosciences (NASDAQ:TYRA) Is In A Good Position To Deliver On Growth Plans

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

我们很容易理解为什么投资者会对未盈利的公司感兴趣。例如,生物技术和矿业勘探公司往往会在找到新的治疗方法或矿物发现之前损失数年。但历史虽然赞扬那些罕见的成功,但失败的案例往往被遗忘;谁还记得Pets.com?

So, the natural question for Tyra Biosciences (NASDAQ:TYRA) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

因此,Tyra Biosciences(纳斯达克:TYRA)股东的自然问题是,他们是否应该关注其现金消耗率。为了本文的目的,我们将现金消耗定义为公司每年用于资金增长的现金支出(也称为其负自由现金流)。我们将首先比较其现金消耗与现金储备,以便计算其现金持续期。

Does Tyra Biosciences Have A Long Cash Runway?

Tyra Biosciences是否拥有充足的现金持续期?

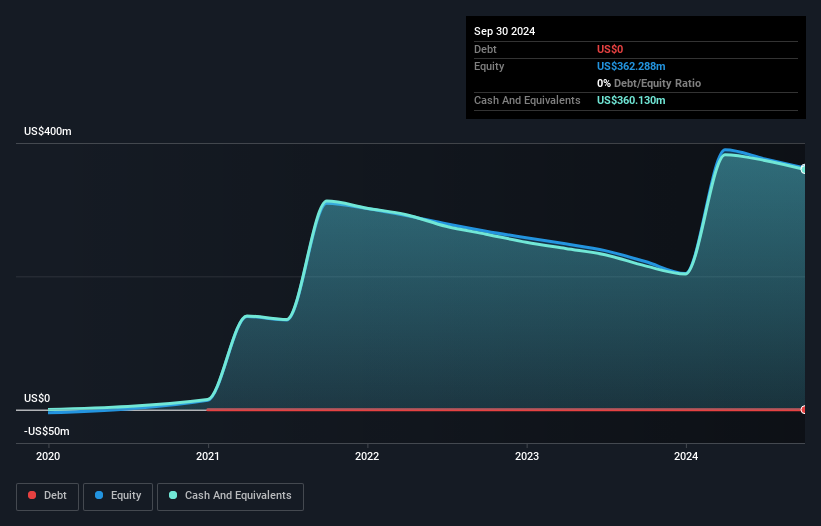

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Tyra Biosciences last reported its September 2024 balance sheet in November 2024, it had zero debt and cash worth US$360m. Looking at the last year, the company burnt through US$65m. That means it had a cash runway of about 5.5 years as of September 2024. Importantly, though, analysts think that Tyra Biosciences will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. You can see how its cash balance has changed over time in the image below.

公司的现金持续期通过将其现金储备除以现金消耗来计算。当Tyra Biosciences在2024年11月最后一次公布其2024年9月的资产负债表时,它的债务为零,现金价值为36000万美元。回顾过去一年,该公司消耗了6500万美元。这意味着截至2024年9月,它的现金持续期大约为5.5年。重要的是,分析师认为Tyra Biosciences将在那之前达到现金流盈亏平衡。这样的话,它可能永远不会达到现金持续期的终点。您可以在下面的图像中看到,其现金余额随时间的变化。

How Is Tyra Biosciences' Cash Burn Changing Over Time?

Tyra Biosciences的现金消耗如何随着时间变化?

Tyra Biosciences didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by 33%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Tyra Biosciences在过去一年没有记录任何营业收入,表明它是一家仍在开发其业务的早期阶段公司。尽管如此,我们仍然可以作为评估其现金消耗状况的一部分来检查其现金消耗轨迹。在过去一年中,其现金消耗实际上增加了33%,这表明管理层正在增加对未来增长的投资,但又没有过于快速。这并不一定是坏事,但投资者应该注意这将缩短现金持续期。显然,关键因素是公司在未来是否会发展其业务。因此,审视我们分析师对该公司的预测是非常有意义的。

How Easily Can Tyra Biosciences Raise Cash?

Tyra Biosciences能多容易地筹集资金?

Given its cash burn trajectory, Tyra Biosciences shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

考虑到其现金消耗轨迹,Tyra Biosciences的股东可能希望考虑它能多容易地筹集更多现金,尽管它的现金储备相对充足。公司可以通过债务或股权筹集资金。上市公司的主要优势之一是它们可以向投资者出售股份以筹集现金和资助增长。通过比较公司现金消耗与其市值,我们可以洞察如果公司需要筹集足够现金以覆盖另一年现金消耗,股东将被稀释多少。

Tyra Biosciences has a market capitalisation of US$846m and burnt through US$65m last year, which is 7.7% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Tyra Biosciences的市值为US$84600万,去年消耗了US$6500万,占公司市值的7.7%。鉴于这是相对较小的百分比,因此公司通过向投资者发行一些新股或甚至借款来资助另一年的增长,可能会非常容易。

So, Should We Worry About Tyra Biosciences' Cash Burn?

那么,我们应该担心Tyra Biosciences的现金消耗吗?

It may already be apparent to you that we're relatively comfortable with the way Tyra Biosciences is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. One real positive is that analysts are forecasting that the company will reach breakeven. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Taking a deeper dive, we've spotted 5 warning signs for Tyra Biosciences you should be aware of, and 2 of them are potentially serious.

你可能已经看到,我们对Tyra Biosciences消耗现金的方式相对满意。特别是,我们认为其现金储备突显出公司对其开支的控制能力。虽然其现金消耗增加并不好,但本文提到的其他因素在这一方面弥补了不足。一个真正的积极信号是,分析师预测公司将实现收支平衡。综上所述,我们对此公司的现金消耗速度并不担心;公司似乎很好地掌控了其中期开支需求。深入分析后,我们发现Tyra Biosciences有5个需要注意的警告信号,其中2个可能是严重的。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

当然,你可能会在其他地方找到优质投资。所以请看看这份有趣公司的免费列表,以及这份根据分析师预测的成长股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

Tyra Biosciences didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by 33%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Tyra Biosciences didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by 33%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.