Here's Why Shareholders Should Examine United Natural Foods, Inc.'s (NYSE:UNFI) CEO Compensation Package More Closely

Here's Why Shareholders Should Examine United Natural Foods, Inc.'s (NYSE:UNFI) CEO Compensation Package More Closely

Key Insights

关键洞察

- United Natural Foods to hold its Annual General Meeting on 17th of December

- CEO Sandy Douglas' total compensation includes salary of US$1.07m

- The total compensation is 47% higher than the average for the industry

- United Natural Foods' EPS declined by 97% over the past three years while total shareholder loss over the past three years was 42%

- 联合原生态食品将在12月17日召开年度股东大会

- 首席执行官Sandy Douglas的总薪酬包括107万美元的薪水

- 总薪酬比行业平均水平高出47%

- 联合原生态食品的每股收益在过去三年中下降了97%,而股东在过去三年中的总损失为42%

The results at United Natural Foods, Inc. (NYSE:UNFI) have been quite disappointing recently and CEO Sandy Douglas bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 17th of December. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

联合原生态食品公司(纽交所:UNFI)的业绩最近相当令人失望,CEO桑迪·道格拉斯对此也有一定责任。股东们将关注董事会在12月17日的下一次年度大会上对于扭转业绩的意见。这也是股东通过投票公司决议影响管理层的机会,例如高管薪酬,这可能会显著影响公司。我们将提出为何我们认为CEO薪酬与公司业绩不匹配的案例。

Comparing United Natural Foods, Inc.'s CEO Compensation With The Industry

比较联合原生态食品公司CEO的薪酬与行业

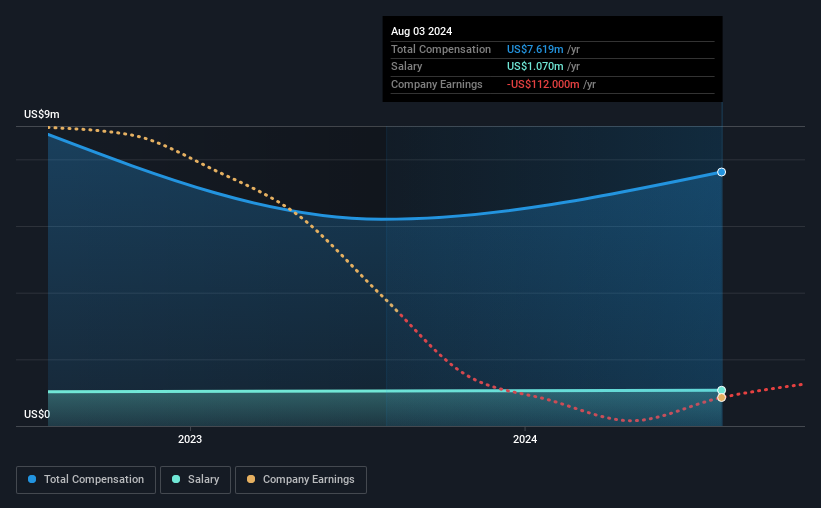

According to our data, United Natural Foods, Inc. has a market capitalization of US$1.5b, and paid its CEO total annual compensation worth US$7.6m over the year to August 2024. That's a notable increase of 23% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.1m.

根据我们的数据,联合原生态食品公司市值为15亿美金,2024年8月之前支付给CEO的总年薪酬为760万美金。这比去年增加了23%。我们认为总薪酬更为重要,但我们的数据显示CEO的薪水较低,为110万美金。

In comparison with other companies in the American Consumer Retailing industry with market capitalizations ranging from US$1.0b to US$3.2b, the reported median CEO total compensation was US$5.2m. This suggests that Sandy Douglas is paid more than the median for the industry. What's more, Sandy Douglas holds US$4.2m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

与其他市值范围在10亿到32亿美金的美国消费零售行业公司相比,报告的CEO总薪酬中位数为520万美金。这表明桑迪·道格拉斯的薪水高于该行业的中位数。更重要的是,桑迪·道格拉斯以自己名义持有价值420万美金的股份,表明他们在公司中有很大的利益关系。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$1.1m | US$1.1m | 14% |

| Other | US$6.5m | US$5.2m | 86% |

| Total Compensation | US$7.6m | US$6.2m | 100% |

| 组成部分 | 2024 | 2023 | 比例(2024) |

| 薪资 | 美元1.1百万 | 美元1.1百万 | 14% |

| 其他 | 650万美元 | 520万美元 | 86% |

| 总薪酬 | 760万美元 | 620万美元 | 100% |

On an industry level, roughly 13% of total compensation represents salary and 87% is other remuneration. It's interesting to note that United Natural Foods pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

在行业层面,总补偿的大约13%来自薪资,87%是其他薪酬。值得注意的是,联合原生态食品通过薪资支付的薪酬比例高于行业平均水平。重要的是,倾向于非薪资补偿表明总薪酬与公司的表现相关。

United Natural Foods, Inc.'s Growth

联合原生态食品公司成长

Over the last three years, United Natural Foods, Inc. has shrunk its earnings per share by 97% per year. Its revenue is up 3.3% over the last year.

在过去三年中,联合原生态食品公司的每股收益每年缩减了97%。它的营业收入在过去一年增长了3.3%。

Overall this is not a very positive result for shareholders. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

总体而言,这对于股东来说并不是一个非常积极的结果。而在12个月内的温和营业收入增长也无法弥补每股收益的减少。因此,考虑到这种相对疲弱的表现,股东可能不想看到CEO获得高额薪酬。暂时离开当前的议题,查看分析师对未来的预期的这个免费可视化图示可能很重要。

Has United Natural Foods, Inc. Been A Good Investment?

联合原生态食品公司是一个好的投资吗?

The return of -42% over three years would not have pleased United Natural Foods, Inc. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

三年回报率为-42%可能让联合原生态食品公司的股东感到不满。因此,如果CEO获得丰厚的薪酬,股东们可能会感到不快。

In Summary...

总结...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

由于业务表现不佳,股东在投资方面也遭受了低回报,表明他们几乎不可能支持CEO的薪资增加。在即将召开的股东大会上,董事会将有机会解释其计划采取的改进业务表现的措施。

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for United Natural Foods (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

CEO薪酬是一个重要的关注领域,但我们还需要关注公司的其他属性。这就是为什么我们进行了研究,并确定了联合原生态食品的2个预警信号(其中1个是重要的!),以便您对股票有全面的了解。

Switching gears from United Natural Foods, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

从联合原生态食品转变,如果您在寻找优质资产负债表和高回报,免费列表中的高回报、低负债公司是个不错的选择。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

On an industry level, roughly 13% of total compensation represents salary and 87% is other remuneration. It's interesting to note that United Natural Foods pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

On an industry level, roughly 13% of total compensation represents salary and 87% is other remuneration. It's interesting to note that United Natural Foods pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.