Vistra Unusual Options Activity For December 11

Vistra Unusual Options Activity For December 11

Deep-pocketed investors have adopted a bullish approach towards Vistra (NYSE:VST), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VST usually suggests something big is about to happen.

财力雄厚的投资者对瑞致达(纽约证券交易所代码:VST)采取了看涨态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是vST的如此实质性的变动通常表明重大事件即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Vistra. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了瑞致达的11项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 36% bearish. Among these notable options, 7 are puts, totaling $844,269, and 4 are calls, amounting to $150,347.

这些重量级投资者的总体情绪存在分歧,36%的人倾向于看涨,36%的人倾向于看跌。在这些值得注意的期权中,有7个是看跌期权,总额为844,269美元,4个是看涨期权,总额为150,347美元。

Predicted Price Range

预测的价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $155.0 for Vistra, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者将注意力集中在瑞致达过去三个月的125.0美元至155.0美元之间的价格区间上。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

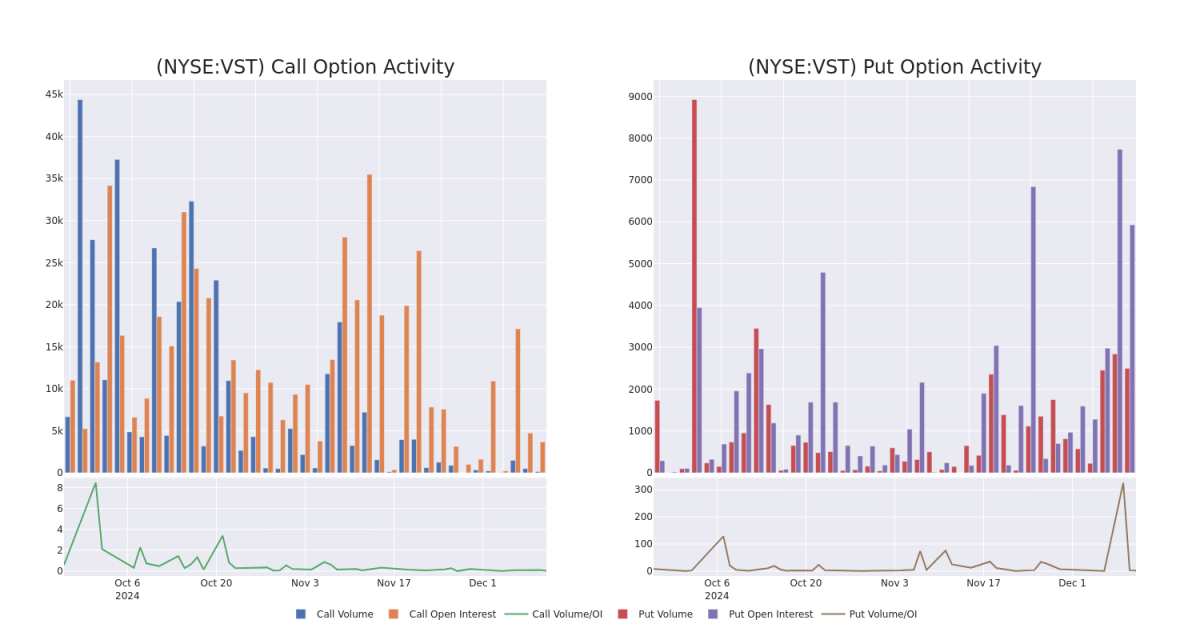

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Vistra's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Vistra's significant trades, within a strike price range of $125.0 to $155.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量瑞致达期权在特定行使价下的流动性和利息水平的关键。下面,我们将简要介绍过去一个月瑞致达重大交易的看涨期权和未平仓合约的趋势,行使价区间为125.0美元至155.0美元。

Vistra Option Activity Analysis: Last 30 Days

瑞致达期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | PUT | SWEEP | NEUTRAL | 01/17/25 | $5.8 | $5.7 | $5.8 | $135.00 | $289.4K | 1.3K | 507 |

| VST | PUT | TRADE | BULLISH | 01/17/25 | $6.0 | $5.7 | $5.8 | $135.00 | $255.7K | 1.3K | 948 |

| VST | PUT | SWEEP | BEARISH | 12/20/24 | $12.7 | $12.7 | $12.7 | $155.00 | $106.6K | 708 | 85 |

| VST | PUT | SWEEP | BEARISH | 12/20/24 | $7.6 | $7.6 | $7.6 | $148.00 | $63.8K | 198 | 90 |

| VST | CALL | TRADE | BEARISH | 12/20/24 | $23.0 | $20.0 | $21.0 | $125.00 | $52.5K | 2.2K | 25 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | 放 | 扫 | 中立 | 01/17/25 | 5.8 美元 | 5.7 美元 | 5.8 美元 | 135.00 美元 | 289.4 万美元 | 1.3K | 507 |

| VST | 放 | 贸易 | 看涨 | 01/17/25 | 6.0 美元 | 5.7 美元 | 5.8 美元 | 135.00 美元 | 255.7 万美元 | 1.3K | 948 |

| VST | 放 | 扫 | 粗鲁的 | 12/20/24 | 12.7 美元 | 12.7 美元 | 12.7 美元 | 155.00 美元 | 106.6 万美元 | 708 | 85 |

| VST | 放 | 扫 | 粗鲁的 | 12/20/24 | 7.6 美元 | 7.6 美元 | 7.6 美元 | 148.00 美元 | 63.8 万美元 | 198 | 90 |

| VST | 打电话 | 贸易 | 粗鲁的 | 12/20/24 | 23.0 美元 | 20.0 美元 | 21.0 美元 | 125.00 美元 | 52.5 万美元 | 2.2K | 25 |

About Vistra

关于瑞致达

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

瑞致达能源是美国最大的电力生产商和零售能源提供商之一。继2024年收购能源港之后,瑞致达拥有41千兆瓦的核能、煤炭、天然气和太阳能发电,以及世界上最大的公用事业规模电池项目之一。其零售电力业务为20个州的500万客户提供服务,其中包括德克萨斯州所有电力消费者的近三分之一。瑞致达于2016年从能源未来控股公司的破产中脱颖而出,成为一家独立的实体。它于2018年收购了戴尼基。

Current Position of Vistra

瑞致达目前的立场

- With a trading volume of 1,581,753, the price of VST is up by 2.92%, reaching $145.65.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 77 days from now.

- vST的交易量为1,581,753美元,上涨了2.92%,达到145.65美元。

- 当前的RSI值表明该股可能接近超买。

- 下一份收益报告定于即日起77天后发布。

What The Experts Say On Vistra

专家对瑞致达的看法

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $169.0.

在过去的一个月中,1位行业分析师分享了他们对该股的见解,提出平均目标价为169.0美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Vistra, targeting a price of $169.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处查看。* 摩根士丹利的一位分析师维持其立场,继续维持瑞致达的增持评级,目标价为169美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过每天进行自我教育、扩大交易规模、遵循多个指标以及密切关注市场来管理这种风险。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $155.0 for Vistra, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $125.0 and $155.0 for Vistra, spanning the last three months.