Axiata Targeting The Enterprise Segment In Indonesia

Axiata Targeting The Enterprise Segment In Indonesia

On account of XL Axiata's merger with Smartfren to form XLSmart via a share-based transaction, analysts have maintained their OUTPERFORM call for Axiata Group Bhd and has kept the target price at RM2.60 which awards an upside of 24 sen (nearly 10%) over market valuation, according to a research note dated Dec 12 published by Kenanga Investment Bank Bhd (Kenanga Research).

肯南加投资银行有限公司(Kenanga Research)于12月12日发布的一份研究报告显示,由于XL Axiata与Smartfren合并,通过股票交易组建了XLSmart,分析师维持了对Axiata集团有限公司的跑赢大盘的期望,并将目标价格维持在2.60令吉,比市场估值高出24先令(近10%)。

As at 10:20am Dec 12, Axiata's stock traded at RM2.36. (Stock updates from Bursa Malaysia)

截至12月12日上午10点20分,Axiata的股票交易价格为2.36令吉。(来自马来西亚证券交易所的最新股票)

The merger deal involves Axiata's 66.5%-owned Indonesian mobile operation XL Axiata and Sinar Mas Group's 77.5%-owned Smartfren, which is practically the sole owner of Indonesia's Smart Telecom, to create a new entity called PT XLSmart Telecom Sejahtera, or simply XLSmart. (Sinar Mas also written as sinarmas at times)

合并协议涉及Axiata拥有66.5%股权的印度尼西亚移动运营公司XL Axiata和Sinar Mas Group持有77.5%股权的Smartfren(实际上是印度尼西亚智能电信的唯一所有者),旨在创建一家名为Pt XLSmart Telecom Sejahtera的新实体,简称XLSmart。(Sinar Mas 有时也写成 sinarmas)

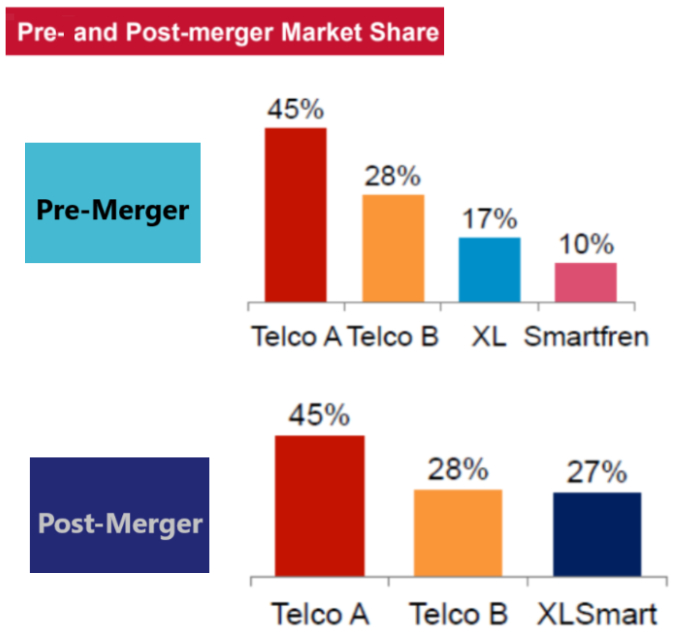

XLSmart will serve a combined mobile subscriber base of around 94.5 million representing around 27% of local market share, making XLSmart the third-largest mobile operator in Indonesia, behind Indosat and Telkomsel.

XLSmart将为总共约9450万的移动用户群提供服务,约占当地市场份额的27%,使XLSmart成为仅次于Indosat和Telkomsel的印度尼西亚第三大移动运营商。

This transaction is expected to be completed by the second quarter of 2025 after securing approvals from regulators, Indonesia's Financial Services Authority and Ministry of Communication and Digital Affairs, as well as shareholders.

在获得监管机构、印度尼西亚金融服务管理局和通信与数字事务部以及股东的批准后,该交易预计将于2025年第二季度完成。

Post-merger, XL Axiata, the surviving entity of the merger, will see its spectrum holdings expanded with the addition of Smartfren's 62MHz of spectrum, resulting in XLSmart's total spectrum holdings of 152MHz. This will position XLSmart as the operator with the second-largest spectrum holdings in Indonesia. Analysts believe that the spectrum factor is the primary driver of the merger.

合并后,合并中幸存的实体XL Axiata将增加Smartfren的62MHz频谱,从而扩大其频谱持有量,从而使XLSmart的总频谱持有量达到152MHz。这将使XLSmart成为印度尼西亚拥有第二大频谱的运营商。分析师认为,频谱因素是合并的主要驱动力。

Upon full integration, XLSmart is expected to realise annual pre-tax synergies of US$300 million to US$400 million, stemming from economies of scale, cost savings and efficiency gains in opex (operating expenditure), capex (capital expenditure) and leases.

全面整合后,XLSmart预计每年将实现3亿至4亿美元的税前协同效应,这要归因于规模经济、成本节约和运营支出(运营支出)、资本支出(资本支出)和租赁方面的效率提高。

Key initiatives to drive these synergies include the decommission of 20%−30% of overlapping sites within XLSmart's network

footprint of 67K sites, selective network expansion in targeted cities with a focus on profitability, leveraged volume and price

book matching to attain best prices from vendors, and finally, direct dealing with retailers and optimised incentive structure.

推动这些协同作用的关键举措包括停用XLSmart网络中20%至30%的重叠站点

占地面积为6.7万个站点,在目标城市进行选择性网络扩张,重点是盈利能力、杠杆数量和价格

进行图书配对以从供应商那里获得最优惠的价格,最后,直接与零售商打交道并优化激励结构。

However, Smartfren's financial health could be a concern. Despite achieving positive earnings before tax in the third quarter of financial year 2024, Smartfren reported year-to-date (up to nine months) losses after tax amounting to IDR1 trillion (~RM294 million).

但是,Smartfren的财务状况可能令人担忧。尽管在2024财年第三季度实现了正税前收益,但Smartfren报告称,年初至今(最多九个月)的税后亏损为1万亿印尼盾(约29400万令吉)。

Axiata plans to capitalise on Sinar Mas's extensive local market expertise, given its position as one of Indonesia's largest conglomerates with a diverse business portfolio involving pulp & paper, agri-business & food, financial services, real estate, communications & technology, energy & infrastructure, and healthcare.

鉴于Sinar Mas是印度尼西亚最大的企业集团之一,拥有多元化的业务组合,涉及纸浆和造纸、农业企业和食品、金融服务、房地产、通信和技术、能源和基础设施以及医疗保健,Axiata计划利用其丰富的本地市场专业知识。

In particular, Axiata is optimistic about leveraging Sinar Mas' data centres to position XLSmart as the preferred Indonesian enterprise service provider by offering end-to-end enterprise solutions, according to Kenanga Research.

特别是,根据Kenanga Research的数据,Axiata对利用Sinar Mas的数据中心通过提供端到端的企业解决方案将XLSmart定位为印度尼西亚首选的企业服务提供商持乐观态度。

XLSmart will serve a combined mobile subscriber base of around 94.5 million representing around 27% of local market share, making XLSmart the third-largest mobile operator in Indonesia, behind Indosat and Telkomsel.

XLSmart will serve a combined mobile subscriber base of around 94.5 million representing around 27% of local market share, making XLSmart the third-largest mobile operator in Indonesia, behind Indosat and Telkomsel.