Microsoft Unusual Options Activity For December 12

Microsoft Unusual Options Activity For December 12

Financial giants have made a conspicuous bearish move on Microsoft. Our analysis of options history for Microsoft (NASDAQ:MSFT) revealed 30 unusual trades.

金融巨头对微软采取了明显的看跌举动。我们对微软(纳斯达克股票代码:MSFT)期权历史的分析显示了30笔不寻常的交易。

Delving into the details, we found 33% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $64,618, and 28 were calls, valued at $1,143,396.

深入研究细节,我们发现33%的交易者看涨,而46%的交易者表现出看跌趋势。在我们发现的所有交易中,有2笔是看跌期权,价值64,618美元,28笔是看涨期权,价值1,143,396美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $445.0 to $465.0 for Microsoft over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将微软的价格定在445.0美元至465.0美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是对股票进行尽职调查的一种有见地的方式。

This data can help you track the liquidity and interest for Microsoft's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下微软期权的流动性和利息。

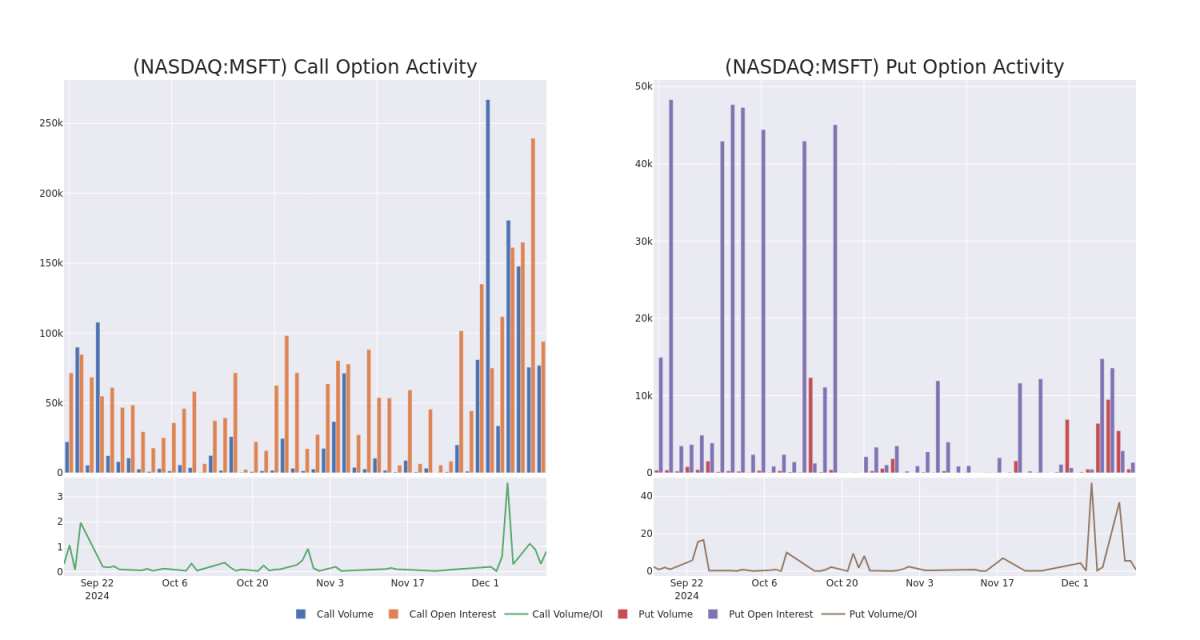

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Microsoft's whale activity within a strike price range from $445.0 to $465.0 in the last 30 days.

下面,我们可以观察过去30天中微软所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化,其行使价在445.0美元至465.0美元之间。

Microsoft Call and Put Volume: 30-Day Overview

微软看涨期权和看跌期权交易量:30 天概述

Significant Options Trades Detected:

检测到的重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | CALL | SWEEP | BULLISH | 12/13/24 | $4.95 | $4.6 | $4.79 | $447.50 | $96.5K | 2.3K | 264 |

| MSFT | CALL | SWEEP | BEARISH | 12/27/24 | $2.31 | $2.3 | $2.31 | $465.00 | $66.7K | 21.1K | 1.4K |

| MSFT | CALL | SWEEP | BEARISH | 12/13/24 | $2.67 | $2.58 | $2.67 | $452.50 | $60.4K | 2.7K | 2.8K |

| MSFT | CALL | SWEEP | BEARISH | 12/13/24 | $6.15 | $5.7 | $5.7 | $447.50 | $57.0K | 2.3K | 956 |

| MSFT | CALL | SWEEP | BULLISH | 07/18/25 | $32.5 | $32.2 | $32.5 | $465.00 | $55.2K | 28 | 20 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | 打电话 | 扫 | 看涨 | 12/13/24 | 4.95 美元 | 4.6 美元 | 4.79 美元 | 447.50 美元 | 96.5 万美元 | 2.3K | 264 |

| MSFT | 打电话 | 扫 | 粗鲁的 | 12/27/24 | 2.31 美元 | 2.3 美元 | 2.31 美元 | 465.00 美元 | 66.7 万美元 | 21.1 K | 1.4K |

| MSFT | 打电话 | 扫 | 粗鲁的 | 12/13/24 | 2.67 美元 | 2.58 美元 | 2.67 美元 | 452.50 美元 | 60.4 万美元 | 2.7K | 2.8K |

| MSFT | 打电话 | 扫 | 粗鲁的 | 12/13/24 | 6.15 美元 | 5.7 美元 | 5.7 美元 | 447.50 美元 | 57.0 万美元 | 2.3K | 956 |

| MSFT | 打电话 | 扫 | 看涨 | 07/18/25 | 32.5 美元 | 32.2 美元 | 32.5 美元 | 465.00 美元 | 55.2 万美元 | 28 | 20 |

About Microsoft

关于微软

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

微软开发和许可消费者和企业软件。它以其Windows操作系统和办公生产力套件而闻名。该公司分为三个规模相等的细分市场:生产力和业务流程(传统的微软Office、基于云的Office 365、Exchange、SharePoint、Skype、LinkedIn、Dynamics)、情报云(基础架构和平台即服务产品Azure、Windows Server操作系统、SQL Server)以及更多个人计算(Windows客户端、Xbox、必应搜索、显示广告以及Surface笔记本电脑、平板电脑和台式机)。

Following our analysis of the options activities associated with Microsoft, we pivot to a closer look at the company's own performance.

在分析了与微软相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Where Is Microsoft Standing Right Now?

微软现在的立场在哪里?

- With a volume of 1,309,255, the price of MSFT is up 0.68% at $452.05.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 47 days.

- mSFT的交易量为1,309,255美元,上涨0.68%,至452.05美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在47天后公布。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处访问。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过每天进行自我教育、扩大交易规模、遵循多个指标以及密切关注市场来管理这种风险。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.