Netflix Surges Past $900. Is Stock Split On The Cards? Analyst Says Such Move 'Wouldn't Surprise Us'

Netflix Surges Past $900. Is Stock Split On The Cards? Analyst Says Such Move 'Wouldn't Surprise Us'

Netflix Inc. (NASDAQ:NFLX) has witnessed its stock price soar beyond $900, sparking speculation about a potential stock split. This surge aligns with a broader market rally, particularly in Big Tech, driven by advancements in AI software and chips.

奈飞公司(纳斯达克:NFLX)的股价已超过$900,激发了对可能拆股的猜测。此次上涨与整体市场反弹一致,特别是在大型科技股中,受到人工智能软件和芯片进展的推动。

What Happened: Netflix's shares have increased more than fivefold since hitting a low in 2022. The S&P 500 has risen 70% since the bear market bottomed in October 2022. Companies like Nvidia Corp. (NASDAQ:NVDA) and Deckers Outdoor Corp. (NYSE:DECK) have already executed stock splits this year, Barron's reported on Friday.

发生了什么:自2022年触及低点以来,奈飞的股价已上涨超过五倍。S&P 500自2022年10月熊市触底以来上涨了70%。像英伟达公司(纳斯达克:NVDA)和Deckers户外公司(纽交所:DECK)这样的公司已经在今年进行了拆股,并且《巴伦周刊》在星期五报道了这一消息。

Ken Mahoney of Mahoney Asset Management commented, "Once stocks are worth way into the high hundreds of dollars per share range, a lot of people get in their mind that a stock split could be coming."

Mahoney资产管理公司的肯·马霍尼评论道:“一旦股票价格达到每股高几百美元的区间,很多人就会想到可能要拆股。”

"It wouldn't surprise us if Netflix followed suit within the next few announcing earnings."

“如果奈飞在接下来的几个财报发布前效仿,我们并不会感到惊讶。”

A stock split can attract more investors by making shares more affordable, potentially boosting market value.

拆股可以吸引更多投资者,因为这会让股票变得更具可负担性,可能会提升市场价值。

Netflix has yet to respond to Benzinga's queries.

奈飞尚未回应Benzinga的查询。

Netflix's growth, particularly outside the U.S., and increased profit margins have contributed to its rising stock price. Analysts anticipate further revenue growth through higher international subscription prices and advertising. However, Netflix's high valuation could deter some investors if earnings expectations are not met.

奈飞的增长,尤其是在美国以外地区,以及利润率的提高,推动了其股价的上涨。分析师预计,通过提高国际订阅价格和广告收入,营业收入将进一步增长。然而,奈飞的高估值可能会使一些投资者望而却步,尤其是在未能达到盈利预期的情况下。

Why It Matters: The recent surge in Netflix's stock price is not an isolated event. Jim Cramer recently expressed strong buying conviction for Netflix as its shares traded near $934. This comes amid broader tech market strength and a recommendation from JPMorgan analyst Doug Anmuth, who raised his price target on Netflix to $1,010 from $850. Anmuth cited robust subscriber growth and expanding ad revenue as key factors.

为什么这很重要:奈飞股价的近期激增并非孤立事件。吉姆·克雷默最近对奈飞表达了强烈的买入信心,因其股价接近$934。这恰逢更广泛的科技市场强劲,以及摩根大通的分析师道格·安穆斯提高了对奈飞的目标价,从$850上调至$1,010。安穆斯指出,强劲的用户增长和不断扩大的广告收入是关键因素。

Netflix's recent milestone, the Jake Paul vs. Mike Tyson boxing match, became the most-streamed sporting event ever, with 60 million households watching live. This achievement underscores the platform's growing influence in the streaming industry and its ability to attract a massive audience.

奈飞最近的里程碑,杰克·保罗与迈克·泰森的拳击比赛,成为了有史以来观看次数最多的体育赛事,6000万家庭现场观看。这一成就凸显了奈飞在流媒体行业日益增长的影响力和吸引大量观众的能力。

Price Action: According to Benzinga Pro, Netflix was trading slightly higher at $204.60 on Friday during pre-market hours after previously closing at $203.68.

价格动态:根据Benzinga Pro的消息,奈飞在周五盘前交易中略微上涨至204.60美元,此前收盘价为203.68美元。

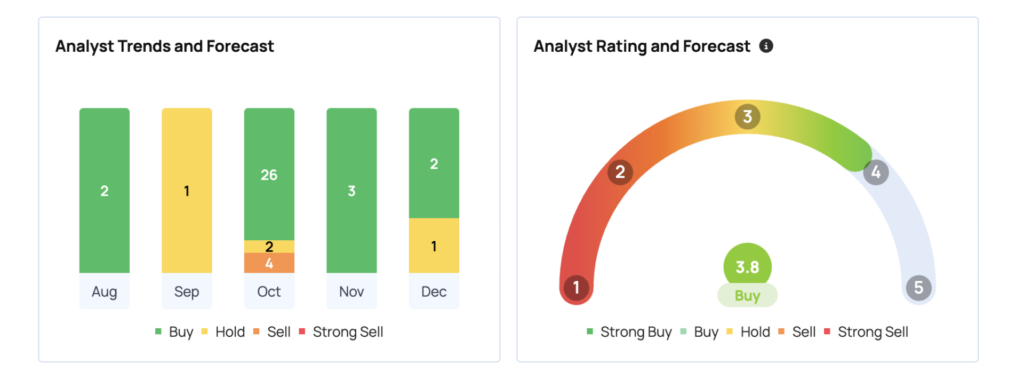

Meanwhile, as per the three most-recent analyst ratings, released by JP Morgan, Citigroup, and Canaccord Genuity the average price target of Netflix is $956.67, with an implied 3.48% upside for the company.

与此同时,根据摩根大通、花旗集团和CAN发布的三项最新分析师评级,奈飞的平均目标价为956.67美元,意味着该公司的潜在上涨空间为3.48%。

- Dogecoin Can Touch $18 If Things 'Go Wild,' Says Influential Crypto Trader: 'Thankful For The Dip And Will Buy More'

- 如果情况“火爆”,狗狗币可能达到$18,影响力加密交易员表示:“感谢下跌,会买更多。”

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

免责声明:此内容部分由Benzinga Neuro生成,并由Benzinga编辑审核和发布。

Image via Pixabay

图片来自 Pixabay

"It wouldn't surprise us if Netflix followed suit within the next few announcing earnings."

"It wouldn't surprise us if Netflix followed suit within the next few announcing earnings."