DraftKings's Options: A Look at What the Big Money Is Thinking

DraftKings's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on DraftKings.

资金雄厚的鲸鱼对DraftKings采取了明显的看好态度。

Looking at options history for DraftKings (NASDAQ:DKNG) we detected 9 trades.

查看DraftKings(纳斯达克:DKNG)的期权历史,我们发现了9笔交易。

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 44% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,44%的投资者以看涨预期开盘交易,44%以看跌预期开盘。

From the overall spotted trades, 5 are puts, for a total amount of $283,106 and 4, calls, for a total amount of $202,619.

在所有发现的交易中,有5笔为看跌,总金额为$283,106,4笔为看涨,总金额为$202,619。

What's The Price Target?

价格目标是什么?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $39.0 and $50.0 for DraftKings, spanning the last three months.

经过评估交易量和未平仓合约,可以明显看出主要市场推动者在DraftKings的价格区间集中在$39.0到$50.0,覆盖了过去三个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

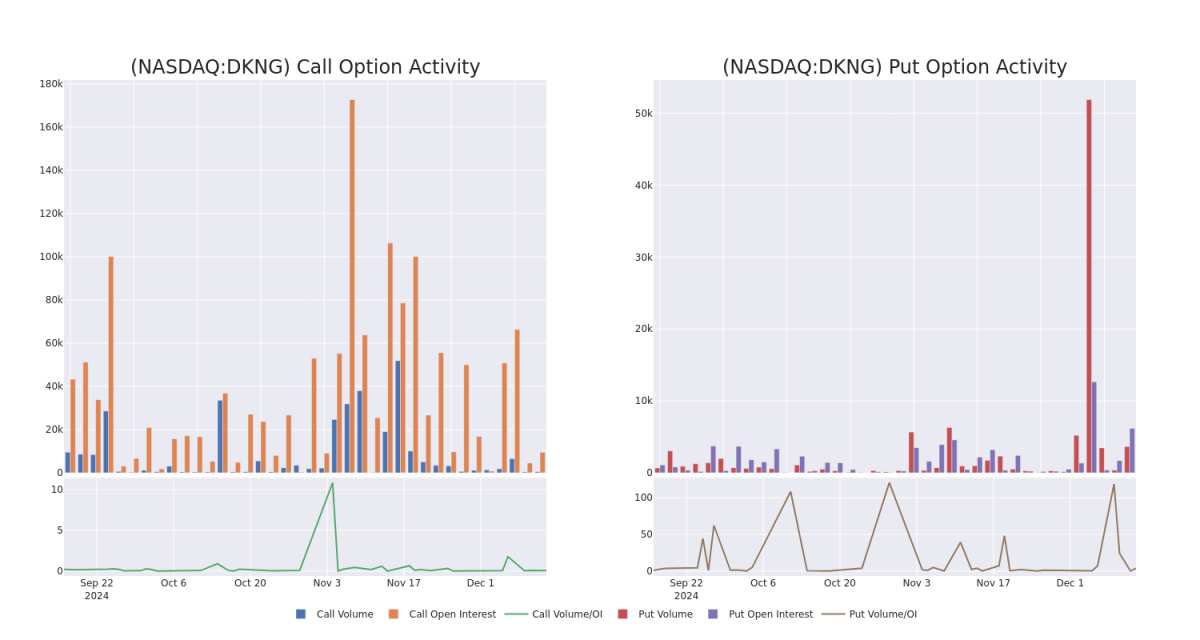

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in DraftKings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to DraftKings's substantial trades, within a strike price spectrum from $39.0 to $50.0 over the preceding 30 days.

评估成交量和未平仓合约是进行期权交易的战略步骤。这些指标揭示了投资者对DraftKings特定执行价格的期权的流动性和兴趣。接下来的数据可视化显示了在过去30天内与DraftKings的大额交易相关的看涨和看跌的交易量及未平仓合约的波动,执行价格范围为$39.0到$50.0。

DraftKings Option Activity Analysis: Last 30 Days

DraftKings期权异动分析:过去30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DKNG | PUT | TRADE | BEARISH | 12/20/24 | $1.25 | $1.0 | $1.15 | $40.50 | $123.7K | 556 | 1.6K |

| DKNG | CALL | SWEEP | BEARISH | 05/16/25 | $5.0 | $4.9 | $4.9 | $42.00 | $93.1K | 240 | 190 |

| DKNG | PUT | SWEEP | BULLISH | 03/21/25 | $10.05 | $9.95 | $9.95 | $50.00 | $56.7K | 487 | 57 |

| DKNG | CALL | TRADE | BULLISH | 01/16/26 | $5.0 | $4.8 | $5.0 | $50.00 | $50.0K | 5.2K | 107 |

| DKNG | PUT | SWEEP | BEARISH | 12/20/24 | $1.25 | $1.13 | $1.25 | $41.00 | $39.8K | 2.6K | 842 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DKNG | 看跌 | 交易 | 看淡 | 12/20/24 | $1.25 | $1.0 | $1.15 | $40.50 | $123.7K | 556 | 1.6K |

| DKNG | 看涨 | 扫单 | 看淡 | 05/16/25 | $5.0 | $4.9 | $4.9 | $42.00 | $93.1K | 240 | 190 |

| DKNG | 看跌 | 扫单 | 看好 | 03/21/25 | $10.05 | $9.95 | $9.95 | $50.00 | $56.7K | 487 | 57 |

| DKNG | 看涨 | 交易 | 看好 | 01/16/26 | $5.0 | $4.8 | $5.0 | $50.00 | 50,000美元 | 5200 | 107 |

| DKNG | 看跌 | 扫单 | 看淡 | 12/20/24 | $1.25 | $1.13 | $1.25 | $41.00 | $39.8K | 2.6千 | 842 |

About DraftKings

关于DraftKings

DraftKings got its start in 2012 as an innovator in daily fantasy sports. Then, following a Supreme Court ruling in 2018 that allowed states to legalize online sports wagering, the company expanded into online sports and casino gambling, where it generally holds the number two or three revenue share position across states in which it competes. DraftKings is now live with online or retail sports betting in about 30 states and iGaming in seven states, with both products available to around 40% of Canada's population. The company also operates a non-fungible token commissioned-based marketplace and develops and licenses online gaming products.

DraftKings于2012年作为日常幻想体育的创新者开始发展。然后,在2018年最高法院裁决允许各州合法化在线体育博彩后,该公司扩展到了在线体育和赌场博彩,在其竞争的各州中,一般保持着营业收入的第二或第三位置。DraftKings目前在大约30个州提供在线或零售体育博彩,在七个州提供iGaming,两个产品的服务覆盖了大约40%的加拿大人口。该公司还运营一个基于非同质化代币的市场,并开发和授权在线游戏产品。

In light of the recent options history for DraftKings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到DraftKings最近的期权历史,现在适合关注这家公司本身。我们旨在探讨其当前的表现。

Present Market Standing of DraftKings

DraftKings的当前市场地位

- Currently trading with a volume of 2,021,612, the DKNG's price is down by -2.04%, now at $40.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 62 days.

- 目前成交量为2,021,612的DKNG股价下跌了-2.04%,现价为$40.62。

- RSI读数表明该股票目前可能接近超买状态。

- 预计盈利发布将在62天后进行。

What The Experts Say On DraftKings

专家对DraftKings的看法

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $53.0.

在过去一个月中,1位行业分析师对这只股票分享了他们的见解,提出了53.0美元的平均目标价。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for DraftKings, targeting a price of $53.

Benzinga Edge的期权异动板块在潜在市场驱动因素发生之前就能发现。查看大资金对你喜欢的股票的持仓。点击这里以获取访问权限。* 一位来自摩根大通的分析师坚持其观点,继续对DraftKings维持增持评级,目标价为53美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DraftKings options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断学习、调整策略、监控多个因子及密切关注市场动向来管理这些风险。通过Benzinga Pro获取实时警报,随时了解最新的DraftKings期权交易。

From the overall spotted trades, 5 are puts, for a total amount of $283,106 and 4, calls, for a total amount of $202,619.

From the overall spotted trades, 5 are puts, for a total amount of $283,106 and 4, calls, for a total amount of $202,619.