Snowflake AI Revolution Gains Traction, Stock Forms Golden Cross

Snowflake AI Revolution Gains Traction, Stock Forms Golden Cross

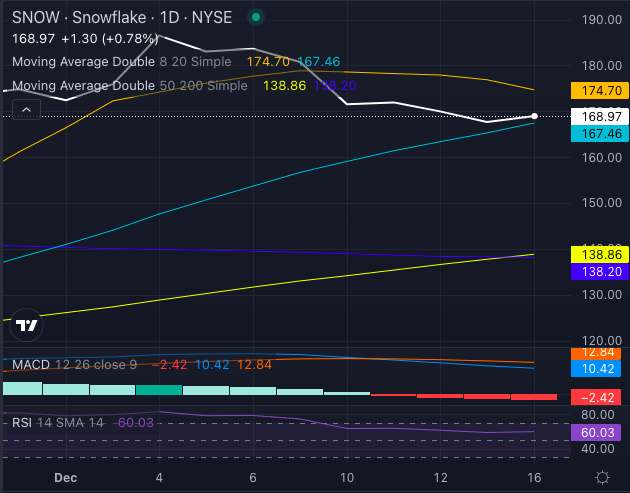

Snowflake Inc. (NYSE:SNOW) is turning heads in the market with its recently formed a Golden Cross — a bullish technical pattern where the 50-day moving average crosses above the 200-day moving average.

Snowflake Inc. (纽交所:SNOW) 在市场上引起了关注,因为其最近形成了一个黄金交叉——一种看好的技术形态,其中50日移动平均线突破200日移动平均线。

Chart created using Benzinga Pro

图表使用Benzinga Pro创建

At $168.97, the stock price reflects strong momentum, sitting well above both the 50-day SMA (simple moving average) of $138.86 and the 200-day SMA of $138.20.

在168.97美元的股价上,反映出强劲的动能,远高于50日SMA(简单移动平均线)的138.86美元和200日SMA的138.20美元。

The MACD (moving average convergence/divergence) indicator stands at a bullish 10.42, reinforcing the stock's upward trajectory.

MACD(移动平均收敛/发散)指标为10.42,显示看好的信号,进一步巩固了股票的上升轨迹。

However, short-term signals present a mixed bag. The eight-day SMA of $174.70 suggests some selling pressure, while the 20-day SMA at $167.46 aligns with a bullish signal, hinting at near-term consolidation.

然而,短期信号呈现出混合的局面。八日SMA为174.70美元,暗示出一些卖压,而20日SMA为167.46美元与看好的信号一致,提示近期可能会整合。

With an RSI (relative strength index) of 60.03, Snowflake stays in neutral territory, leaving room for further upward movement.

随着相对强弱指数(RSI)为60.03,Snowflake保持在中立区域,仍有进一步上升的空间。

Read Also: Snowflake, Elastic Poised For AI Revolution Gains, Analyst Upgrades The Stocks

另请阅读:Snowflake、Elastic即将迎来人工智能革命红利,分析师上调了这些股票的评级。

Snowflake's AI Advantage

Snowflake的人工智能优势

Jefferies has raised its price target to $200, naming Snowflake a top AI pick for 2025, reported Investing. The firm cites Snowflake's emphasis on AI product development as a key driver for future revenue and backlog growth.

Jefferies将目标价提高至200美元,并将Snowflake列为2025年的顶级人工智能选择,报道了Investing。该公司指出,Snowflake对人工智能产品开发的重视是未来营业收入和订单积压增长的关键驱动因素。

The company's strong fundamentals, including a 30.28% revenue growth rate and a 67.33% gross profit margin, underscore its potential.

公司的强劲基本面,包括30.28%的营业收入增长率和67.33%的毛利润率,突显了其潜力。

Other analysts are equally bullish. KeyBanc recently set a $210 price target, and Citi raised its bar to $225, following what it called a "redemption quarter" for the company.

其他分析师同样看好。KeyBanc最近设定了210美元的目标价,而花旗将其目标价提高至225美元,称之为公司的一次"救赎季度"。

Both firms highlight Snowflake's ability to capitalize on the surging demand for data and AI-driven solutions, aligning with the broader industry shift toward digital transformation.

两家公司都强调Snowflake能够利用对数据和人工智能驱动解决方案日益增长的需求,与更广泛的行业板块向数字化转型的转变相一致。

Snowflake Poised For Long-Term Growth

Snowflake为长期增长做好准备

With a Golden Cross signaling bullish momentum and Wall Street analysts stacking the deck in its favor, Snowflake appears poised for long-term growth.

随着金叉信号显示看好的动能,华尔街分析师也助其一臂之力,Snowflake似乎为长期增长做好了准备。

The fusion of strong technicals and AI-fueled optimism cements Snowflake's position as a leader in the evolving data landscape.

强劲的技术指标与人工智能驱动的乐观情绪融合,巩固了Snowflake在不断演变的数据领域中的领先地位。

- SoundHound AI Soars Over 700%: Short Squeeze Potential Has Traders Talking

- SoundHound人工智能上涨超过700%:开空挤压潜力引发交易者热议

Image: Shutterstock

图片:shutterstock

The MACD (moving average convergence/divergence) indicator stands at a bullish 10.42, reinforcing the stock's upward trajectory.

The MACD (moving average convergence/divergence) indicator stands at a bullish 10.42, reinforcing the stock's upward trajectory.