Individual Investors Invested in Singapore Post Limited (SGX:S08) Copped the Brunt of Last Week's S$68m Market Cap Decline

Individual Investors Invested in Singapore Post Limited (SGX:S08) Copped the Brunt of Last Week's S$68m Market Cap Decline

Key Insights

关键见解

- Significant control over Singapore Post by individual investors implies that the general public has more power to influence management and governance-related decisions

- The top 25 shareholders own 43% of the company

- Analyst forecasts along with ownership data serve to give a strong idea about prospects for a business

- 个人投资者对新加坡邮政的重大控制意味着公众拥有更大的影响管理和治理相关决策的权力

- 前 25 名股东拥有公司 43% 的股份

- 分析师的预测以及所有权数据可以让人们对企业前景有一个深刻的了解

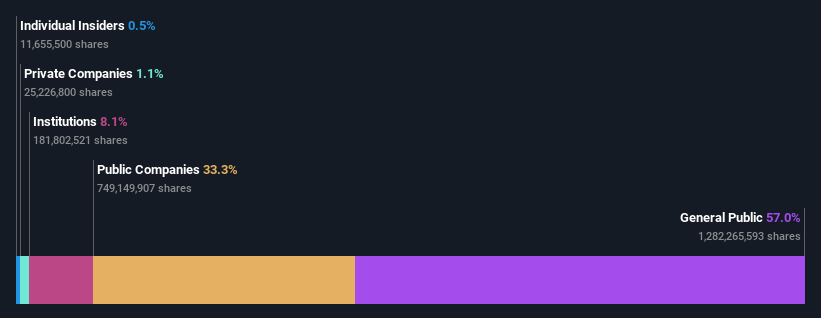

Every investor in Singapore Post Limited (SGX:S08) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 57% to be precise, is individual investors. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

新加坡邮政有限公司(SGX: S08)的每位投资者都应该了解最强大的股东群体。持有公司股份最多的集团是个人投资者,准确地说约为57%。也就是说,如果股票上涨,该集团将受益最大(如果出现低迷,则损失最大)。

As market cap fell to S$1.3b last week, individual investors would have faced the highest losses than any other shareholder groups of the company.

随着上周市值跌至13亿新元,个人投资者面临的损失将超过该公司任何其他股东群体。

In the chart below, we zoom in on the different ownership groups of Singapore Post.

在下图中,我们放大了新加坡邮政的不同所有权群体。

What Does The Institutional Ownership Tell Us About Singapore Post?

关于新加坡邮政,机构所有权告诉我们什么?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

机构在向自己的投资者报告时通常会根据基准来衡量自己,因此,一旦股票被纳入主要指数,他们通常会变得更加热情。我们预计大多数公司都会注册一些机构,尤其是在它们成长的情况下。

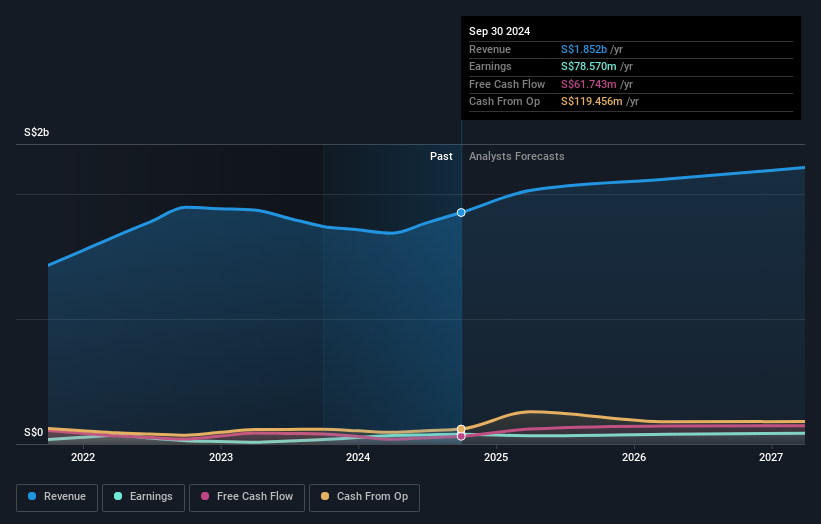

Singapore Post already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Singapore Post's historic earnings and revenue below, but keep in mind there's always more to the story.

新加坡邮政已经在股票登记处设立了机构。事实上,他们拥有该公司可观的股份。这可能表明该公司在投资界具有一定程度的信誉。但是,最好谨慎地依赖机构投资者所谓的验证。他们有时也会弄错。当多家机构拥有一只股票时,总是存在处于 “拥挤交易” 的风险。当这样的交易出错时,多方可能会竞相快速出售股票。对于没有增长历史的公司,这种风险更高。你可以在下面看到新加坡邮政的历史收益和收入,但请记住,故事总是有更多内容。

Singapore Post is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is Singapore Telecommunications Limited with 22% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 11% and 2.5%, of the shares outstanding, respectively.

新加坡邮政不归对冲基金所有。从我们的数据来看,我们可以看到最大股东是新加坡电信有限公司,已发行股份的22%。同时,第二和第三大股东分别持有已发行股份的11%和2.5%。

A deeper look at our ownership data shows that the top 25 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

深入研究我们的所有权数据后发现,前25名股东共持有不到一半的股份,这表明在很大一部分小股东中,没有一个单一股东占多数。

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

研究机构所有权是衡量和筛选股票预期表现的好方法。通过研究分析师的情绪也可以实现同样的目标。有不少分析师报道了该股,因此您可以很容易地研究预测的增长。

Insider Ownership Of Singapore Post

新加坡邮政的内部所有权

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

不同国家对内部人士的定义可能略有不同,但董事会成员总是计算在内。公司管理层对董事会的回答,董事会应代表股东的利益。值得注意的是,有时高层管理人员自己也在董事会中。

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

大多数人认为内部所有权是积极的,因为这可能表明董事会与其他股东的关系良好。但是,在某些情况下,过多的权力集中在该群体中。

Our data suggests that insiders own under 1% of Singapore Post Limited in their own names. But they may have an indirect interest through a corporate structure that we haven't picked up on. It seems the board members have no more than S$6.5m worth of shares in the S$1.3b company. Many tend to prefer to see a board with bigger shareholdings. A good next step might be to take a look at this free summary of insider buying and selling.

我们的数据表明,内部人士以自己的名义拥有新加坡邮政有限公司不到1%的股份。但是,他们可能会通过我们尚未采用的公司结构获得间接利益。看来董事会成员在这家13亿新元的公司中持有的股份不超过650万新元。许多人倾向于看到一个拥有更多股权的董事会。一个不错的下一步可能是看看这份免费的内幕买入和卖出摘要。

General Public Ownership

普通公有制

The general public, who are usually individual investors, hold a substantial 57% stake in Singapore Post, suggesting it is a fairly popular stock. With this amount of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to vote on acquisitions or mergers that may not improve profitability.

公众通常是个人投资者,持有新加坡邮政57%的大量股份,这表明它是一只相当受欢迎的股票。有了这么多的所有权,散户投资者可以在影响股东回报的决策中共同发挥作用,例如股息政策和董事任命。他们还可以对可能不会提高盈利能力的收购或合并行使投票权。

Public Company Ownership

上市公司所有权

Public companies currently own 33% of Singapore Post stock. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

上市公司目前拥有新加坡邮政33%的股票。这可能是战略利益,两家公司可能有相关的商业利益。可能是他们已经消失了。这一裁定可能值得进一步调查。

Next Steps:

后续步骤:

It's always worth thinking about the different groups who own shares in a company. But to understand Singapore Post better, we need to consider many other factors. For instance, we've identified 1 warning sign for Singapore Post that you should be aware of.

拥有公司股份的不同群体总是值得考虑的。但是,为了更好地了解新加坡邮政,我们需要考虑许多其他因素。例如,我们已经为新加坡邮政确定了一个警告标志,你应该注意。

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

但归根结底,决定该业务所有者的表现的是未来,而不是过去。因此,我们认为最好看一下这份免费报告,该报告显示分析师是否在预测更光明的未来。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注意:本文中的数字是使用过去十二个月的数据计算得出的,这些数据是指截至财务报表日期当月最后日期的12个月期间。这可能与全年年度报告数据不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗?直接联系我们。或者,发送电子邮件给编辑组(网址为)simplywallst.com。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.