Investors Bid Ascletis Pharma (HKG:1672) up HK$455m Despite Increasing Losses YoY, Taking One-year Return to 50%

Investors Bid Ascletis Pharma (HKG:1672) up HK$455m Despite Increasing Losses YoY, Taking One-year Return to 50%

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Ascletis Pharma Inc. (HKG:1672) share price is up 50% in the last 1 year, clearly besting the market return of around 18% (not including dividends). So that should have shareholders smiling. Zooming out, the stock is actually down 15% in the last three years.

投资股票最简单的方法就是购买交易所交易基金。但通过选择表现优于平均水平的股票(作为多元化投资组合的一部分),人们可以做得更好。例如,Ascletis Pharma Inc.(HKG:1672)的股价在过去一年上涨了50%,明显高于市场回报的18%(不包括分红派息)。所以这应该让股东们开心。放眼看过去,这只股票在过去三年中实际上下跌了15%。

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

在强劲的7天表现的基础上,让我们来看看该公司基本面在推动长期股东回报中发挥了什么作用。

We don't think Ascletis Pharma's revenue of CN¥10,090,000 is enough to establish significant demand. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Ascletis Pharma comes up with a great new product, before it runs out of money.

我们认为Ascletis Pharma的营业收入为人民币10,090,000并不足以建立显著的需求。因此,投资者似乎更关注可能出现的情况,而不是关注当前的营业收入(或缺乏收入)。例如,他们可能希望Ascletis Pharma能够推出一款出色的新产品,在耗尽资金之前。

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

我们认为那些既没有显著营业收入也没有利润的公司风险相当高。几乎总是有可能需要筹集更多资金,而它们的进展和股价将决定这对当前持有者的稀释程度。虽然一些这样的公司最终会产生营业收入,利润,并创造价值,但其他公司则在希望的天真的投资者的炒作中走向破产。

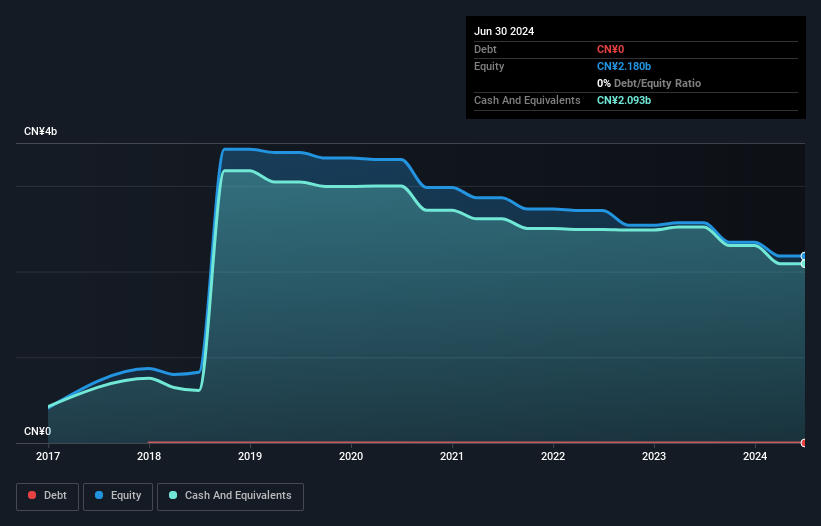

When it last reported its balance sheet in June 2024, Ascletis Pharma could boast a strong position, with cash in excess of all liabilities of CN¥2.0b. That allows management to focus on growing the business, and not worry too much about raising capital. And with the share price up 125% in the last year , the market is focussed on that blue sky potential. The image below shows how Ascletis Pharma's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

当它在2024年6月最后一次报告其资产负债表时,Ascletis Pharma可以自豪地说其现金超过了所有负债,达到人民币20亿。这使管理层能够专注于发展业务,而不必过于担心筹集资金。而且在过去一年中,股价上涨了125%,市场更关注这种蓝天潜力。下图显示了Ascletis Pharma的资产负债表如何随时间变化;如果您想查看具体的数值,只需点击图像。

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

实际上,在评估一个既没有营业收入也没有利润的业务时,很难有太多确定性。你可以做的一件事是检查公司内部人员是否在购买股票。如果他们有所购入,那通常是积极的信号,因为这可能表明他们看到了股票的价值。幸运的是,我们可以为您提供这一免费的内部购买(和出售)图表。

A Different Perspective

不同的视角

We're pleased to report that Ascletis Pharma shareholders have received a total shareholder return of 50% over one year. That certainly beats the loss of about 5% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Ascletis Pharma has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

我们很高兴地报告,Ascletis Pharma的股东在一年内获得了50%的总股东回报。这当然超过了过去五年每年约5%的损失。我们通常更重视长期业绩而非短期业绩,但最近的改善可能暗示业务中的一个(积极的)拐点。虽然考虑市场条件对股价的不同影响是非常值得的,但还有其他因素更为重要。例如风险——Ascletis Pharma有3个警告信号(还有1个我们觉得不太好的)我们认为你应该知道。

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

如果你喜欢与管理层一起买入股票,那么你可能会喜欢这个免费的公司名单。(提示:很多公司鲜为人知,而且估值吸引。)

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

请注意,本文中引用的市场回报反映了目前在香港交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.