Returns On Capital Signal Tricky Times Ahead For China National Electric Apparatus Research Institute (SHSE:688128)

Returns On Capital Signal Tricky Times Ahead For China National Electric Apparatus Research Institute (SHSE:688128)

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after briefly looking over the numbers, we don't think China National Electric Apparatus Research Institute (SHSE:688128) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

你知道有一些财务指标可以为潜在的多倍回报提供线索吗?通常,我们希望注意资本回报率(ROCE)不断增长的趋势,以及随之而来的资本投入基础的扩大。这向我们表明这是一台复利机器,能够不断将收益再投资于业务中并产生更高的回报。然而,在简单浏览了这些数字后,我们认为中国电力设备研究院(SHSE:688128)在未来的多倍回报潜力不大,但让我们看看原因。

What Is Return On Capital Employed (ROCE)?

什么是资本回报率(ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for China National Electric Apparatus Research Institute:

对于那些不知道的人来说,ROCE是衡量公司年均税前利润(其回报)与业务中所投入资本的比例。分析师用这个公式为中国电力设备研究院计算它:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

资本利用率 = 利息和税前利润(EBIT) ÷ (总资产 - 流动负债)

0.12 = CN¥403m ÷ (CN¥7.1b - CN¥3.8b) (Based on the trailing twelve months to September 2024).

0.12 = CN¥40300万 ÷ (CN¥71亿 - CN¥3.8b)(基于截至2024年9月的过去12个月)。

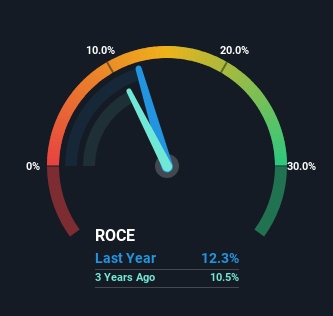

So, China National Electric Apparatus Research Institute has an ROCE of 12%. In absolute terms, that's a satisfactory return, but compared to the Electrical industry average of 5.8% it's much better.

因此,中国电力设备研究院的ROCE为12%。从绝对值来看,这是一个令人满意的回报,但与电气行业平均水平的5.8%相比,明显更好。

Above you can see how the current ROCE for China National Electric Apparatus Research Institute compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering China National Electric Apparatus Research Institute for free.

上面可以看到中国国家电气设备研究院当前的资本回报率与其过去的资本回报率的对比,但从过去的数据中你能了解到的内容是有限的。如果你愿意,可以免费查看覆盖中国国家电气设备研究院的分析师的预测。

So How Is China National Electric Apparatus Research Institute's ROCE Trending?

那么,中国国家电气设备研究院的资本回报率趋势如何呢?

When we looked at the ROCE trend at China National Electric Apparatus Research Institute, we didn't gain much confidence. To be more specific, ROCE has fallen from 16% over the last five years. On the other hand, the company has been employing more capital without a corresponding improvement in sales in the last year, which could suggest these investments are longer term plays. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

当我们查看中国国家电气设备研究院的资本回报率趋势时,并没有获得太多信心。具体来说,过去五年资本回报率已从16%下降。另一方面,公司在过去一年里投入了更多资本,但销售没有相应改善,这可能表明这些投资是长期的游戏。从这里开始,关注公司的盈利情况,看看这些投资是否最终对底线有所贡献是值得的。

On a separate but related note, it's important to know that China National Electric Apparatus Research Institute has a current liabilities to total assets ratio of 54%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

另外,与此相关的是,重要的是要知道中国国家电气设备研究院的流动负债与总资产比率为54%,我们认为这相当高。这实际上意味着供应商(或短期债权人)为业务的一大部分提供资金,因此需要注意这可能引入一些风险因素。理想情况下,我们希望看到这一比例降低,因为这将意味着较少的风险责任。

The Bottom Line On China National Electric Apparatus Research Institute's ROCE

中国国家电气设备研究院资本回报率的底线

To conclude, we've found that China National Electric Apparatus Research Institute is reinvesting in the business, but returns have been falling. And investors may be recognizing these trends since the stock has only returned a total of 19% to shareholders over the last five years. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

总结一下,我们发现中国国家电气设备研究院正在将资金再投资于业务,但回报却在下降。由于过去五年股票仅回报给股东19%,投资者可能已经意识到这些趋势。因此,如果你在寻找多倍收益的股票,基本趋势表明你可能在其他地方会有更好的机会。

China National Electric Apparatus Research Institute could be trading at an attractive price in other respects, so you might find our free intrinsic value estimation for 688128 on our platform quite valuable.

中国国家电器研究院在其他方面的交易价格可能具有吸引力,因此您可能会觉得我们平台上688128的免费内在价值估算相当有价值。

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

对于喜欢投资于稳健公司的投资者,可以查看这个免费的稳健资产负债表和高股本回报率公司的列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

0.12 = CN¥403m ÷ (CN¥7.1b - CN¥3.8b)

0.12 = CN¥403m ÷ (CN¥7.1b - CN¥3.8b)