Jim Cramer Signals Potential Bottom For Nvidia At $127 After Predicting 'Vicious' Reversal Earlier

Jim Cramer Signals Potential Bottom For Nvidia At $127 After Predicting 'Vicious' Reversal Earlier

CNBC's Jim Cramer suggested on Tuesday that NVIDIA Corp. (NASDAQ:NVDA) may have reached a key turning point after the stock touched $127, potentially signaling a bottom for the semiconductor giant's recent pullback.

CNBC的吉姆·克莱默周二表示,NVIDIA公司(纳斯达克股票代码:NVDA)在该股触及127美元后可能已经到了一个关键的转折点,这可能预示着这家半导体巨头最近的回调触底。

What Happened: "We may have hit a possible crescendo for Nvidia's stock when it hit the $127 mark. Could be a moment where everyone who wanted to sell did so," Cramer wrote on X, formerly Twitter. This marks a shift from his Monday warning when he predicted a "vicious" and "fast" reversal for the chipmaker.

发生了什么:“当Nvidia的股票触及127美元大关时,我们的股票可能已经上涨了。可能是所有想卖出的人都这样做的时刻。” 克莱默在X(前身为Twitter)上写道。这标志着他周一的警告发生了转变,当时他预测这家芯片制造商将出现 “恶性” 和 “快速” 的逆转。

We may have hit a possible crescendo for Nvidia's stock when it hit the $127 mark. Could be a moment where everyone who wanted to sell did so. Never know but it did seem do or die

— Jim Cramer (@jimcramer) December 17, 2024

当Nvidia的股票触及127美元大关时,我们的股票可能已经上涨了。可能是所有想卖出的人都这样做的时刻。从来不知道,但看来要么死

— 吉姆·克莱默 (@jimcramer) 2024 年 12 月 17 日

Nvidia shares closed Tuesday at $130.39, down 1.22%, before gaining 0.53% in after-hours trading. Despite recent volatility, the stock has maintained an impressive 170.69% gain year-to-date, largely fueled by artificial intelligence demand.

英伟达股价周二收于130.39美元,下跌1.22%,然后在盘后交易中上涨0.53%。尽管最近出现波动,但该股今年迄今仍保持了令人印象深刻的170.69%的涨幅,这主要是由人工智能需求推动的。

Why It Matters: The company's fundamental strength remains evident in its recent financial performance, with third-quarter revenue surging 94% year-over-year to $35.1 billion. Nvidia's market capitalization stands at $3.21 trillion, with a price-to-earnings ratio of 53.

为何重要:该公司的基本实力在最近的财务表现中仍然显而易见,第三季度收入同比增长94%,达到351亿美元。英伟达的市值为3.21万亿美元,市盈率为53。

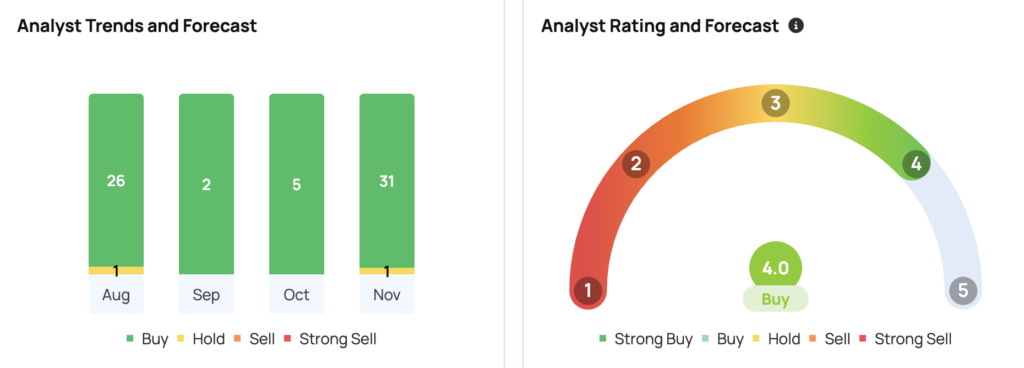

Wall Street maintains an optimistic outlook, with 40 analysts setting an average price target of $170.56. Rosenblatt Securities leads with the most bullish target of $220, while New Street Research sets a more conservative target of $120, according to Benzinga Pro data.

华尔街保持乐观的前景,40位分析师将平均目标股价设定为170.56美元。根据Benzinga Pro的数据,罗森布拉特证券以最看涨的目标为220美元,而新街研究将更为保守的目标设定为120美元。

- Bitcoin, Ethereum, Dogecoin Stay Muted Before Fed's Interest Rate Decision: Analyst Says BTC In Parabolic Phase, Reveals Its Duration

- 在美联储做出利率决定之前,比特币、以太坊、狗狗币保持沉默:分析师称比特币处于抛物线阶段,透露了其持续时间

Image Via Shutterstock

图片来自 Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免责声明:该内容部分是在人工智能工具的帮助下制作的,并由Benzinga编辑审查和发布。

Nvidia shares closed Tuesday at $130.39, down 1.22%, before gaining 0.53% in after-hours trading. Despite recent volatility, the stock has maintained an impressive 170.69% gain year-to-date, largely fueled by artificial intelligence demand.

Nvidia shares closed Tuesday at $130.39, down 1.22%, before gaining 0.53% in after-hours trading. Despite recent volatility, the stock has maintained an impressive 170.69% gain year-to-date, largely fueled by artificial intelligence demand.