Rigetti Computing Unusual Options Activity

Rigetti Computing Unusual Options Activity

High-rolling investors have positioned themselves bullish on Rigetti Computing (NASDAQ:RGTI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in RGTI often signals that someone has privileged information.

高风险投资者在 Rigetti Computing(纳斯达克:RGTI)上采取了看好的立场,这对散户交易者来说很重要。\ 今天,我们通过 Benzinga 对公开可用的期权数据的追踪注意到了这一活动。这些投资者的身份尚不清楚,但在 RGTI 上如此重大的举动通常表明有人掌握了内部信息。

Today, Benzinga's options scanner spotted 10 options trades for Rigetti Computing. This is not a typical pattern.

今天,Benzinga 的期权扫描仪发现了 10 笔 Rigetti Computing 的期权交易。这并不是一个典型的模式。

The sentiment among these major traders is split, with 60% bullish and 30% bearish. Among all the options we identified, there was one put, amounting to $27,000, and 9 calls, totaling $552,112.

这些主要交易者的情绪分歧,与 60% 的看好和 30% 的看淡相符。在我们识别的所有期权中,有一笔看跌,金额为 27,000 美元,以及 9 笔看涨,总计 552,112 美元。

What's The Price Target?

价格目标是什么?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $15.0 for Rigetti Computing during the past quarter.

分析这些合约的成交量和未平仓合约,似乎大玩家在过去一个季度关注 Rigetti Computing 的价格区间为 7.5 美元至 15.0 美元。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

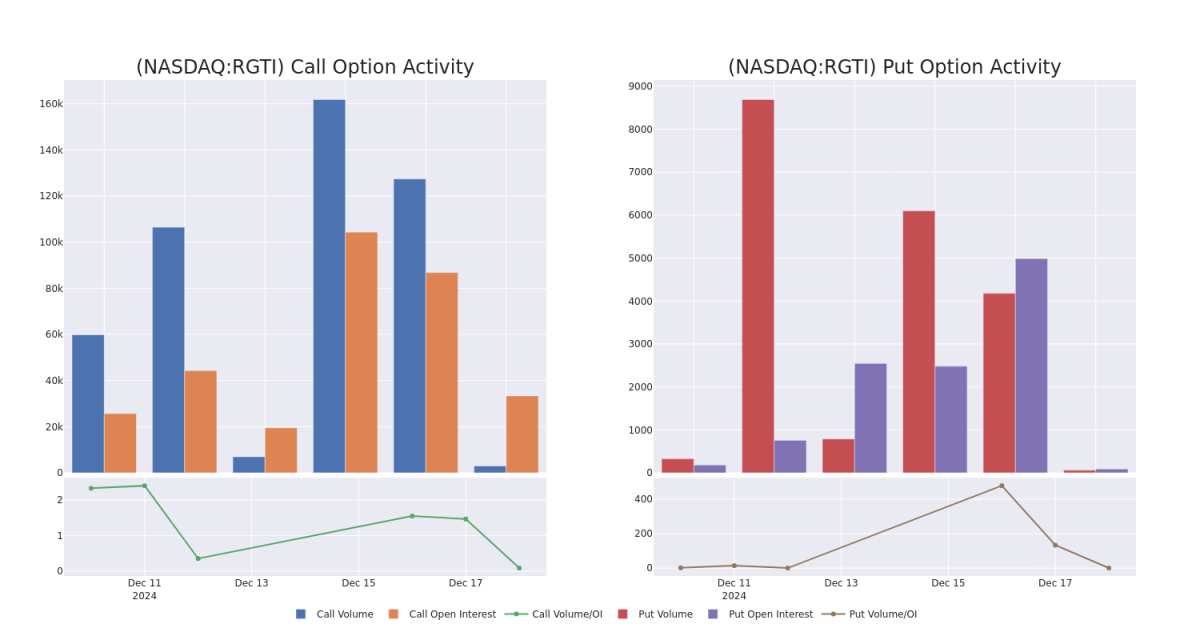

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Rigetti Computing's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Rigetti Computing's substantial trades, within a strike price spectrum from $7.5 to $15.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易的一个战略步骤。这些指标揭示了投资者对 Rigetti Computing 指定执行价格的期权的流动性和兴趣。即将提供的数据将可视化过去 30 天内与 Rigetti Computing 大笔交易相关的看涨和看跌的成交量及未平仓合约的波动,执行价格范围从 7.5 美元到 15.0 美元。

Rigetti Computing 30-Day Option Volume & Interest Snapshot

Rigetti Computing 30 天期权成交量和兴趣快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RGTI | CALL | TRADE | BULLISH | 12/20/24 | $5.3 | $5.1 | $5.27 | $7.50 | $105.4K | 17.2K | 1.2K |

| RGTI | CALL | TRADE | BULLISH | 12/20/24 | $5.3 | $5.1 | $5.26 | $7.50 | $105.2K | 17.2K | 1.2K |

| RGTI | CALL | TRADE | NEUTRAL | 05/16/25 | $5.1 | $4.8 | $4.95 | $13.00 | $99.0K | 500 | 225 |

| RGTI | CALL | SWEEP | BULLISH | 12/20/24 | $0.5 | $0.2 | $0.5 | $15.00 | $56.5K | 4.0K | 55 |

| RGTI | CALL | TRADE | BEARISH | 01/17/25 | $4.5 | $4.2 | $4.2 | $7.50 | $50.4K | 8.4K | 5 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RGTI | 看涨 | 交易 | 看好 | 12/20/24 | $5.3 | $5.1 | $5.27 | $7.50 | 105,400美元 | 1.72万 | 1.2K |

| RGTI | 看涨 | 交易 | 看好 | 12/20/24 | $5.3 | $5.1 | $5.26 | $7.50 | $105.2K | 1.72万 | 1.2K |

| RGTI | 看涨 | 交易 | 中立 | 05/16/25 | $5.1 | $4.8 | $4.95 | $13.00 | 99,000美元 | 500 | 225 |

| RGTI | 看涨 | 扫单 | 看好 | 12/20/24 | $0.5 | $0.2 | $0.5 | $15.00 | $56.5K | 4.0K | 55 |

| RGTI | 看涨 | 交易 | 看淡 | 01/17/25 | $4.5 | $4.2 | $4.2 | $7.50 | $50.4K | 8,400 | 5 |

About Rigetti Computing

关于Rigetti计算公司

Rigetti Computing Inc is engaged in the business of full-stack quantum computing. Its proprietary quantum-classical infrastructure provides ultra-low latency integration with public and private clouds for high-performance practical quantum computing. The company has developed the industry's first multi-chip quantum processor for scalable quantum computing systems. Geographically, it derives a majority of its revenue from the United States.

Rigetti计算公司从事全栈量子计算业务。其专有的量子-经典基础设施提供与公共和私有云的超低延迟集成,支持高性能的实用量子计算。该公司开发了行业首个多芯片量子处理器,用于可扩展的量子计算系统。在地理上,它的大部分营业收入来自美国。

Following our analysis of the options activities associated with Rigetti Computing, we pivot to a closer look at the company's own performance.

在对与Rigetti Computing相关的期权活动进行分析后,我们开始更深入地关注该公司的自身表现。

Rigetti Computing's Current Market Status

Rigetti Computing目前的市场状况

- Trading volume stands at 54,960,675, with RGTI's price up by 6.65%, positioned at $11.87.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 85 days.

- 成交量为54,960,675,RGTI的价格上涨了6.65%,现报11.87美元。

- 相对强弱指标显示该股票可能被超买。

- 预计在85天内发布财报。

What Analysts Are Saying About Rigetti Computing

分析师对Rigetti Computing的看法

In the last month, 1 experts released ratings on this stock with an average target price of $4.0.

在过去一个月中,1位专家对该股票发布了评级,平均目标价为4.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from B. Riley Securities has decided to maintain their Buy rating on Rigetti Computing, which currently sits at a price target of $4.

一位拥有20年经验的期权交易员透露了他的单线图表技术,展示了何时买入和卖出。复制他的交易,这些交易每20天平均获利27%。点击这里获取访问权限。*来自b. Riley证券的分析师决定维持对Rigetti Computing的买入评级,目前目标价为4美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Rigetti Computing options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在收益。精明的交易者通过不断教育自己、调整策略、监控多个因子并密切关注市场动态来管理这些风险。通过Benzinga Pro的实时警报,及时了解Rigetti Computing最新的期权交易。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $15.0 for Rigetti Computing during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $15.0 for Rigetti Computing during the past quarter.