Check Out What Whales Are Doing With GME

Check Out What Whales Are Doing With GME

Investors with a lot of money to spend have taken a bullish stance on GameStop (NYSE:GME).

有大量资金可以花的投资者对GameStop(纽约证券交易所代码:GME)采取了看涨立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在Benzinga追踪的公开期权历史记录中时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当 GME 发生这么大的事情时,通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 11 uncommon options trades for GameStop.

今天,Benzinga的期权扫描仪发现了GameStop的11种不常见的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 54% bullish and 45%, bearish.

这些大资金交易者的整体情绪介于54%的看涨和45%的看跌之间。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $581,850, and 7 are calls, for a total amount of $451,802.

在我们发现的所有特殊期权中,有4个是看跌期权,总额为581,850美元,7个是看涨期权,总额为451,802美元。

Predicted Price Range

预测的价格区间

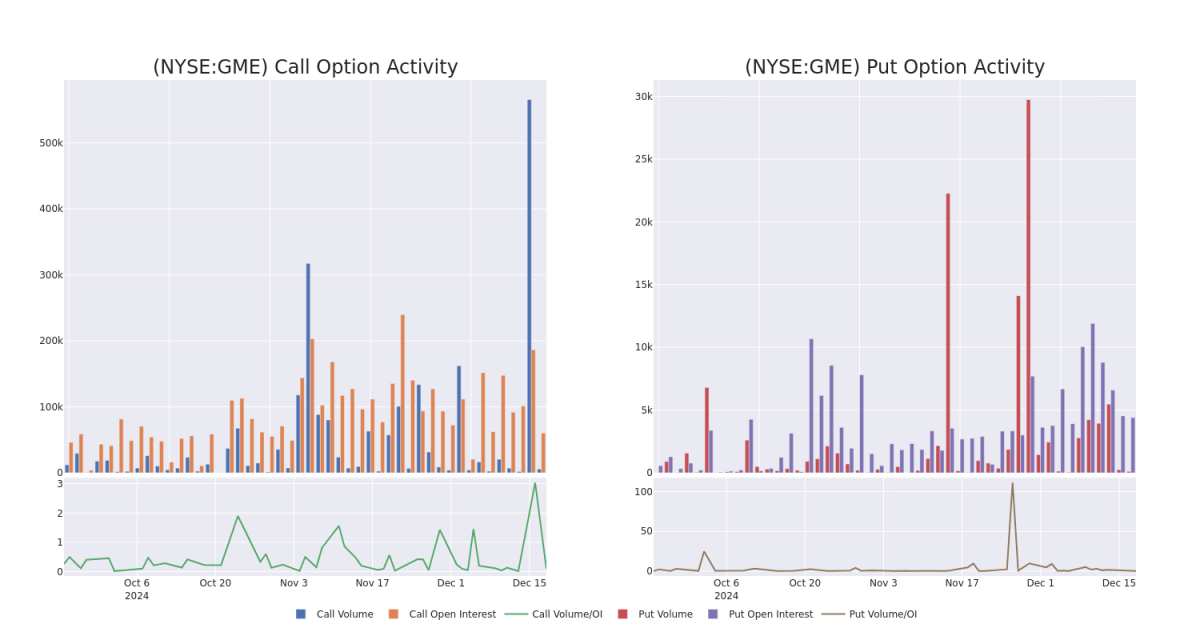

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $17.0 to $125.0 for GameStop during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注GameStop在过去一个季度的价格范围从17.0美元到125.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GameStop's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale trades within a strike price range from $17.0 to $125.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下GameStop期权的流动性和利息。下面,我们可以观察过去30天内GameStop所有鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的变化,其行使价在17.0美元至125.0美元之间。

GameStop Call and Put Volume: 30-Day Overview

GameStop 看涨和看跌交易量:30 天概述

Significant Options Trades Detected:

检测到的重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | PUT | TRADE | BEARISH | 01/16/26 | $97.0 | $96.4 | $97.0 | $125.00 | $242.5K | 4.4K | 61 |

| GME | PUT | SWEEP | BULLISH | 01/16/26 | $98.3 | $97.0 | $97.0 | $125.00 | $242.5K | 4.4K | 36 |

| GME | CALL | TRADE | BULLISH | 02/21/25 | $4.65 | $4.3 | $4.65 | $35.00 | $232.0K | 1.2K | 13 |

| GME | CALL | SWEEP | BEARISH | 12/20/24 | $2.2 | $2.19 | $2.19 | $30.00 | $51.9K | 23.1K | 3.2K |

| GME | PUT | TRADE | BEARISH | 01/16/26 | $96.9 | $96.4 | $96.9 | $125.00 | $48.4K | 4.4K | 11 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 游戏 | 放 | 贸易 | 粗鲁的 | 01/16/26 | 97.0 美元 | 96.4 美元 | 97.0 美元 | 125.00 美元 | 242.5 万美元 | 4.4K | 61 |

| 游戏 | 放 | 扫 | 看涨 | 01/16/26 | 98.3 美元 | 97.0 美元 | 97.0 美元 | 125.00 美元 | 242.5 万美元 | 4.4K | 36 |

| 游戏 | 打电话 | 贸易 | 看涨 | 02/21/25 | 4.65 美元 | 4.3 美元 | 4.65 美元 | 35.00 美元 | 232.0 万美元 | 1.2K | 13 |

| 游戏 | 打电话 | 扫 | 粗鲁的 | 12/20/24 | 2.2 美元 | 2.19 美元 | 2.19 美元 | 30.00 美元 | 51.9 万美元 | 23.1K | 3.2K |

| 游戏 | 放 | 贸易 | 粗鲁的 | 01/16/26 | 96.9 美元 | 96.4 美元 | 96.9 美元 | 125.00 美元 | 48.4 万美元 | 4.4K | 11 |

About GameStop

关于 GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp 是一家美国多渠道视频游戏、消费电子产品和服务零售商。该公司在欧洲、加拿大、澳大利亚和美国开展业务。GameStop主要通过GameStop、Eb Games和Micromania商店以及国际电子商务网站销售新的和二手的视频游戏硬件、实体和数字视频游戏软件以及视频游戏配件。大部分销售来自美国。

In light of the recent options history for GameStop, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于GameStop最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Present Market Standing of GameStop

GameStop目前的市场地位

- Currently trading with a volume of 3,895,563, the GME's price is up by 0.29%, now at $31.35.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 97 days.

- GME目前的交易量为3,895,563美元,价格上涨了0.29%,目前为31.35美元。

- RSI读数表明该股目前可能接近超买。

- 预计收益将在97天后发布。

Turn $1000 into $1270 in just 20 days?

在短短 20 天内将 1000 美元变成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处访问。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的GameStop期权交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with GME, it often means somebody knows something is about to happen.