This Is What Whales Are Betting On Etsy

This Is What Whales Are Betting On Etsy

Whales with a lot of money to spend have taken a noticeably bullish stance on Etsy.

有很多资金的鲸鱼对Etsy采取了明显的看好态度。

Looking at options history for Etsy (NASDAQ:ETSY) we detected 12 trades.

查看Etsy(纳斯达克:ETSY)的期权历史,我们发现了12笔交易。

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 33% with bearish.

如果考虑每笔交易的具体情况,可以准确地说,66%的投资者以看好的预期进行了交易,33%则以看淡的预期进行交易。

From the overall spotted trades, 3 are puts, for a total amount of $159,220 and 9, calls, for a total amount of $887,270.

在所有发现的交易中,有3笔是看跌期权,总金额为159,220美元,9笔是看涨期权,总金额为887,270美元。

Expected Price Movements

预期价格变动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $45.0 to $75.0 for Etsy over the last 3 months.

考虑到这些合约的成交量和未平仓合约,鲸鱼们似乎在过去3个月内将Etsy的目标价格区间定在45.0美元到75.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

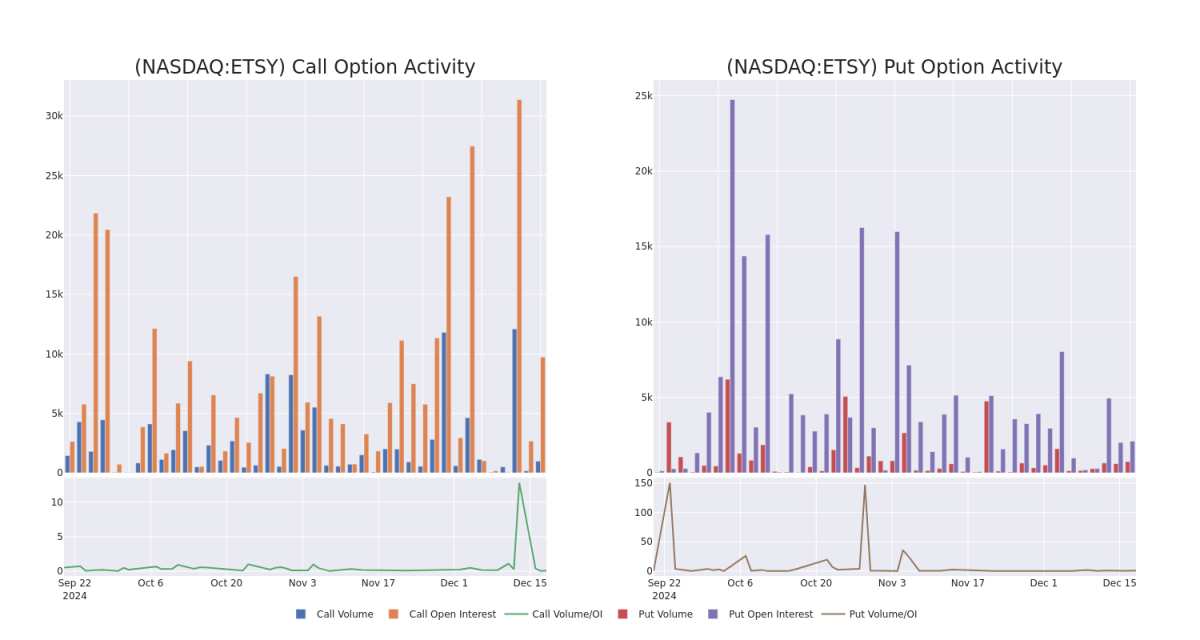

In today's trading context, the average open interest for options of Etsy stands at 1184.0, with a total volume reaching 1,720.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Etsy, situated within the strike price corridor from $45.0 to $75.0, throughout the last 30 days.

在今天的交易背景下,Etsy期权的平均未平仓合约为1184.0,总成交量达到1720.00。随附的图表描绘了过去30天内Etsy高价值交易的看涨和看跌期权成交量及未平仓合约的进展,位于45.0美元到75.0美元的行权价区间内。

Etsy Call and Put Volume: 30-Day Overview

Etsy 看涨和看跌 成交量:30天概览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETSY | CALL | TRADE | BULLISH | 09/19/25 | $10.05 | $10.0 | $10.05 | $60.00 | $175.8K | 882 | 175 |

| ETSY | CALL | SWEEP | BULLISH | 03/21/25 | $8.35 | $8.25 | $8.35 | $55.00 | $167.0K | 3.6K | 201 |

| ETSY | CALL | TRADE | BEARISH | 06/20/25 | $8.35 | $8.15 | $8.2 | $60.00 | $131.2K | 2.0K | 200 |

| ETSY | CALL | SWEEP | BULLISH | 12/19/25 | $10.1 | $9.7 | $9.75 | $65.00 | $97.5K | 282 | 1 |

| ETSY | CALL | SWEEP | BULLISH | 09/19/25 | $6.5 | $6.45 | $6.45 | $70.00 | $97.3K | 289 | 150 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETSY | 看涨 | 交易 | 看好 | 09/19/25 | $10.05 | $10.0 | $10.05 | $60.00 | $175.8K | 882 | 175 |

| ETSY | 看涨 | 扫单 | 看好 | 03/21/25 | $8.35 | $8.25 | $8.35 | $55.00 | ¥167.0K | 3.6K | 201 |

| ETSY | 看涨 | 交易 | 看淡 | 06/20/25 | $8.35 | $8.15 | $8.2 | $60.00 | $131.2K | 2.0K | 200 |

| ETSY | 看涨 | 扫单 | 看好 | 12/19/25 | $10.1 | $9.7 | $9.75 | $65.00 | 97.5K美元 | 282 | 1 |

| ETSY | 看涨 | 扫单 | 看好 | 09/19/25 | $6.5 | $6.45 | $6.45 | $70.00 | $97.3K | 289 | 150 |

About Etsy

关于Etsy

Etsy operates a top-10 e-commerce marketplace operator in the us and the UK, with sizable operations in Germany, France, Australia, and Canada. The firm dominates an interesting niche, connecting buyers and sellers through its online market to exchange vintage and craft goods. With $13.2 billion in 2023 consolidated gross merchandise volume, Etsy has cemented itself as one of the largest players in a quickly growing space, generating revenue from listing fees, commissions on sold items, advertising services, payment processing, and shipping labels. As of the end of 2023, the firm connected more than 96 million buyers and 9 million sellers on its marketplace properties: Etsy, Reverb (musical equipment), and Depop (clothing resale).

Etsy是美国和英国十大电子商务市场运营商之一,在德国、法国、澳洲和加拿大有着可观的业务。该公司主导了一个有趣的细分市场,通过其在线市场连接买卖双方,交易复古和手工艺品。2023年,其合并总商品成交量达到132亿,Etsy巩固了自己在这个快速增长领域中的最大玩家之一,营业收入来自列表费用、已售商品的佣金、广告服务、支付处理和运单标签。截至2023年底,Etsy在其市场平台上连接了超过9600万买家和900万卖家,这些平台包括Etsy、Reverb(音乐设备)和Depop(服装转售)。

After a thorough review of the options trading surrounding Etsy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对Etsy的期权交易进行全面审查后,我们开始更详细地评估该公司。这包括对其当前市场状况和表现的评估。

Where Is Etsy Standing Right Now?

Etsy目前的状况如何?

- Currently trading with a volume of 1,417,130, the ETSY's price is down by -3.51%, now at $58.83.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 63 days.

- 目前ETSY的成交量为1,417,130,价格下跌了-3.51%,现在为$58.83。

- RSI读数表明该股票目前可能接近超买状态。

- 预计收益发布将在63天后进行。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位拥有20年经验的期权交易员揭示了他的单行图表技巧,帮助判断何时买入和卖出。复制他的交易,这些交易每20天平均获得27%的利润。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

From the overall spotted trades, 3 are puts, for a total amount of $159,220 and 9, calls, for a total amount of $887,270.

From the overall spotted trades, 3 are puts, for a total amount of $159,220 and 9, calls, for a total amount of $887,270.