This Is What Whales Are Betting On Quantum Computing

This Is What Whales Are Betting On Quantum Computing

Whales with a lot of money to spend have taken a noticeably bullish stance on Quantum Computing.

在量子计算概念上,许多有钱的“大鳄”们采取了明显的看好的态度。

Looking at options history for Quantum Computing (NASDAQ:QUBT) we detected 8 trades.

查看量子计算概念(纳斯达克:QUBT)的期权历史,我们发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,50%的投资者以看涨的预期进行交易,37%以看跌的预期进行交易。

From the overall spotted trades, 4 are puts, for a total amount of $284,800 and 4, calls, for a total amount of $822,158.

从整体发现的交易中,4笔为看跌期权,总金额为284,800美元,4笔为看涨期权,总金额为822,158美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $2.5 to $30.0 for Quantum Computing during the past quarter.

分析这些合约的成交量和未平仓合约,似乎大玩家在过去一个季度中一直关注量子计算概念的价格区间为2.5美元到30.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

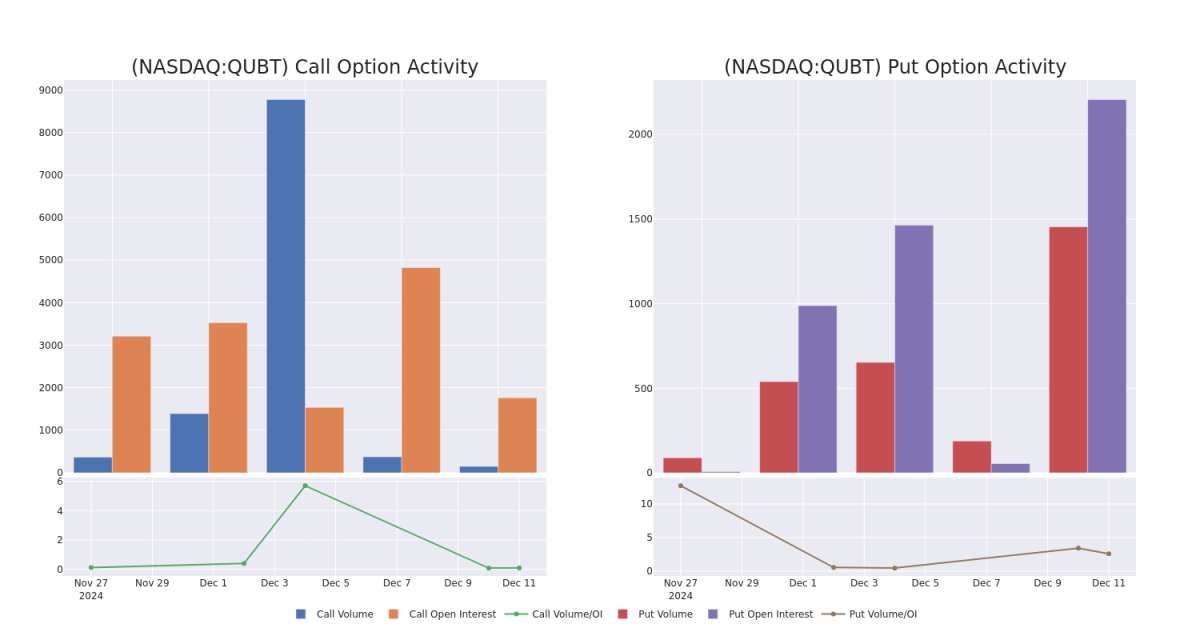

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Quantum Computing's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Quantum Computing's substantial trades, within a strike price spectrum from $2.5 to $30.0 over the preceding 30 days.

评估成交量和未平仓合约是进行期权交易的战略步骤。这些指标突显了量子计算概念中指定行使价格的期权的流动性和投资者兴趣。即将发布的数据展示了过去30天内,量子计算概念的看涨期权和看跌期权的成交量和未平仓合约的波动情况,关联到2.5美元到30.0美元的行使价格区间内的大额交易。

Quantum Computing Option Volume And Open Interest Over Last 30 Days

量子计算概念期权的成交量和未平仓合约在过去30天的情况

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QUBT | CALL | SWEEP | BULLISH | 01/17/25 | $3.5 | $3.0 | $3.0 | $30.00 | $600.0K | 883 | 80 |

| QUBT | CALL | TRADE | BEARISH | 04/17/25 | $17.0 | $15.9 | $16.2 | $2.50 | $113.4K | 1.5K | 264 |

| QUBT | PUT | TRADE | BULLISH | 04/17/25 | $9.0 | $8.5 | $8.7 | $18.00 | $113.1K | 75 | 205 |

| QUBT | PUT | TRADE | NEUTRAL | 04/17/25 | $9.6 | $9.0 | $9.35 | $19.00 | $93.5K | 7 | 105 |

| QUBT | CALL | TRADE | BULLISH | 01/17/25 | $15.2 | $14.3 | $15.0 | $5.00 | $67.5K | 10.0K | 50 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QUBT | 看涨 | 扫单 | 看好 | 01/17/25 | $3.5 | $3.0 | $3.0 | $30.00 | 60万美元 | 883 | 80 |

| QUBT | 看涨 | 交易 | 看淡 | 04/17/25 | $17.0 | $15.9 | $16.2 | $2.50 | 113.4K美元 | 1.5K | 264 |

| QUBT | 看跌 | 交易 | 看好 | 04/17/25 | $9.0 | $8.5 | $8.7 | $18.00 | $113.1K | 75 | 205 |

| QUBT | 看跌 | 交易 | 中立 | 04/17/25 | $9.6 | $9.0 | $9.35 | $19.00 | $93.5K | 7 | 105 |

| QUBT | 看涨 | 交易 | 看好 | 01/17/25 | $15.2 | $14.3 | $15.0 | $5.00 | $67.5K | 10.0K | 50 |

About Quantum Computing

关于量子计算概念

Quantum Computing Inc is an American company utilizing non-linear quantum optics (optical devices whose output due to quantum effects is exponentially, not linearly, related to inputs) to deliver quantum products for high-performance computing applications. QCi's products are designed to operate at room temperature and use low power at an affordable cost. The Company's portfolio of core technology and products offer new capabilities in the areas of high-performance computing, artificial intelligence, cyber security as well as remote sensing applications.

量子计算公司是一家美国公司,利用非线性量子光学(由于量子效应其输出与输入呈指数关系而非线性关系的光学设备)提供高性能计算应用的量子产品。量子计算公司的产品旨在在常温下运行,并以一种经济实惠的方式使用低功耗。公司的核心技术和产品组合在高性能计算、人工智能、网络安全以及遥感应用领域提供了新的能力。

After a thorough review of the options trading surrounding Quantum Computing, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面审查了围绕量子计算的期权交易后,我们开始更详细地审视该公司。这包括对其当前市场状态和表现的评估。

Present Market Standing of Quantum Computing

量子计算的当前市场状况

- Trading volume stands at 48,943,180, with QUBT's price down by -28.74%, positioned at $18.3.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 102 days.

- 交易量为48,943,180,QUBT的价格下跌了-28.74%,目前价格为18.3美元。

- 相对强弱指标显示该股票可能被超买。

- 预计在102天后公布财报。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位拥有20年经验的期权交易员揭示了他的单行图表技巧,帮助判断何时买入和卖出。复制他的交易,这些交易每20天平均获得27%的利润。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

From the overall spotted trades, 4 are puts, for a total amount of $284,800 and 4, calls, for a total amount of $822,158.

From the overall spotted trades, 4 are puts, for a total amount of $284,800 and 4, calls, for a total amount of $822,158.