Vistra's Options: A Look at What the Big Money Is Thinking

Vistra's Options: A Look at What the Big Money Is Thinking

Deep-pocketed investors have adopted a bearish approach towards Vistra (NYSE:VST), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VST usually suggests something big is about to happen.

资金雄厚的投资者对Vistra(纽交所:VST)采取了看淡的态度,这一点市场参与者不能忽视。我们在Benzinga对公共期权记录的追踪揭示了今天这一重大举动。这些投资者的身份尚不清楚,但VSt如此大规模的举动通常意味着某种重大事件即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 16 extraordinary options activities for Vistra. This level of activity is out of the ordinary.

我们今天的观察得到了这一信息,当Benzinga的期权扫描仪为Vistra突出显示了16个非凡的期权活动。这种活动水平是异常的。

The general mood among these heavyweight investors is divided, with 31% leaning bullish and 50% bearish. Among these notable options, 6 are puts, totaling $224,668, and 10 are calls, amounting to $627,643.

这些重量级投资者之间的整体情绪是分化的,31%偏向看好,50%看淡。在这些显著的期权中,有6个是看跌期权,总计224,668美元,10个是看涨期权,总计627,643美元。

What's The Price Target?

价格目标是什么?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $175.0 for Vistra over the recent three months.

根据交易活动,显著投资者似乎正瞄准Vistra在过去三个月的价格区间,从80.0美元到175.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

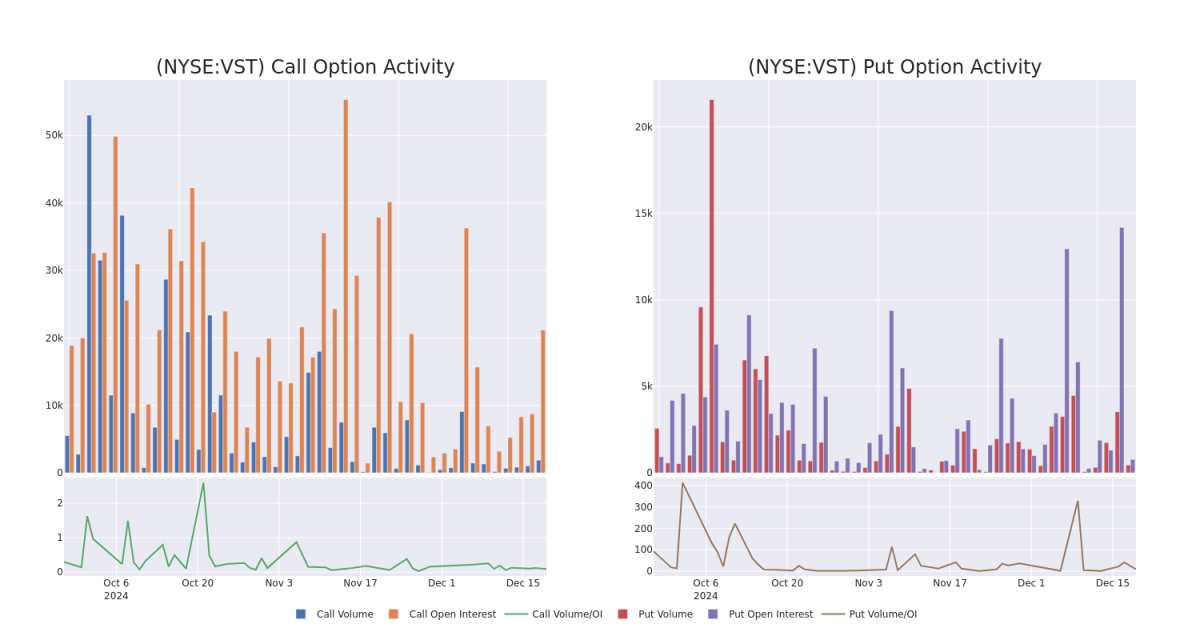

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Vistra's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Vistra's significant trades, within a strike price range of $80.0 to $175.0, over the past month.

检查成交量和未平仓合约为股票研究提供了重要洞察。此信息在衡量Vistra的期权在特定行权价格的流动性和兴趣水平方面至关重要。以下是我们提供的过去一个月内基于Vistra重要交易的看涨和看跌期权在80.0美元至175.0美元的行权价格区间的成交量和未平仓合约趋势的快照。

Vistra Option Activity Analysis: Last 30 Days

Vistra期权活动分析:过去30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | SWEEP | BULLISH | 01/17/25 | $2.1 | $1.55 | $1.9 | $170.00 | $214.9K | 4.5K | 1.1K |

| VST | CALL | SWEEP | BEARISH | 06/20/25 | $16.6 | $16.2 | $16.2 | $160.00 | $77.7K | 641 | 49 |

| VST | CALL | SWEEP | BEARISH | 02/21/25 | $4.7 | $4.5 | $4.5 | $170.00 | $65.2K | 209 | 146 |

| VST | CALL | SWEEP | BEARISH | 01/17/25 | $3.7 | $3.1 | $3.4 | $155.00 | $60.1K | 4.8K | 225 |

| VST | PUT | SWEEP | BULLISH | 01/17/25 | $38.6 | $38.5 | $38.5 | $175.00 | $57.7K | 32 | 15 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Vistra Energy | 看涨 | 扫单 | 看好 | 01/17/25 | $2.1 | $1.55 | $1.9 | $170.00 | ¥214.9K | 4.5K | 1.1千 |

| Vistra Energy | 看涨 | 扫单 | 看淡 | 06/20/25 | $16.6 | $16.2 | $16.2 | $160.00 | $77.7K | 641 | 49 |

| Vistra Energy | 看涨 | 扫单 | 看淡 | 02/21/25 | $4.7 | $4.5 | $4.5 | $170.00 | 65.2K美元 | 209 | 146 |

| Vistra Energy | 看涨 | 扫单 | 看淡 | 01/17/25 | $3.7 | $3.1 | $3.4 | $155.00 | $60.1K | 4.8K | 225 |

| Vistra Energy | 看跌 | 扫单 | 看好 | 01/17/25 | $38.6 | $38.5 | $38.5 | $175.00 | $57.7K | 32 | 15 |

About Vistra

关于Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 500万 customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Following our analysis of the options activities associated with Vistra, we pivot to a closer look at the company's own performance.

Following our analysis of the options activities associated with Vistra, we pivot to a closer look at the company's own performance.

Current Position of Vistra

Vistra的当前状况

- Currently trading with a volume of 1,948,136, the VST's price is up by 1.35%, now at $134.68.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 69 days.

- Currently trading with a volume of 1,948,136, the VST's price is up by 1.35%, now at $134.68.

- RSI读数表明该股票当前可能接近超卖。

- 预期的财报发布时间为69天后。

Expert Opinions on Vistra

关于Vistra的专家意见

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $169.0.

在过去一个月中,1位行业分析师分享了他们对该股票的见解,提出的平均目标价为169.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Vistra, targeting a price of $169.

一位拥有20年经验的期权交易员揭示了他的一行图表技巧,显示何时买入和卖出。复制他的交易,这些交易每20天平均获利27%。点击这里获取访问权限。* 在继续保持立场的同时,摩根士丹利的一位分析师继续对Vistra保持“增持”评级,目标价为169美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vistra with Benzinga Pro for real-time alerts.

交易期权涉及更大风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略交易调整、利用各种因子以及关注市场动态来降低这些风险。请通过Benzinga Pro跟进Vistra的最新期权交易,获取实时警报。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $175.0 for Vistra over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $175.0 for Vistra over the recent three months.