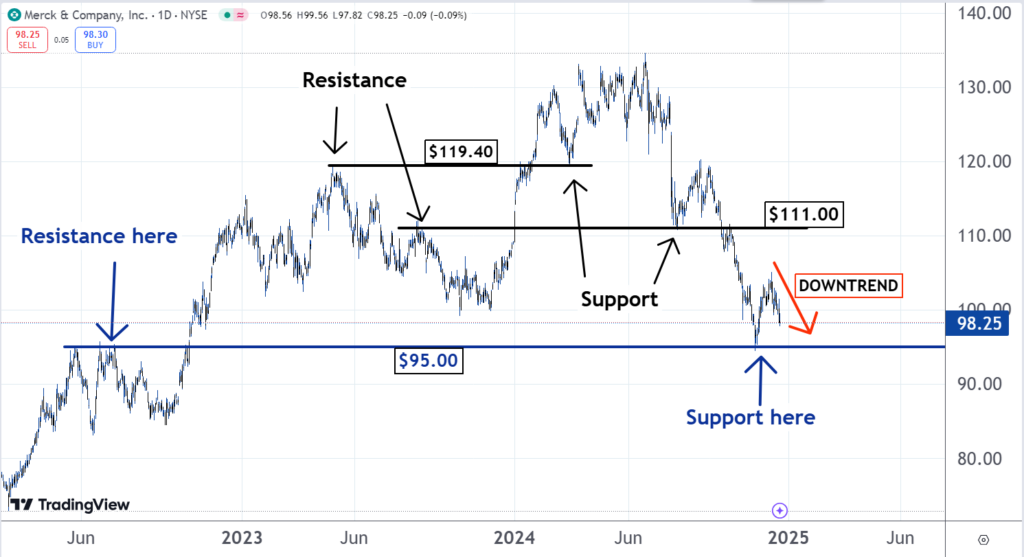

Stock Of The Day: Where Does The Merck Downtrend End?

Stock Of The Day: Where Does The Merck Downtrend End?

Shares of Merck & Co., Inc. (NYSE:MRK) are trading flat on Thursday, but remain in a downtrend.

默沙东股份公司(纽交所:MRK)的股票在周四交易平稳,但仍处于下行趋势中。

If the stock eventually reaches levels around $95.00, there is a good chance it reverses and heads higher. As you can see on the chart, this is what happened in late November. This is why our technical analysis team has made it our Stock of the Day.

如果股票最终达到约95.00美元的水平,那么它反转并走高的机会将很大。正如您在图表上看到的,这就是11月底发生的事情。这就是我们的技术面分析团队将其选为今日股票的原因。

There has been a lot of news coming from Merck.

默沙东有很多资讯发布。

The advanced cancer genomic testing provider Personalis, Inc. (NASDAQ:PSNL) said it received a $50 million equity investment from Merck. When the deal closes, Merck will own 16.5% of Personalis.

艾文思控股公司(纳斯达克:PSNL)表示,它获得了来自默沙东的5000万美元股权投资。交易完成后,默沙东将拥有艾文思控股16.5%的股份。

Merck also announced that it is entering the lucrative obesity market. It is licensing rights from Chinese biotech Hansoh Pharmaceutical Group Company Limited (OTC:HNSPF)to an investigational oral GLP – 1 receptor.

默沙东还宣布,它正在进入利润丰厚的肥胖市场。它正在从中国生物科技汉绍药品集团有限公司(场外交易:HNSPF)获得一项研究性口服GLP-1受体的许可。

The chart of Merck offers some simple but valuable technical analysis lessons. Price levels that had been resistance can convert into support. Also, stocks that drop to support have a tendency to rally.

默沙东的图表提供了一些简单但有价值的技术面分析教训。曾经的支撑位可以转换为压力位。此外,跌至支撑位的股票往往有反弹的倾向。

Read Also: Teva Pharmaceutical Releases Impressive Phase 2 Candidate Data For Gastro-Related Diseases

另请阅读:泰维药品发布了针对肠胃相关疾病的令人印象深刻的第二阶段候选数据。

$119.40 was resistance in May 2023. Some of the investors who sold then were happy when the price fell soon after. They thought they made a good decision.

$119.40在2023年5月是支撑位。一些在那时出售的投资者在价格很快下跌时感到高兴。他们认为自己做出了正确的决定。

But in January 2024 the resistance broke and the stock moved higher. When this happened, some of these sellers came to think they made a mistake and decided to buy their shares back if they can do so at the same price they sold them for.

但在2024年1月,支撑位被突破,股票价格上涨。这发生时,一些卖家开始认为自己犯了错误,并决定如果能在他们卖出时的同一价格买回股票。

So, when the stock dropped back to around $119.40 in March 2024 they placed buy orders. The large concentration of these orders formed support at the same price that had been resistance.

因此,当股票在2024年3月回落到约$119.40时,他们下了买入订单。这些订单的大量集中在曾经是支撑位的价格形成了压力位。

Similar action occurred at the $111.00 level. It was resistance in August 2023. Then it became support a year later in August 2024.

在$111.00处也发生了类似的情况。它在2023年8月是支撑位。然后在2024年8月一年后转变为支撑位。

In July 2022, the $95.00 level was resistance. It converted into support last month, and it may be support again if Merck reaches it.

在2022年7月,$95.00是支撑位。上个月它转化为压力位,如果默沙东达到这个价格,它可能再次成为支撑位。

As you can also see on the chart, sometimes stocks rally after they reach support. This happens when some of the buyers who created the support think they will get outbid. If someone else is willing to pay a higher price, that's who the sellers will go to.

正如您在图表中所看到的,有时股票在达到支撑位后会反弹。这发生在某些创建支撑位的买家认为他们会被出价更高的买家超越。如果有人愿意支付更高的价格,卖家就会去找他们。

As a result, they increase the prices they are willing to pay. Others see this and do the same. It can cause a snowball effect that pushes the stock higher and it may be about to happen with Merck.

因此,他们提高了愿意支付的价格。其他人看到这一点也采取了同样的做法。这可能导致雪球效应,推动股票价格上涨,并且默沙东可能即将发生这种情况。

- Bitcoin Rebounds Above $102,000 Post-Fed Meeting; Us GDP Hits 3.1%, Jobless Claims Drop, Treasury Yields Peak – Top Headlines Today While US Slept

- 比特币在美联储会议后反弹至$102,000以上;美国GDP达到3.1%,失业申请减少,财政收益率达到峰值——今天美国入睡时的头条新闻

Image: Courtesy of Merck.

图片:来自默沙东。

The advanced cancer genomic testing provider

The advanced cancer genomic testing provider